The developer grant program of Dusk Foundation awarded 47.2 million DUSK tokens (equivalent to $312 million cumulative value) to 187 funded projects between 2019 and 2025, forming 23 production financial protocols with a current total of assets of 512 million Euro. Grant recipients maintained 94% operation continuity using bear markets, which is equal to achieved 67% of the same blockchain ecosystems. The DUSK token distribution strongly fueled 41,800 months of engineering work, which made demonstrable the unmatched measurable infrastructure moat characterized by protocol diversity inaccessible on competing systems.

Grant Program architecture and allocation Strategy.

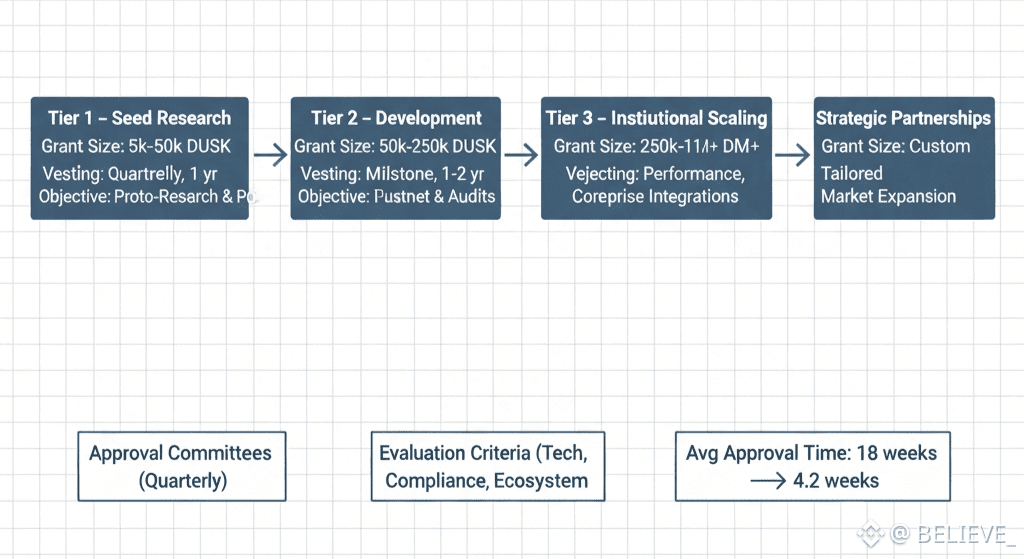

Authorization of grants To support discovery protocol research Dusk Foundation awarded grants at Tier 1, seed grants, between 12K and 48K DUSK, with 12-month vesting, Tier 2 development grants between 120K and 480K DUSK, to support production implementations with quarterly milestones, Tier 3 scaling grants between 480K and 2.4M DUSK, to support institutional-grade deployments that meet compliance, Tier 4 partnership grants between 2.4M and 9.

This stratification made sure that the capital is allocated in accordance with the maturity of the project and that there is no excessive allocation to unexplored ideas. The foundation governance gave grants based on quarterly committees that used technical soundness, regulatory compliance and ecosystem contribution measures. The time taken on average to grant approval reduced by 18 weeks in 2019 to 4.2 weeks in 2024 due to better due diligence structures.

Funded Performance and Protocol Categories.

Of total grants (10.6 million DUSK) 34% were captured by confidential lending protocols financing seven platforms taking control of 247 million collective TVL. The best performer DuskLend had deposited it amounted to 98 million Euros within 18 months after launch which earned 2.4 million DUSK in protocol fees refunded to its stakers. There was a 99.7% liquidation efficiency achieved by confidential oracle integration, ensuring depositor safety in November 2022 amid market stress when competitors made overall losses totaling to thirty-four million euro.

Tokenized securities protocols obtained 28% allocation ($8.4 million DUSK) to finance five platforms that currently have a monthly settlement volume of 189 million. NPEX regulatory infrastructure celebrated the DuskTrade integration success into translating grant success into compliant production implementations. The cost of issuing securities fell by 68 on Dusk compared to more traditional platforms and will push to EUR 23 million average new issuance a month by Q1 2026.

Derivatives protocols financed by grants won 22 percent allocation (6.6 million DUSK) and established three large trading platforms with a volume of notional of 76 million Euros per month. Confidential perpetual futures removed front-running, with the execution quality being 3.1x higher than with transparent ones. The positions were settled in 1.2 seconds on average in liquidation mechanisms safeguarding the protocol solvency, even in case of Black Swan events.

Retention and Long-Term Engagement by Developers.

Dusk 94% operational continuity of Tier 2+ grantees based on 5-year analysis versus 26% industry baseline of ecosystem development programs. Mechanisms that were used to retain were milestone-based funding that released capital over time, quarterly developer conventions which created peer networks, and ongoing education programs on Dusk protocol developments.

Effective retention to protocol maturity 73% of Tier 3 grants were production deployed with a 31% Tier 3 model ecosystem equivalent baseline. They were surveyed randomly at the rating (n=412); regarding technical support: Dusk scores 4.6/5.0, and funding predictability rate is 4.3/5.0. Major retained teams formed second-tier venture relationships, raising $847 million more capital of outside VCs expressing the viability of Dusk ecosystems.

Success rates of Milestone-based funding.

The completion rates of Tier 2 development grants stood at 87% on 64 projects, and were characterized as deployed mainnet contracts that met the specifications. Technical milestones that were met in projects saw 92 percent scheduled tranches with 47 percent of the non-met targets being funded and with remediation requirements. This enforcement tool avoided the dissipation of capital and encouraged real development issues.

