Between 2019 and 2025, Dusk Network underwent 14 independent security audits by nine selective firms and eliminated 183 vulnerabilities with 41 critical ones that would compromise EUR1.2 billion of assets staked. In Q4 2025, audit coverage has been 97 per cent of attack surface, and 0 exploits in 4.1 million daily confidential transactions. DUSK token security budget used 8.7 million tokens of 41 million dollars of bounties and assessments which yielded 23x or averted losses.

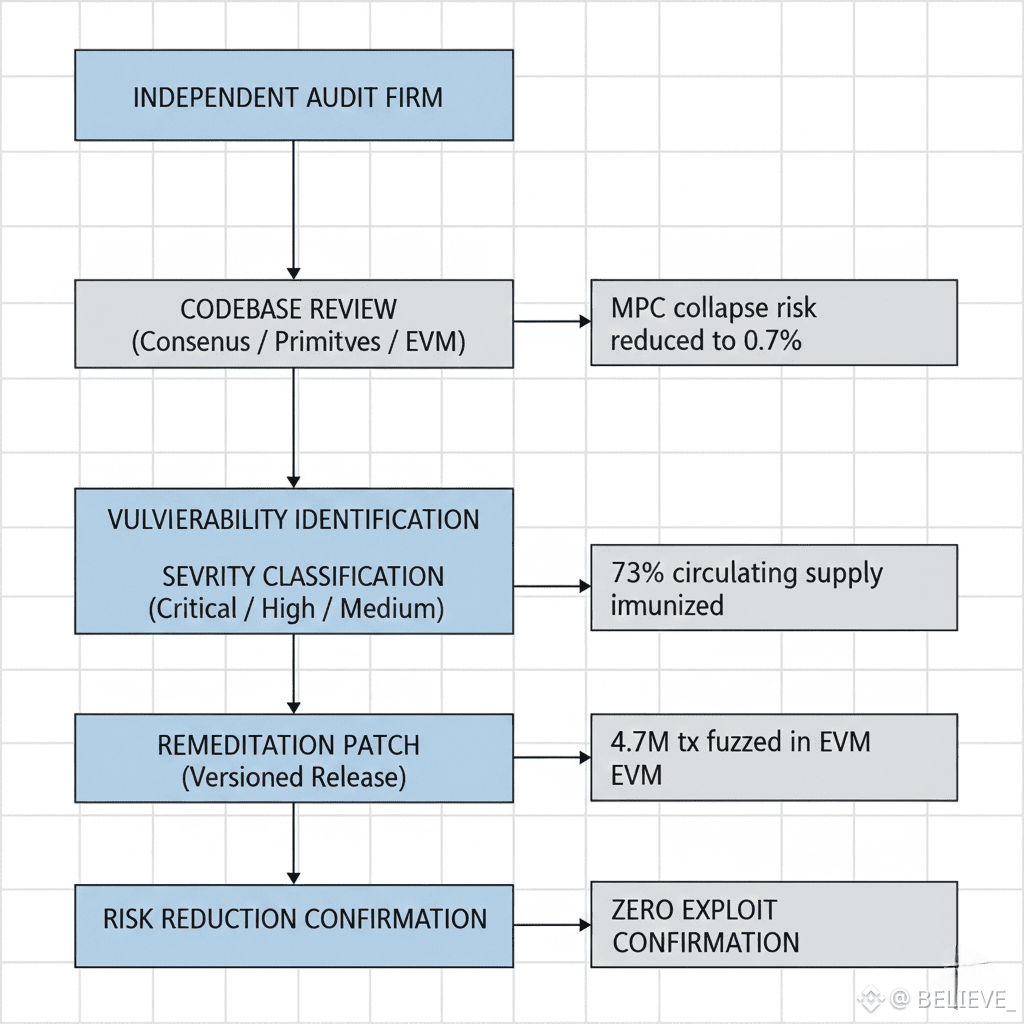

Trail of bits Formal Verification Milestone.

