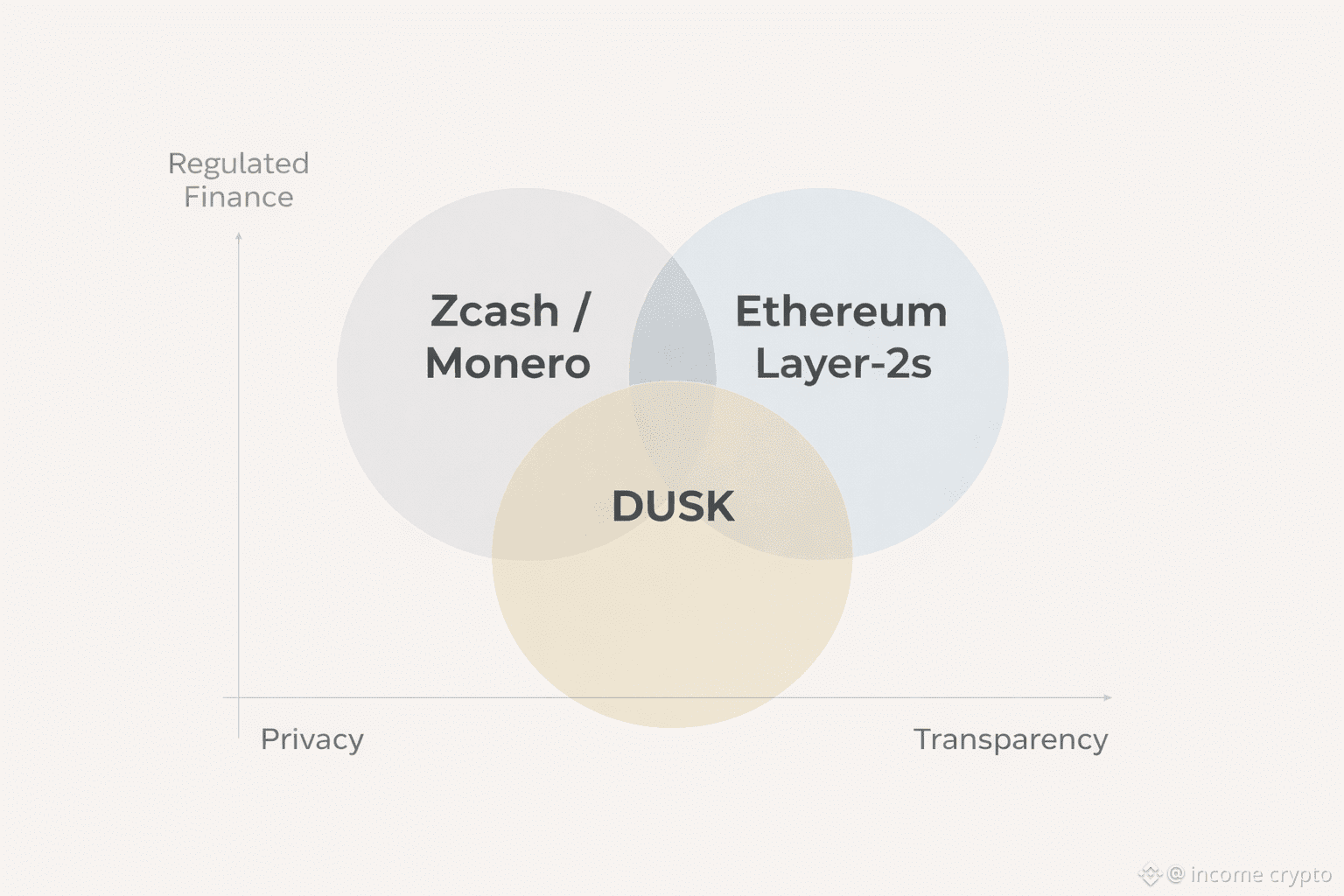

This isn’t a simple privacy vs transparency debate. It’s a question of which tradeoffs actually let systems work in the real world.

When I compared execution metrics, community signals, and developer toolsets across chains, the patterns were clear. Some networks prioritize absolute transparency for composability. Others bake privacy into core settlement mechanics. That choice changes who can build and who will adopt.

Privacy and transparency are not opposites - they are composable tools that meet different institutional needs.

Which approach delivers usable infrastructure for builders and institutions?

