The cryptocurrency market is once again heating up, and $STX (Stacks) is drawing strong attention from traders and investors. Recent price action suggests that $STX is approaching a major resistance level, a zone that could decide its next big move. Understanding this resistance area is crucial for anyone looking to trade or invest in Stacks.

What Is $STX (Stacks)?

Stacks ($STX) is a blockchain project designed to bring smart contracts and decentralized applications (dApps) to Bitcoin. By leveraging Bitcoin’s security, Stacks enables developers to build Web3 applications without modifying the Bitcoin network itself.

Because of its strong fundamentals and growing ecosystem, STX price movements often attract high trading volume, especially near key technical levels.

Why Resistance Levels Matter

A resistance level is a price zone where selling pressure increases, often preventing the price from moving higher. When an asset approaches a strong resistance:

Sellers may take profit

Short-term traders may open short positions

Price can either reject or break out

For $STX, the current resistance zone is considered significant due to previous price rejections and high volume activity.

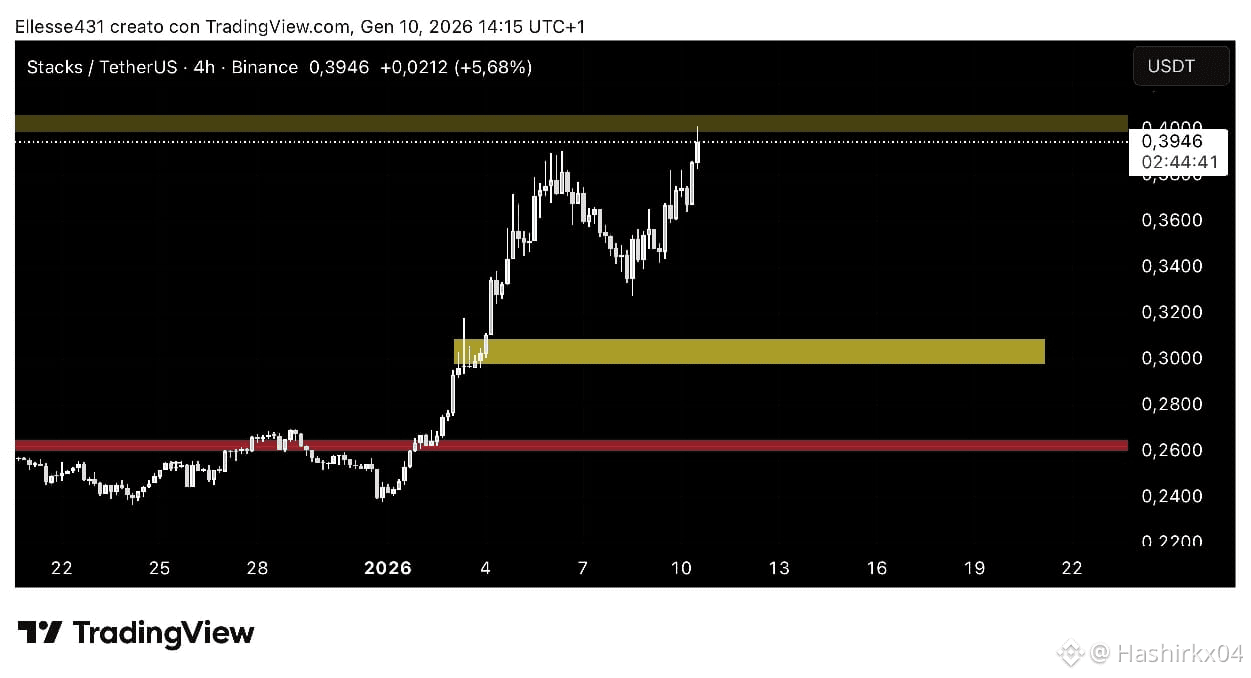

$STX Big Resistance Level Approaching – Technical Analysis

As STX climbs higher, it is now testing a historical resistance level that previously acted as a rejection point. Key technical observations include:

Multiple rejections in past price history

Rising volume near the resistance zone

Price trading above key moving averages

Momentum indicators showing mixed signals This suggests that STX is at a decision-making level, where volatility could increase. Possible Scenarios for STX price.

1. Bullish Breakout:

If buying pressure remains strong and volume increases:

STX could break above resistance Previous resistance may turn into support New upside targets could open in the short term.

2. Rejection & Pullback:

If sellers defend the resistance:

Price may face rejection A short-term pullback or consolidation could occur Support levels below will become important to watch Market Sentiment & On-Chain Outlook Market sentiment around Stacks remains cautiously optimistic, supported by:

Increased interest in Bitcoin Layer-2 solutions Growing awareness of Bitcoin DeFi Strong developer activity within the Stacks ecosystem

However, broader crypto market conditions and Bitcoin’s price action will also play a major role in determining $STX next move

Conclusion:

STX big resistance level approaching is a key moment for traders and investors. Whether Stacks breaks above this zone or faces rejection, the coming price action could set the tone for its next trend.

For now, this resistance area should be closely monitored, as it may provide high-probability trading opportunities in the days ahead.

#USNonFarmPayrollReport #USTradeDeficitShrink #ZTCBinanceTGE #WriteToEarnUpgrade #hashirkx04