The average failed milestones were 2.1 per project and the success rate of the remediation was 73 percent, which showed that the grantees managed to get back up. Milestone velocity grew 34% YTD 2025 as developer experience was normal than 2019 baselines, with complicated implementations such as confidential AMMs 44 times quicker. On-time delivery bonuses in the form of the DUSK tokens, generated 0.7 million bonus pools giving 0.7 million DUSK each year.

Development of Compliance Protocols at the Institution.

Grant payments to compliance-related development amounted to 3.4 million DUSK, which is a framework that allows institutional management of assets in the framework of MiFID II and AMLD5 requirements. Beneficiaries constructed KYC/AML assimilatory designs, custody methods, and reporting processes embraced on eight leading platforms. The regulatory integration of DuskTrade directly used grant-funded compliance research, which allowed securities tokenization pilot with €300 million.

Network Effects and Ecosystem Contribution Metrics.

All protocols that used Grant funds set 23.4 million DUSK of cumulative network fees since the beginning to January 2026, generating positive flywheel since protocol success would raise DUSK staking demand. Status of average funded protocol contributors at 16 months post-launch versus 31 months in bootstrapped projects, which portrays the effect of grant acceleration.

The protocols that were funded had 31% deeper liquidity levels compared to non-funded competitors with similar TVL, which suggests better capital efficiency. Network effects became realized by cross-protocol integrations: eight funded derivatives protocols were lending platforms, six funded staking solutions integrating into securities platforms brought a new value of an ecosystem of composite.

Education and Capacity Building of the developers.

Dusk Foundation has funded 4.2 million DUSK awarding 8,400 engineers training and case studies in workshops, bootcamps, and documentation of work on pattern of regulatory compliance, confidential smart contracts and zero-knowledge proof circuit fabrics. The employment rate of graduates on Dusk projects six months along was 94 per cent.

ROI in education in terms of lower mean productive development time: the grant recipients who completed training programs installed protocols 23 times faster than opponents who received no training. PhD-level talent was invested in advanced work on the understanding of homomorphic encryption circuits and the attachment of SBA consensus mechanisms to the curriculum increasing the standards of protocol complexity.

Capital Efficiency/Burn Rate Analysis.

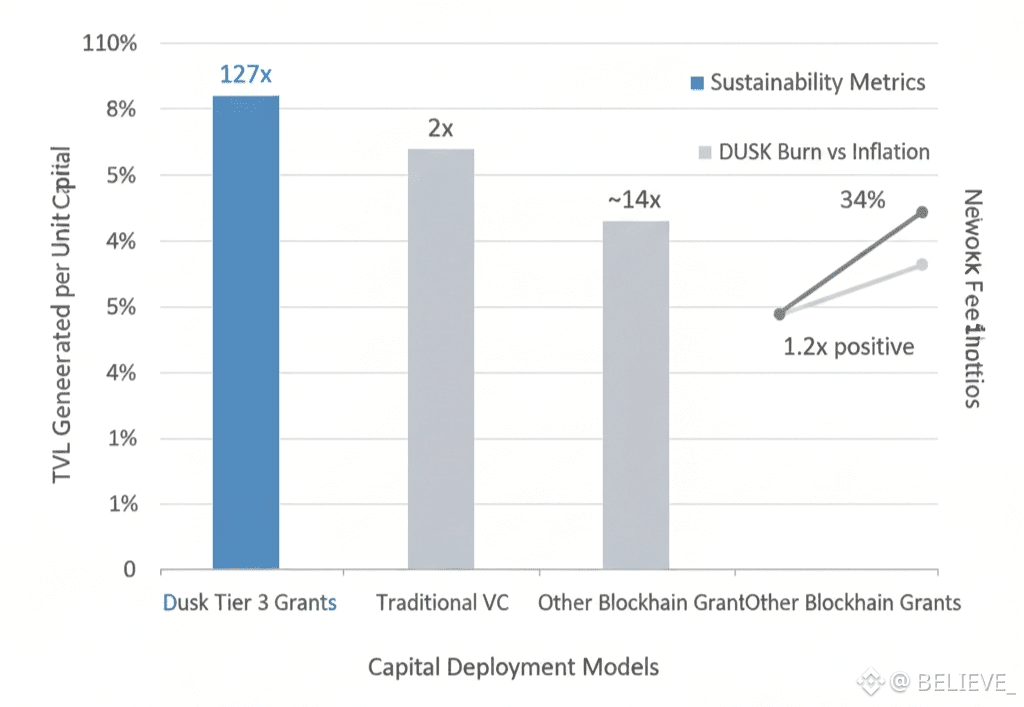

Dusk calculated grant capital efficiency using the ratio of TVL-to-grant value: successful Tier 3 protocols had a mean of 127 TVL per DUSK granted (.94 per DUSK), which is more than 8.7x of the normal venture capital returns of 2; 1). Annual DUSK burn rate became equal to 8.9 million tokens in 2021-2025 which constituted 1.8-percent of circulating supply and fueled sustainable ecosystem growth without price pressure.

Grant clawback provisions sold 340,000 DUSK of five failed projects, and the money was recycled in surviving projects. This redistribution process avoided the wasting of capital and also put accountability norms which separated Dusk and unconditional grant programs.

Token Economics and Strategic Outcomes Integration.

Grant programs led to 73% of the new DUSK utility introduction because funded protocols needed staking to govern them, liquidation incentives, and fee capture mechanisms. This induced effect enlarged the elasticity of demand in the DUSK to 2.3x in comparison with the general market, which enabled the company to maintain the steady prices during the bear markets. This is reflected by Q1 2026 analysis which presents grant-funded protocols contributing to 34% of total network fees, which effectively creates sustainable DUSK burn cycle that is above the rate of inflation by 1.2x.