The privacy-focused giant, Zcash ($ZEC ), is currently navigating one of the most turbulent periods in its history. As of January 11, 2026, the token is trading at approximately $376.26, down from its late-2025 highs. A perfect storm of internal governance conflict and technical breakdowns has left traders questioning whether this is a "buy the dip" opportunity or a falling knife.

1. The Catalyst: A Leadership Vacuum

The recent price plummet was primarily driven by a "major governance crisis." On January 7, 2026, the entire core development team at the Electric Coin Company (ECC) resigned en masse.

The Conflict: Former CEO Josh Swihart described the exit as a "constructive discharge" caused by irreconcilable differences with the Bootstrap Foundation board.

The Silver Lining: The protocol remains secure and operational. Furthermore, the departing team has already announced the formation of a new entity to continue building Zcash privacy tech, aiming for "startup-style agility" to scale the network.

2. Tokenomic Analysis: Scarcity vs. Uncertainty

Zcash’s tokenomics are modeled after Bitcoin, featuring a hard cap of 21 million coins and a four-year halving cycle.

Supply Shock Potential: Entering 2026, ZEC's issuance is at its lowest levels following the 2024 halving. With a relatively small float, any return of buyer confidence could trigger an explosive supply-squeeze rally.

The Governance Premium: Historically, $ZEC has traded at a discount due to "governance fatigue." If the new developer-led entity successfully distances itself from previous non-profit constraints, it could unlock a more efficient funding and development model.

