Post Details:

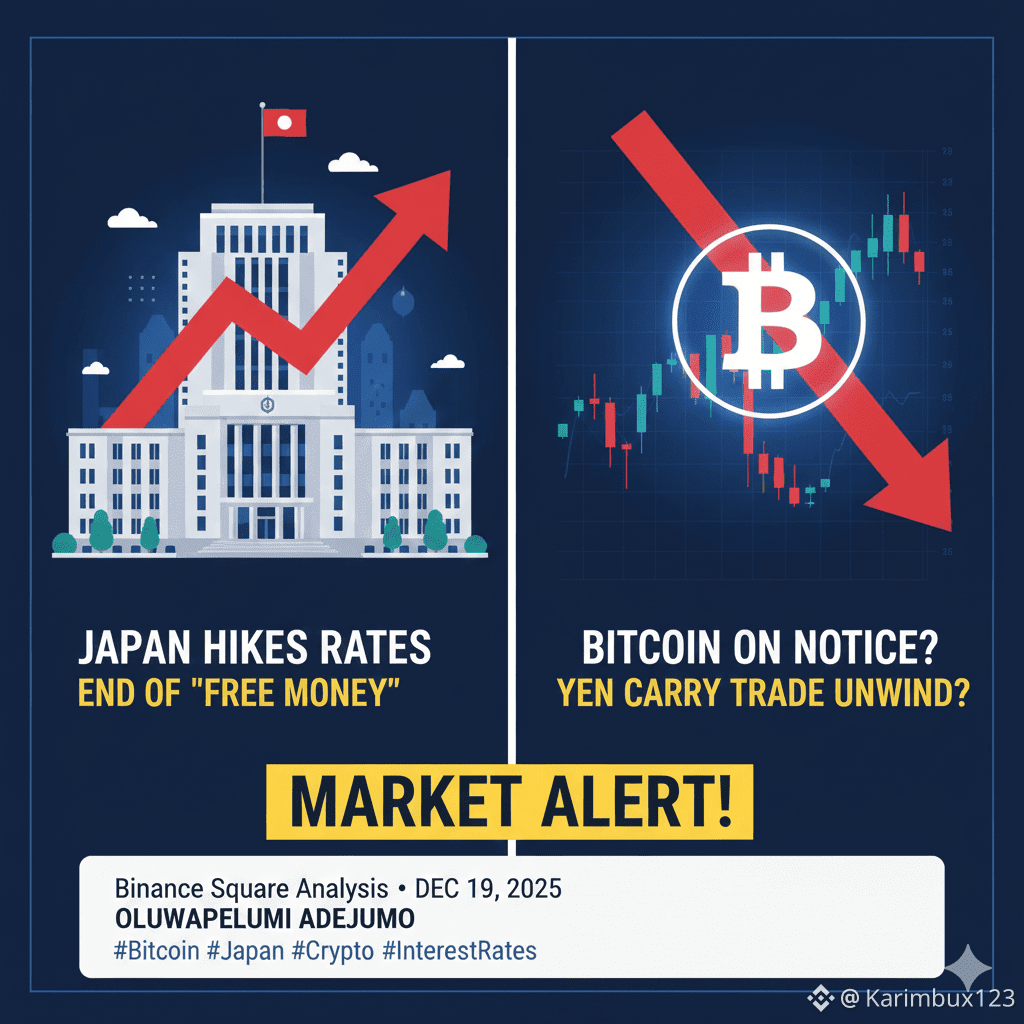

Japan has finally hiked its interest rates, ending a decade of near-zero or negative rates. This isn't just a local event—it's a global market tremor, and Bitcoin holders should be paying close attention!

Why does this matter for crypto?

End of "Free Money": For years, traders borrowed cheap Japanese Yen (JPY) to invest in higher-yielding assets, including cryptocurrencies. This was known as the "Yen Carry Trade."

Carry Trade Unwind: With rising JPY rates, borrowing yen becomes more expensive. Traders will likely start unwinding these positions, selling off riskier assets (like some cryptocurrencies) to repay their JPY loans. This could introduce selling pressure into the crypto market.

Liquidity Impact: Japan has been a significant source of global liquidity. As the Bank of Japan tightens its policy, overall market liquidity could shrink, making it harder for assets, especially volatile ones like crypto, to find buyers.

Broader Market Challenges: This move by Japan could signal a shift in global monetary policy, potentially encouraging other central banks to maintain or even raise their rates. This creates a less favorable environment for risk assets across the board.

What to watch for:

Increased volatility in Bitcoin and altcoins.

Correlation between JPY strength and crypto market movements.

Changes in funding rates and borrowing costs for crypto traders.

This isn't a guaranteed crash, but it's a critical macro development that puts Bitcoin and the broader crypto market "on notice." Stay informed and manage your risk!

#Bitcoin #Japan #Crypto #InterestRates #MarketAlert #YenCarryTrade #MacroEconomics #BinanceSquare

Why this is valuable for your audience:

Urgency: "Market Alert!" and "On Notice" grab attention.

Clear Explanation: Breaks down complex economic concepts into understandable points.

Actionable Insights: Tells users what to watch for.

Relevant Hashtags: Increases visibility on Binance Square.

Visual Aid: The image clearly illustrates the core concepts (Japan's rate hike, potential Bitcoin impact).

#BTCNEWS #USNonFarmPayrollReport #USTradeDeficitShrink