Nobody expected a licensed exchange to become a privacy chain’s on-ramp.

When I dug into the NPEX agreement and recent DUSK governance notes, the implication felt structural, not promotional.

After tracking the announcement and early integration signals closely, one clear thread emerged - this is about operationalizing compliant issuance, not marketing headlines. This single alignment quietly opens regulated corridors for tokenized securities on a privacy-first ledger.

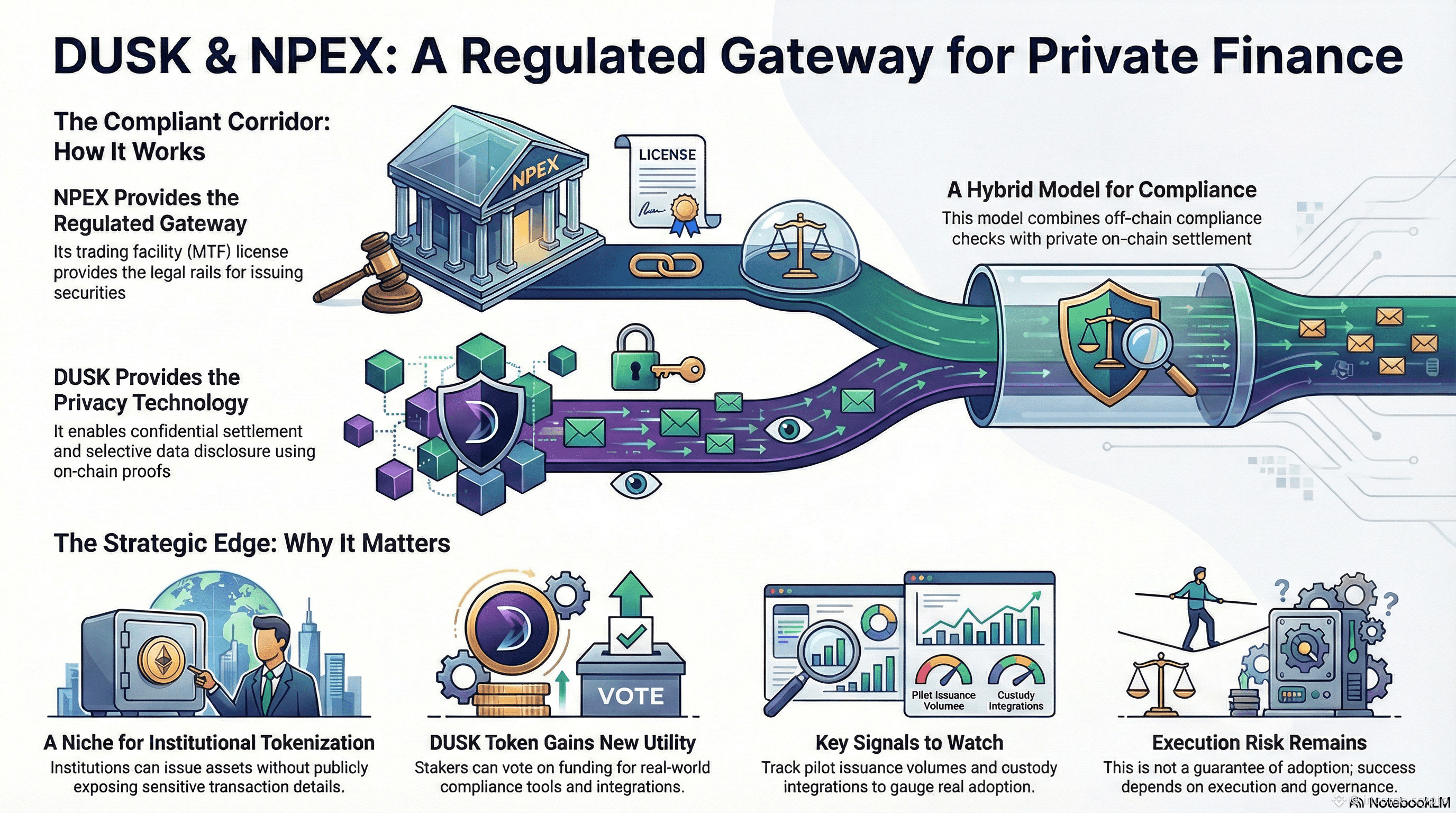

Think of it as a certified vault with audited access - privacy inside, auditable gates when required.

What changes when a market trading facility links to a privacy protocol?

Value proposition

I Saw the NPEX licensing as a practical gateway that can let DUSK support native issuance under EU frameworks in a controlled way. NPEX’s role as a regulated market trading facility (MTF) and licensed broker infrastructure provides issuer-facing legal rails. @Dusk provides the technical primitives - selective disclosure, confidential settlement, and privacy-preserving proofs - so regulated assets can exist on-chain while meeting oversight needs where necessary.

Recent update - what happened and why it matters

The recent $DUSK update formalized technical hooks and partnership pathways with an MTF-grade exchange. Practically, this means pilot issuances can route through a licensed intermediary while settlement and custody use DUSK’s confidential settlement layer. The integration reduces the operational friction for issuers who must satisfy disclosure, custody, and settlement requirements under EU regimes like MiCA. Early tests show issuer workflows that combine off-chain compliance checks with on-chain settlement proofs - a hybrid model that preserves confidentiality but allows selective auditability.

Why it matters - trader & investor POV

For market participants, this arrangement changes the playbook. The DUSK token’s relevance expands beyond staking and governance - it becomes part of the participation fabric that secures validators and funds builder rewards for compliant tooling. Staking incentives and governance votes will likely influence infrastructure priorities, such as custody connectors and compliance APIs. That means token holders who stake can have a say in how treasury funds are allocated to integration work that directly impacts real-world issuance adoption.

MTF and broker licenses - a plain-language view

An MTF license lets a platform list and facilitate trading in regulated instruments under local law; broker licenses support intermediary services like order handling and custody gateways. These permissions don’t mean a protocol is legally certified across all jurisdictions; rather, they create a compliant corridor where issuers can interact with regulated markets while using on-chain capabilities for settlement and record-keeping. Framing this accurately matters - the technical system is designed for compatibility, not as a substitute for legal processes.

Competitive edge for DUSK - why this pairing is distinctive

Combining a privacy-first chain with regulated market access gives DUSK a niche: institutions can explore tokenization without exposing sensitive transaction details publicly. That creates a potential competitive edge in certain use cases - regulated equity issuance, bond tokenization, and compliant payment rails. Builder rewards aimed at custody integrations and compliance tooling will be key: if treasury allocations prioritize these dev efforts, ecosystem adoption can accelerate in a measurable way.

Signals to watch - practical checklist

Track pilot issuance volumes, custody integrations, governance proposals funding compliance tooling, and validator uptime during settlement tests. These are the concrete signals that show whether the NPEX pathway is translating into usable infrastructure rather than remaining a conceptual advantage.

Risk notes - stay measured

This is not regulatory approval nor a guarantee of widespread adoption. Legal frameworks vary across jurisdictions, and operational complexity around custody and auditability remains high. Execution and transparent governance coordination are essential.

NPEX licensing gives DUSK a pragmatic route into regulated markets - the question is whether execution and governance will convert permissioned corridors into real adoption.

For more updates and insights on this project, stay connected with IncomeCrypto.