3. Technical & Chart Analysis

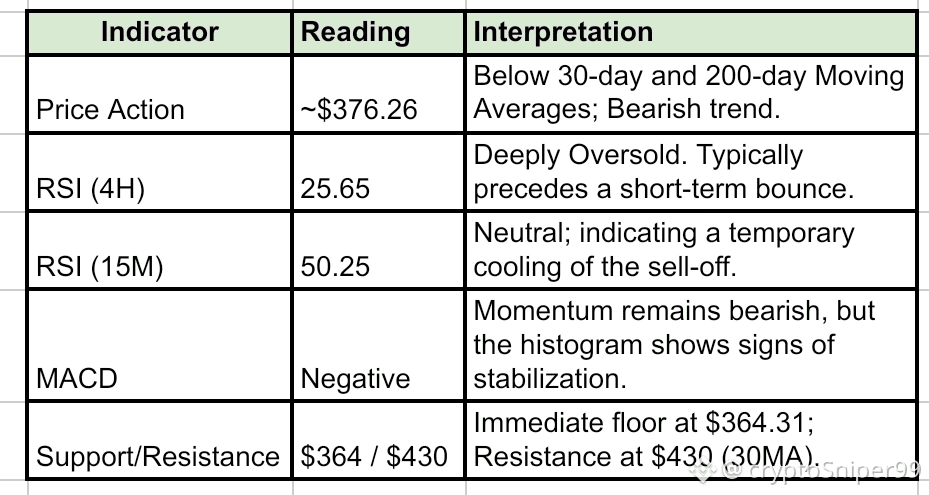

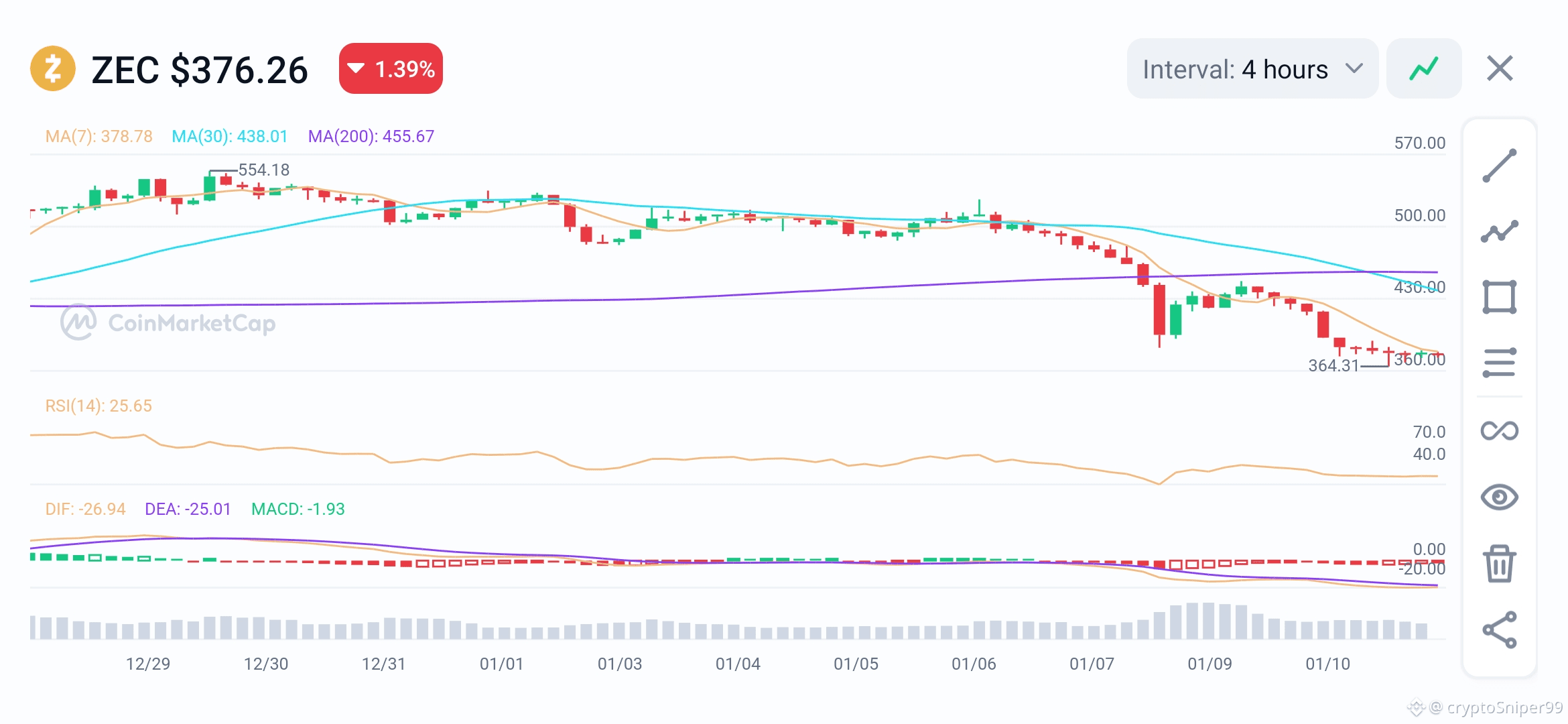

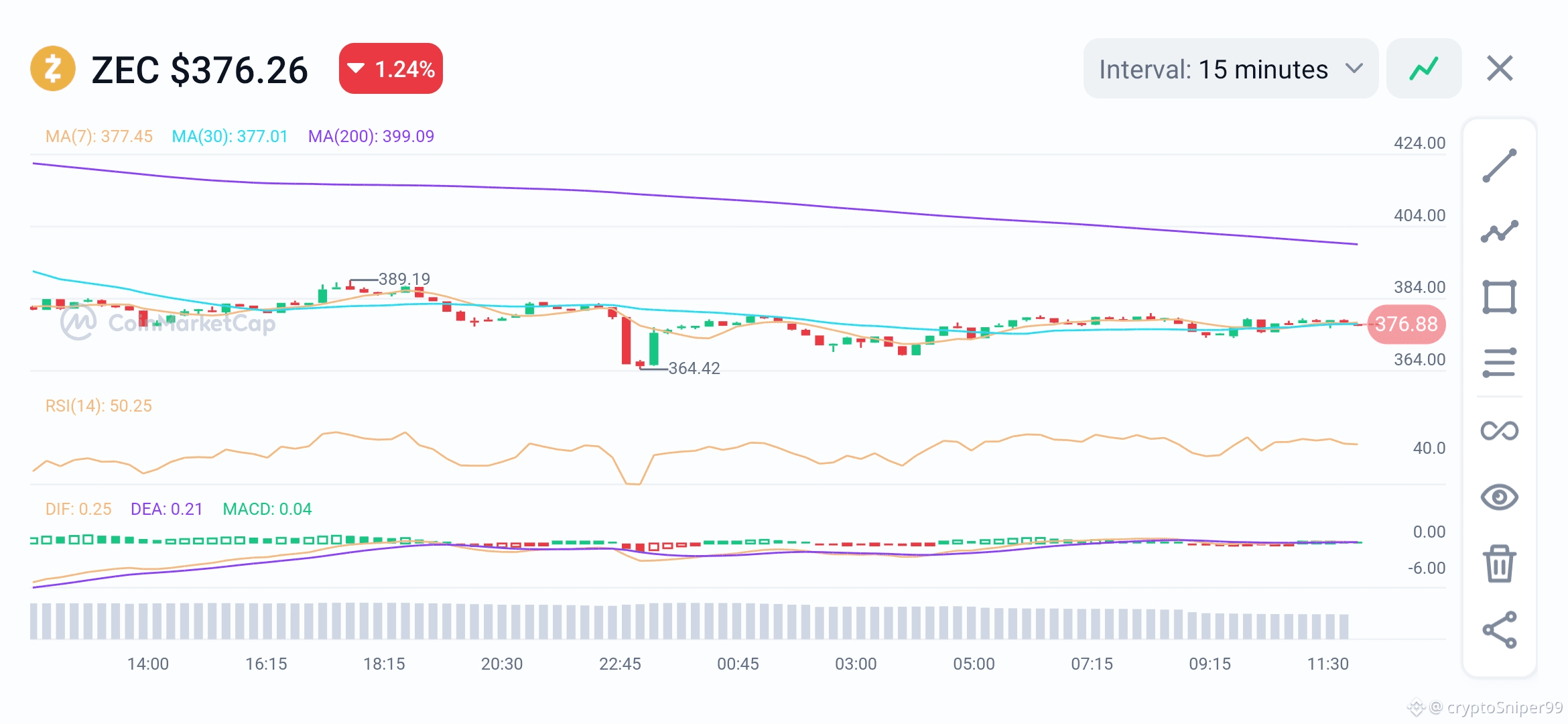

Based on the provided 4-hour and 15-minute charts:

The 4-hour chart reveals a sharp "liquidity flush" down to $364.31. While the long-term trend (200MA) is currently sloping downward, the extremely low RSI (under 30) suggests that the initial "panic selling" may be reaching exhaustion.

4. Trading Strategy: The "Wait-and-Reclaim" Approach

Trading ZEC/USDT in this environment requires a balance of caution and opportunism. Here is a proposed strategy for a profitable trade:

A. The Aggressive "Oversold" Play (Short-term)

Entry: Scale in between $365 and $375 (capturing the oversold bounce).

Target: $420–$435 (retesting the 30-day Moving Average).

Stop-Loss: Below $358 (previous local wick low).

B. The Conservative "Trend Confirmation" Play (Medium-term)

Entry: Wait for a daily candle to close back above the $400 mark. This would signal that the market has "digested" the ECC news.

Target: $500+ if the new development roadmap is received positively by the community.

Note: Keep an eye on the MACD crossover on the 4-hour chart; a bullish cross here would be a strong entry trigger.

Risk Note: The primary risk remains regulatory pressure on privacy coins and further delays in the new team's organizational setup.

Article Title Suggestion: "Zcash at a Crossroads: Can the ECC Team’s ‘New Beginning’ Save ZEC from its Governance Crisis?"

#ZEC , #ZECUSDT , #Write2Earn , $ZEC

PS : Do your own research (DYOR) before making any investments or trades