Bitcoin (BTC) is currently moving through a critical phase as the market balances between consolidation and long-term bullish expectations. Despite short-term volatility, Bitcoin continues to show strong structural support, keeping investor confidence intact.

📊 Current Price Trend

Bitcoin is trading in the $88,000 – $92,000 range, indicating a consolidation phase after a strong rally. Unlike previous cycles, the current drawdowns are relatively mild, suggesting stronger institutional participation and reduced panic selling.

This sideways movement often appears before a major breakout, making this zone extremely important for traders and long-term holders.

📰 Recent Market Developments

Institutional players remain active despite temporary unrealized losses reported by major Bitcoin holders.

Bitcoin recently dipped below $91,000 but quickly recovered, showing strong buying pressure at lower levels.

Innovation in Bitcoin mining efficiency and energy usage continues to strengthen the network’s fundamentals.

🔮 Bitcoin Price Prediction (2026 Outlook)

Several market models and analysts project strong upside potential for Bitcoin:

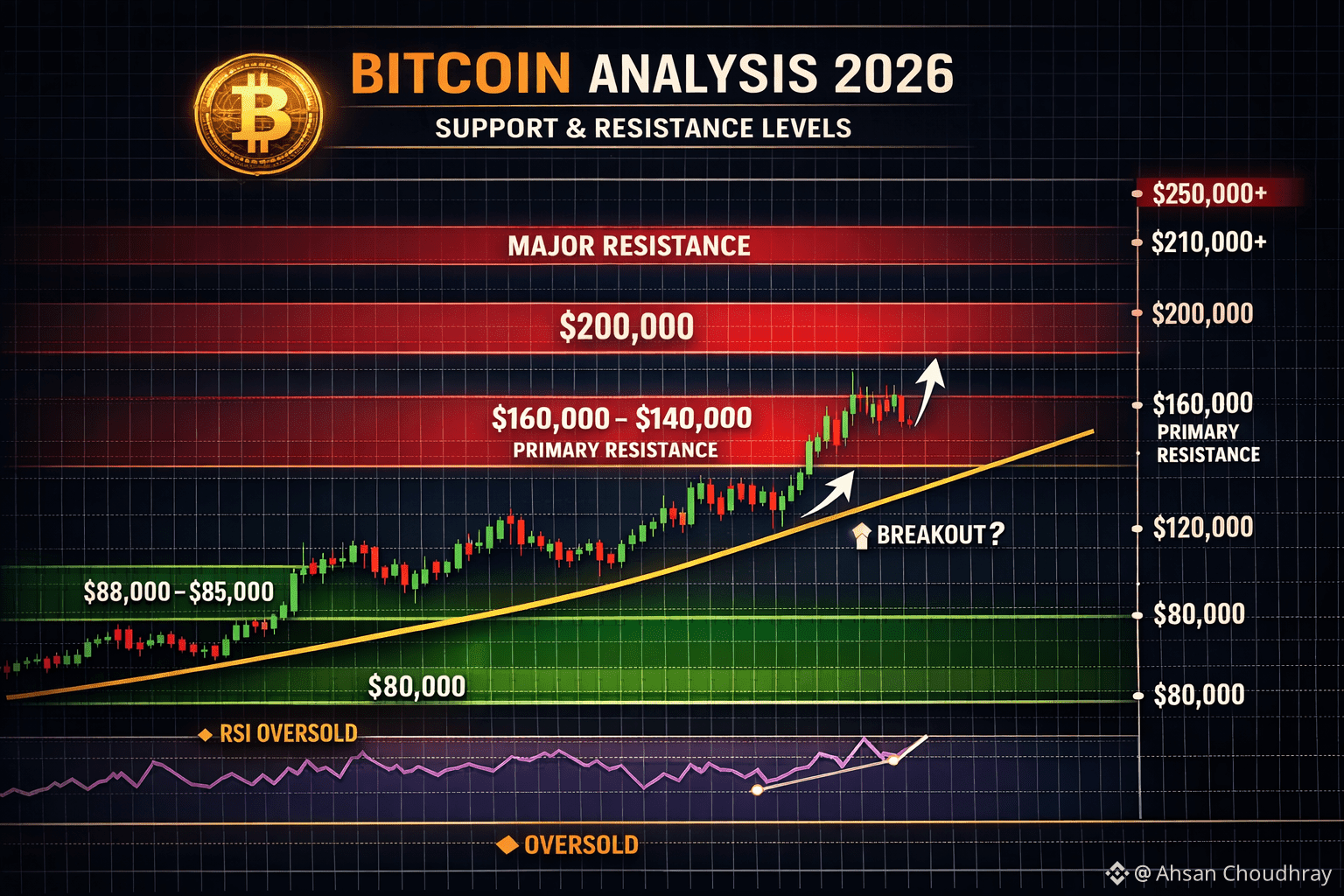

Base Case: $140,000 – $160,000

Bullish Scenario: $180,000 – $200,000

Extreme Bull Case: $250,000+ if institutional inflows accelerate and global liquidity improves

These predictions are supported by Bitcoin’s fixed supply (21 million coins), increasing ETF adoption, and growing recognition as a digital store of value.

📈 Technical Analysis Overview

Support Levels: $85,000 – $88,000

Resistance Levels: $95,000 – $100,000

Momentum indicators suggest Bitcoin is building strength for the next directional move.

Long-term trend remains bullish, while short-term price action remains neutral.

⚠️ Risk Factors

Regulatory uncertainty in major economies

Macroeconomic pressure (interest rates, dollar strength)

Sudden market liquidity shifts

Bitcoin remains a high-volatility asset, and risk management is essential.

🧠 Final Conclusion

Bitcoin is not showing signs of weakness—rather, it is cooling down before its next major move. Historically, such consolidation phases have preceded strong bullish expansions. Long-term sentiment remains positive, but patience is key.

#WriteToEarnUpgrade #USNonFarmPayrollReport #CPIWatch #BTC