$HYPER Hyperlane is an "interoperability-as-a-service" protocol. Unlike traditional bridges that require permission to add new chains, Hyperlane allows developers to deploy its stack on any blockchain (EVM, Solana, Move, etc.) without the core team's approval.

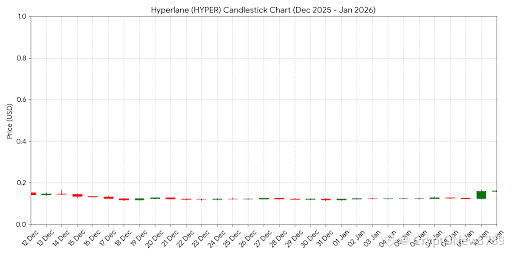

Recent Market Performance: As of January 11, 2026, HYPER is trading at approximately $0.1627. It recently experienced a massive volatility surge, jumping from a consolidation zone around $0.12 to over $0.16 (a 25%+ increase in 24 hours). This spike coincides with increased volume on major exchanges like Binance, where the HYPER/USDT pair has seen significant activity.

Tokenomics: HYPERUSDTPerp0.1407+3.53%

HYPERUSDTPerp0.1407+3.53%Market Cap: ~$35.8 Million.

Circulating Supply: ~220 Million HYPER.

Total Supply: 1 Billion HYPER.

Distinction from HYPE: Investors often confuse Hyperlane (HYPER) with Hyperliquid (HYPE). Hyperliquid is a high-performance Layer 1 Perpetual DEX with a significantly higher market capitalization (~$9 Billion) and higher per-unit token price (~$24-$26)

Key Risks: While the technology is robust and widely integrated, Hyperlane faces stiff competition from established protocols like LayerZero, Axelar, and Wormhole. Its relatively low market cap makes it susceptible to high price volatility.

HYPER NEWS

Avertissement : comprend des opinions de tiers. Il ne s’agit pas d’un conseil financier. Peut inclure du contenu sponsorisé. Consultez les CG.

128

9

Découvrez les dernières actus sur les cryptos

⚡️ Prenez part aux dernières discussions sur les cryptos

💬 Interagissez avec vos créateurs préféré(e)s

👍 Profitez du contenu qui vous intéresse

Adresse e-mail/Nº de téléphone