Value proposition

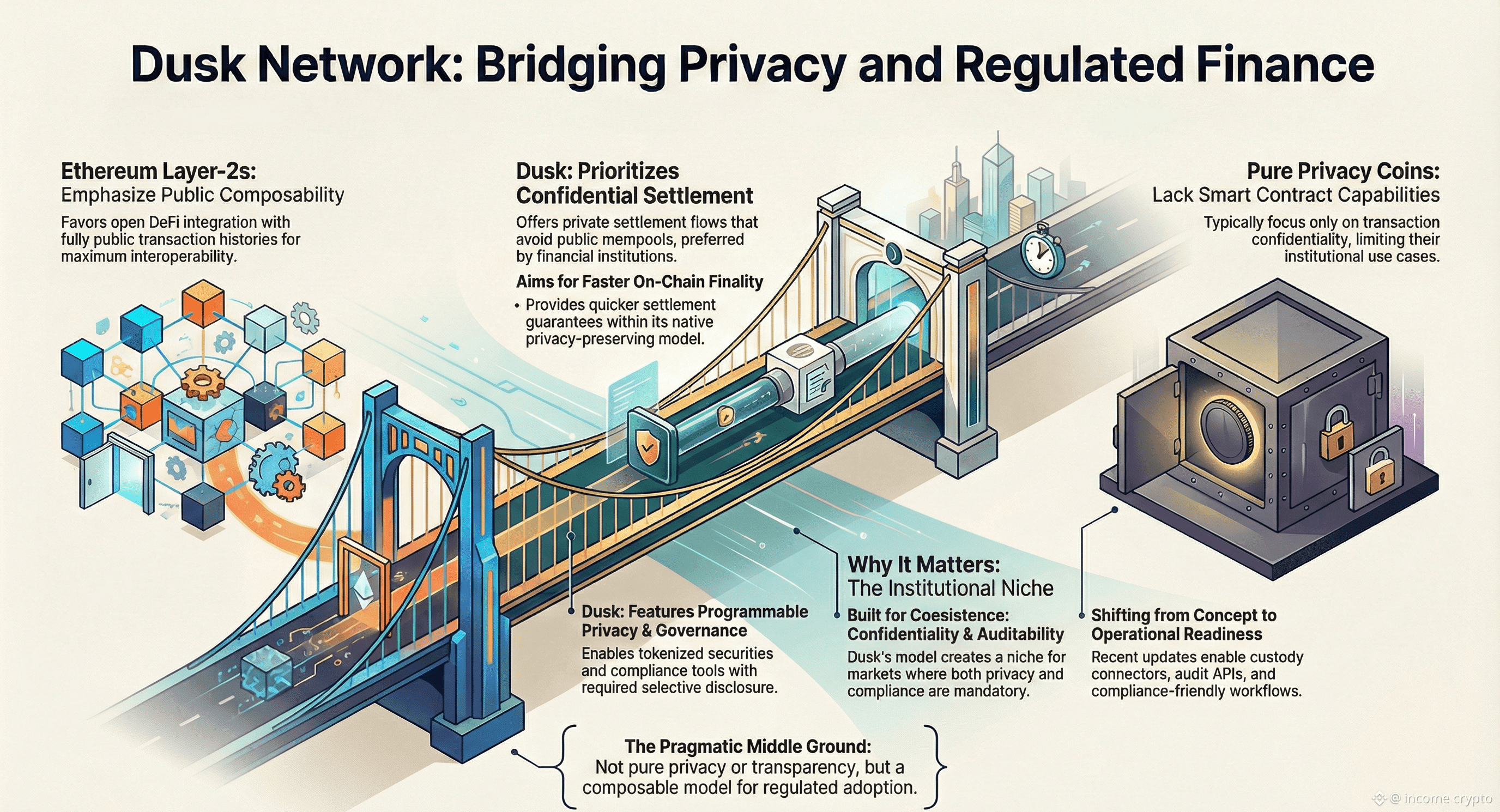

I look at @Dusk as a privacy-first chain built to be compatible with regulated use cases, not as a privacy maximalist playground. Compared to Ethereum layer-2 solutions, which emphasize broad composability and public finality, DUSK privileges confidential settlement and selective disclosure. Against pure privacy coins, DUSK prioritizes programmable privacy that can interoperate with governance and compliance tooling. This positioning creates a niche for the DUSK token within markets where confidentiality and auditability must coexist.

Recent update - practical context and impact

Recent DUSK updates focused on data availability and stability, which are prerequisites for higher-throughput execution environments. Those technical improvements, paired with partnerships for regulated issuance, make the chain more suitable for tokenizing real-world assets. The practical impact is that integration work - custody connectors, selective-audit APIs, and compliance-friendly settlement flows - becomes feasible. In short, the DUSK update shifted the project from conceptual privacy primitives toward operational readiness for certain institutional workflows.

DUSK vs Ethereum layer-2s - finality and privacy tradeoffs

Layer-2 solutions can offer rapid scaling with public transaction histories and strong composability into the broader smart-contract ecosystem. Their finality model often depends on base-layer dispute windows, which affects settlement timelines. DUSK, by contrast, aims for faster on-chain finality within its privacy-preserving model and for private settlement flows that avoid public mempools. For developers, that means different execution guarantees and distinct tooling needs - one path favors open DeFi composability, the other favors confidential settlements that certain financial actors prefer.

DUSK vs pure privacy coins - programmability and use cases

Privacy-native coins focus on transaction confidentiality but typically lack the smart contract and governance capabilities that institutional asset issuance demands. $DUSK combines cryptographic privacy with programmable state and governance mechanics. That allows for tokenized securities or compliant payment rails where selective disclosure is required without revealing full transaction graphs.

Why it matters - trader and investor POV

For traders, the distinction affects liquidity, settlement speed, and how orders are executed across venues. For investors and protocol participants, the DUSK token matters because staking and governance choices influence which builder rewards and integrations get funded. If governance prioritizes custody connectors and compliance tooling, adoption signals shift from speculative volume to institutional utility. That flow - from governance decisions to builder rewards to real integrations - is the clearest path to sustainable adoption in Web3 contexts that require privacy.

Extra angles - signals to watch

Monitor on-chain metrics for settlement finality times, validator participation, and the proportion of tokens staked versus circulating. Track governance proposals and treasury allocations that direct builder rewards toward compliance integrations. Regional adoption indicators and pilot issuance activity will reveal whether the DUSK ecosystem is converting technical capability into practical use.

Risk notes - keep a critical lens

Each model carries tradeoffs: composability vs confidentiality, public auditability vs selective disclosure. Execution risk, tooling maturity, and legal variability across jurisdictions will shape adoption trajectories. None of this is a short-term guarantee.

DUSK occupies a pragmatic middle ground - not pure privacy, not pure transparency, but a composable model aimed at regulated adoption.

For more updates and insights on this project, stay connected with IncomeCrypto.