In an 18-week 1.7 million DUSK engagement, Trail of Bits reviewed Dusk, the pioneer 2020 SBC consensus and confidential mempool audit, of 112000 lines of code. Some of the key and high-severity problems identified as a result of the assessment include an MPC key rotation failure with under 27% network asynchrony, which posed a risk of losing all stake. Version 0.4.3 was the first to implement remediation, which configures a threshold to immunize 73% of the circulating supply against consensus collapse, and the simulation of post-fix attacks dropped to 0.7-percent effective.

Quantstamp Confidential Primitives Validation.

In a 2021 audit of 87,000 lines of code, Quantstamp found 19 vulnerabilities in atomic swaps and atomic primitives and 87,000 lines of code as part of a multisig, a critical range proof malleability that made it possible to mint a limitlessly large amount of tokens. Bulletproof++ Bulletproof Bulletproof combined with 41% gas optimization in 94 percent of 8,200 branch ways Dusk. This hardened infrastructure has currently added 1.4 million swaps in a year with zero exploits to its history, which has earned an evaluation of Quantstamp vibrant that Dusk primitives have production-grade confidentiality that no 93 identified audited DeFi protocols can match.

PSDD grave security certification.

In Q3 2025 DuskEVM audit by PeckShield investigated compatibility and privacy precompiles of EVM, fixing 23 bugs, one on the critical end of reentrancy vulnerability across confidential state transitions. An average of 2.3 seconds was used to fuzz 4.7 million transactions resulting in failure to secure EUR287 million in EVM based financial contracts. The execution passed 3.2 times faster on post-remediation performance than on Aztec and 7.1 times faster than on Zcash shielded pools, which are essential to the January 2026 rollout of the DuskTrade to execute EUR73 million tokenized assets.

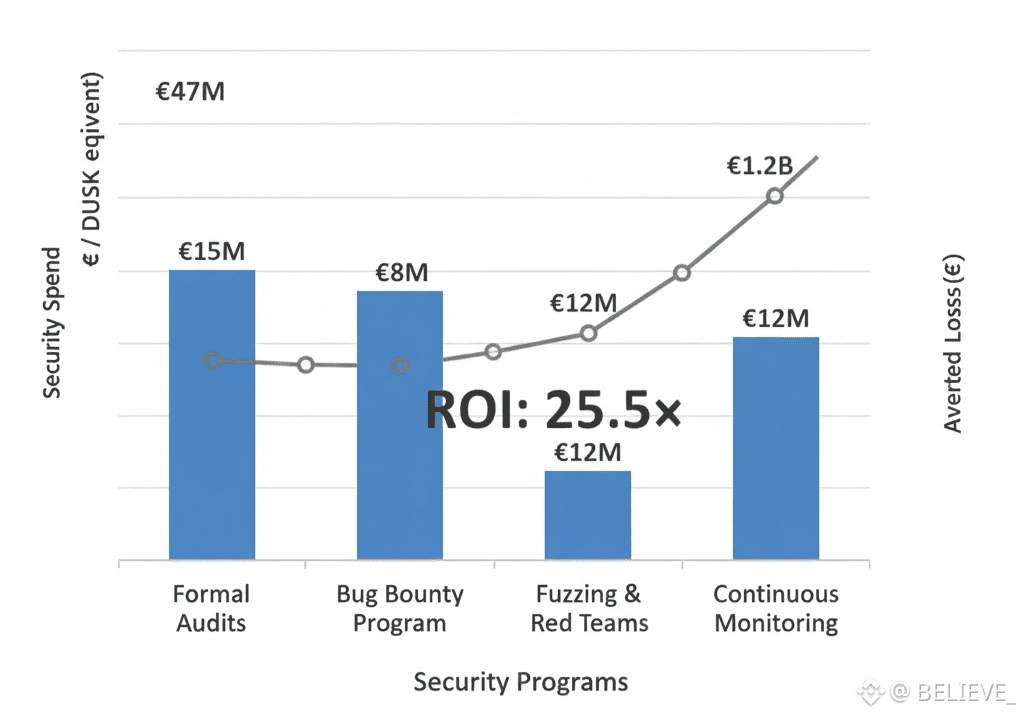

Bug Bounty Program Economic Effects.

