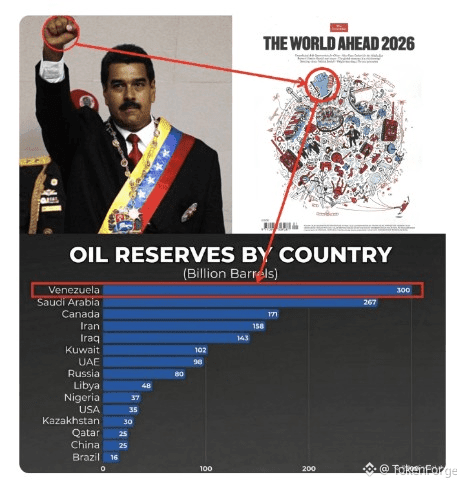

Venezuela isn’t just “a country with a lot of oil” — it holds the largest proven crude oil reserves on Earth. According to the latest energy data, Venezuela’s reserves stand at roughly 300+ billion barrels — about 17% of global proven crude oil reserves, making it larger than Saudi Arabia’s reported reserves. �

Wikipedia +1

At current crude prices (~$50–$60/barrel), that translates to a theoretical value of more than $15–$18 TRILLION on paper. �

But theory is not reality — and here’s where the truth gets striking.

El Economista

🛢️ Why Venezuela’s Oil Isn’t Instantly a Cash Windfall

Despite having massive reserves:

❌ Production Is Tiny Compared to Potential

Venezuela produces only ~1 million barrels per day, roughly ~1% of global oil supply. �

Dinero en Imagen +1

⚠️ Severe Structural Issues

Years of underinvestment, corruption, and sanctions have devastated infrastructure, meaning:

Output is far below historical highs (3m+ bpd in earlier decades). �

Dinero en Imagen

Heavy and extra‑heavy crude dominates (more expensive to refine). �

Dinero en Imagen

💰 Huge Investment Needed to Rebuild

Analysts estimate tens to over $100 billion would be required over many years just to begin restoring capacity — not something that happens overnight. �

chathamhouse.org

🇺🇸 What the United States Is Doing Now

Recent political and military developments have shifted the spotlight:

🪖 U.S. Seizure and Control Moves

The U.S. government has seized Venezuelan and linked oil tankers and is asserting broad control over oil sales tied to Venezuela. �

AP News

The White House says it intends to control Venezuelan oil sales “indefinitely.” �

The Guardian

🧾 Trump’s Executive Actions

President Trump signed an executive order aimed at protecting Venezuelan oil revenue held in U.S. Treasury accounts from creditors and legal seizure — effectively keeping the funds under U.S. control for diplomatic and strategic policy goals. �

Reuters

⛽ Oil Shipments to the U.S.

Trump has publicly stated that Venezuela will turn over between 30–50 million barrels to the U.S., with proceeds overseen by Washington. �

However — that volume equates to only a tiny fraction of global daily oil flow, and not a transformational shift in supply. �

The Guardian +1

opb

Other sanction‑related news suggests the U.S. may ease some restrictions soon to facilitate oil exports and economic engagement, indicating shifting policy dynamics. �

Reuters

🧠 The Reality Check Between Reserves and Revenue

👉 Paper value ≠ liquid cash:

A $15T+ oil reserve valuation looks huge only if that oil is producible at scale and reliably exported — neither of which is currently true with Venezuelan production. �

infobae

👉 Production ≠ Reserves:

Market prices respond to actual output, global demand, and export capability, not just reserve statistics — and Venezuela’s output is tiny relative to markets like the U.S., Saudi Arabia, or Russia. �

infobae

👉 Geopolitical risk is massive:

Control over Venezuelan oil is a geopolitical flashpoint involving:

U.S. policy and sanctions strategy

Global energy security conversations

Foreign investment hesitancy due to political risk

📊 Macro Implications That Actually Move Markets

✔ Venezuela’s oil story is not just about reserves — it’s about:

How political control influences global supply narratives.

How production constraints keep real output low.

How sanctions and infrastructure decay restrict export capacity.

✔ Oil futures, FX markets, and emerging market risk assets will be affected by how this situation evolves — not by theoretical reserves alone.

🧩 Bottom Line

Yes — Venezuela has the world’s largest crude oil reserves.

Yes — that reserve wealth could be worth trillions on paper.

But that’s only part of the story — converting those reserves into actual global influence and revenue will be slow, expensive, and politically fraught.

Stay tuned — because the global energy narrative is shifting right in front of us.

#VenezuelaOil #OilReserves #EnergyGeopolitics #USPolicy #EnergyMarkets