The crypto launch of the week is undeniable: $BREV is on an absolute tear. Fresh off its Token Generation Event (TGE) and mainnet launch, the Brevis token has skyrocketed over 900% from its launch price. But this isn't just a random pump. Brevis sits at the red-hot intersection of Zero-Knowledge (ZK) proofs and Decentralized Physical Infrastructure (DePIN), positioning itself as a critical "ZK coprocessor" for smart contracts across any blockchain. The question everyone is asking: Is this a sustainable infrastructure play or a classic "buy the rumor, sell the news" event about to correct?

📊 The Jaw-Dropping Technical Snapshot

The numbers are staggering and tell a story of extreme speculative interest:

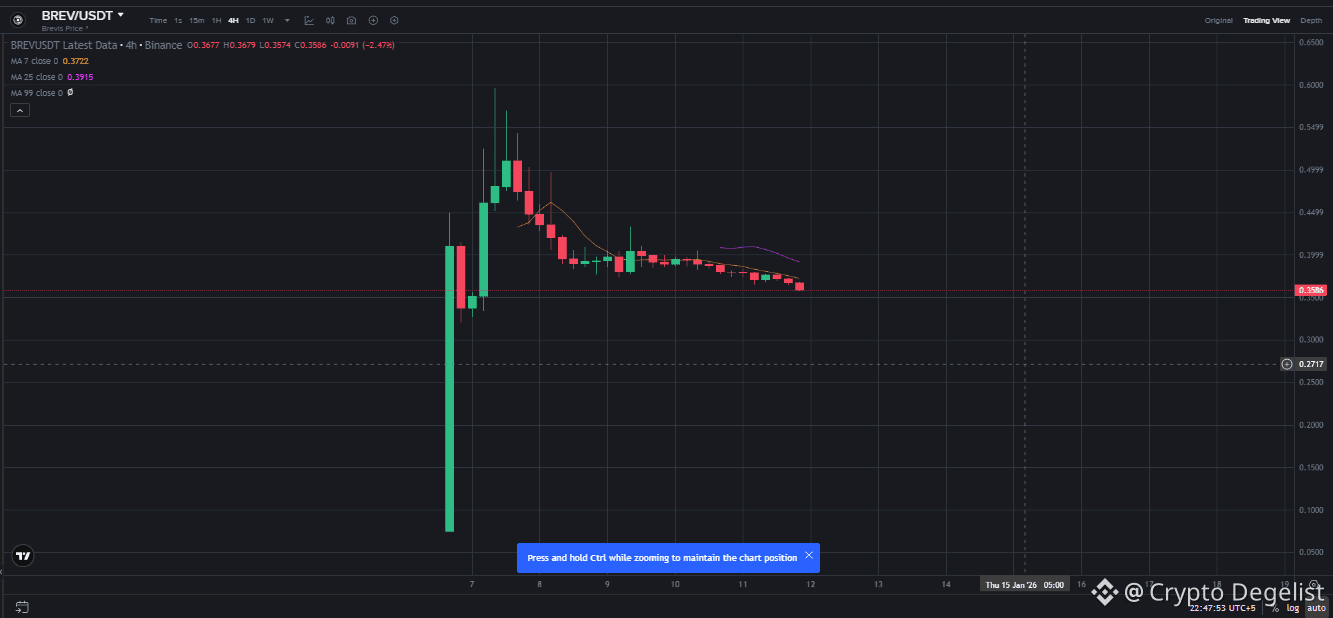

Price Action: Launched near $0.056, peaked above $0.50, and currently consolidating at lofty levels.

Volume Frenzy: 24-hour trading volume hit an astronomical $872 million—that's nearly 8 times its market cap, signaling insane token turnover and pure momentum trading.

Sentiment Signal: The RSI is deep in overbought territory (>70), a classic warning sign that the asset is due for a pullback or consolidation in the short term.

🎯 Critical Price Levels to Watch

Immediate Support: $0.40 - $0.42. This is the zone bulls must defend to prevent a deeper correction.

Key Resistance: $0.55 - $0.60. A clean break above here could target the next psychological level.

Risk Zone: A break below $0.40 could see a swift move toward $0.30.

⚡ The Bull vs. Bear Case: Why It's So Volatile

The Bullish Narrative (Why It Could Go Higher)

Elite Backing: Co-led by Polychain Capital and Binance Labs, with support from HashKey Capital. This is institutional-grade credibility.

Fundamental Utility: As a ZK coprocessor, it solves a real problem—offloading complex computation from blockchains—tapping into the AI and DePIN narratives.

Perfect Launch: Immediate listings on Binance, Coinbase, and Kraken provide unmatched liquidity and access from day one.

The Bearish Risks (Why It Could Correct)

Extreme Speculation: A volume-to-market-cap ratio of 8x is a textbook sign of a frenzy that often precedes sharp, painful corrections.

Future Supply Unlock: Only 250M of 1B $BREV are in circulation. Starting in 2027, tokens for team, investors, and ecosystem will unlock, creating potential sell pressure for years.

Fierce Competition: The ZK infrastructure space is crowded with well-funded rivals. Brevis must execute flawlessly to maintain its lead.

🎲 Bold Price Prediction & Final Verdict

Given the insane volatility, predictions are highly speculative but can be framed by potential market cap moves.

Short-Term (Next 2-4 Weeks): Expect wild swings. A best-case hold of support could lead to a retest of $0.55-$0.60. A loss of support could see a fall toward $0.30-$0.35.

2026 Outlook: Success depends on developer adoption. If the network gains real usage, a market cap of $1.5B-$2B (implying a price of **$0.90 - $1.20+) is plausible. Failure to attract builders will see prices languish.

The Bottom Line: $BREV is the definition of a high-risk, high-reward momentum play. It has elite fundamentals and a killer narrative, but is currently priced for perfection amidst a speculative mania. Trade it with extreme caution, tight stop-losses, and the understanding that the most volatile part of its journey may be just beginning.

#brev #brevis #crypto #Altcoin