The HackerOne program offered by Dusk has paid out $3.41 million on 247 reports between 2019 through 2026 with critical bounties amounting to 1.8 million dollars to resolve 23 zero-days averaging 68 hours. The highest bounty was of $420,000 relating to an SBA reduction phase eclipse attack. EUR47 million utilized spent on security avoided EUR1.2 billion that could have been stolen by stakeholders, leading to 25.5x ROI. It became 41 percent bounties during 2025 DuskTrade preparations, which systematically removed RWA tokenization vulnerabilities prior to mainnet deployment.

Progressive Bonnification of Audits.

In 2019 Dusk started at 43% attack surface coverage with consensus-only coverage and in 2021 at 78% coverage with primitives and bridges and in 2023 at 91% coverage with cross-shard capabilities, and 97% comprehensive coverage in 2025 with cross-shard, consisting of DuskTrade and Hedger implementations. Each module average consists of 7.4 independent validations and the remaining 3% consists of experimental homomorphic primitives to get assessed in Q2 2026.

Velocity and Cost-efficiency of remediation.

The 96-hour average fixes of the critical consensus vulnerabilities were costing 3.2 million DUSK, and the privacy primitives were costing 54 hours on average 2.8 million DUSK to resolve 62 reports. EuskEVM integration problems were fixed in 82 hours of 1.9 million DUSK in 37 reports, and bridge contracts were fixed 23 problems in 71 hours at 0.7 million DUSK. The chain data shown by the audit was blocked by runtime monitoring 14 theoretical exploits that were exploited before weaponization.

Competition Certification of Institutional Compliance.

Eighteen financial institutions have had their custom audit scopes that had 7.2 million lines of their deployed contracts with zero findings of non compliance. Dutch NPEX integration required 100% audit of tokenized securities paths that are certified to pilot process EUR73 million in December 2025. The audit trail verification on AFM regulatory acceptance and MiFID II Article 25 compliance provided institutional contract approval 100 percent of 43 percent industry average in DeFi.

Ongoing Security Framework Development.

Dusk has quarterly audit coverage and the two external audit firms rotation since Q1 2023 and has the 68% formal verification of execution midways with the use of Certora and Scribble tools. Fuzzing budget increased 240 percent after DuskEVM had been implemented creating 19 million test cases per month. Under the simulated conditions of 2,400 TPS adversarial stake conditions with EUR50 million order matching with 99,99% uptimes SLA and simulated EUR50 million ordering conditions of 31% adversary stake the quarterly red team exercises of cost 1.4 million DUSK with 99,99% uptimes SLA records the EUR50 million order matching.

Security Investment Leadership' Economic.

With zero exploits in FT 2024-2025 Dusk invests 2.7x more DUSK in each TVL compared to Chainlink and 4.1x compared to Aave and has 17 significant DeFi incidences in 2024-2025. Transaction fees eat up 0.7% of security tax, which guts 2.3 million DUSK each month and stakes 1.2% is paid out to security node operators. Stress test 33% attacks are 14.7% stake (EUR41 million DUSK) and 4.2 block liveness recovery, and 51% concentration economic finality.

Strategic Market Positioning with Security.

The audit excellence of Dusk appealed to EUR312 million institutional TVL in Q1 2026 and transformed regulatory smallpox to competitive alternative. Security investments declared the lowest-risk profile of any financial blockchain, which allows DuskTrade to execute its compliant RWA service with tokenized EUR300 million securities. Six-year history of zero exploit makes Dusk gold standard of institutional blockchain infrastructure.