When people talk about institutional capital entering crypto, it often sounds abstract. Big words, big numbers, and vague promises. But institutions are very practical. They do not care about hype. They care about whether an infrastructure can safely support real financial activity under real-world rules. When you look at the space through that lens, it becomes clear why a blockchain like Dusk Foundation is not just useful, but necessary.

Institutions operate inside strict legal and regulatory environments. Every transaction, every asset, and every counterparty has obligations attached to it. Most blockchains were never built for this reality. They prioritize open transparency and permissionless access, which works well for retail experimentation, but breaks down when compliance, reporting, and legal accountability enter the picture. Dusk was designed specifically to close that gap.

At the core of Dusk’s value proposition is its understanding of privacy. For institutions, privacy is not about hiding activity. It is about protecting sensitive financial information while still remaining verifiable. Banks, funds, and asset managers cannot expose positions, strategies, or client data on a public ledger for everyone to see. At the same time, they must be able to prove to regulators that rules are being followed. Dusk’s approach to selective disclosure directly addresses this need. Transactions can remain private by default, while still allowing authorized verification when required. This mirrors how traditional financial systems actually function.

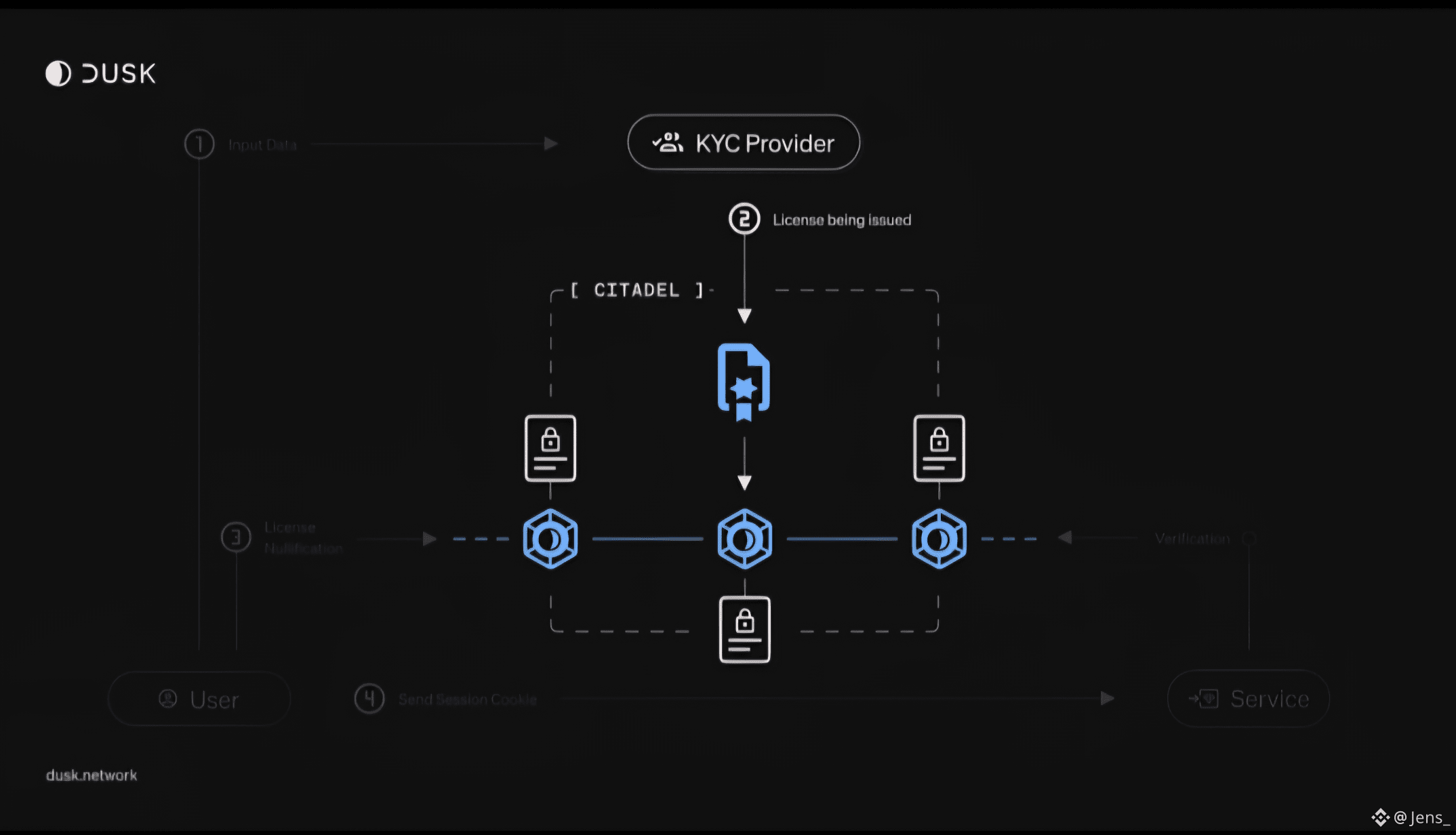

Another reason Dusk stands out is how deeply compliance is embedded into its design. Many blockchain projects treat regulation as something to deal with later, often through off-chain workarounds or application-level controls. Institutions cannot rely on that. They need compliance guarantees at the protocol level. Dusk was built with regulated finance in mind from day one, making it suitable for use cases like regulated DeFi, tokenized securities, and real-world asset issuance. These are not theoretical markets. They are already forming, and they require infrastructure that regulators can accept.

Predictability is another factor institutions care about far more than speed. A system that behaves consistently, can be audited, and does not change its rules unexpectedly is far more valuable than one that simply advertises high throughput. Dusk’s architecture prioritizes correctness, stability, and long-term reliability. This is exactly the mindset institutions bring to infrastructure decisions. They would rather move slower on something that works than move fast on something uncertain.

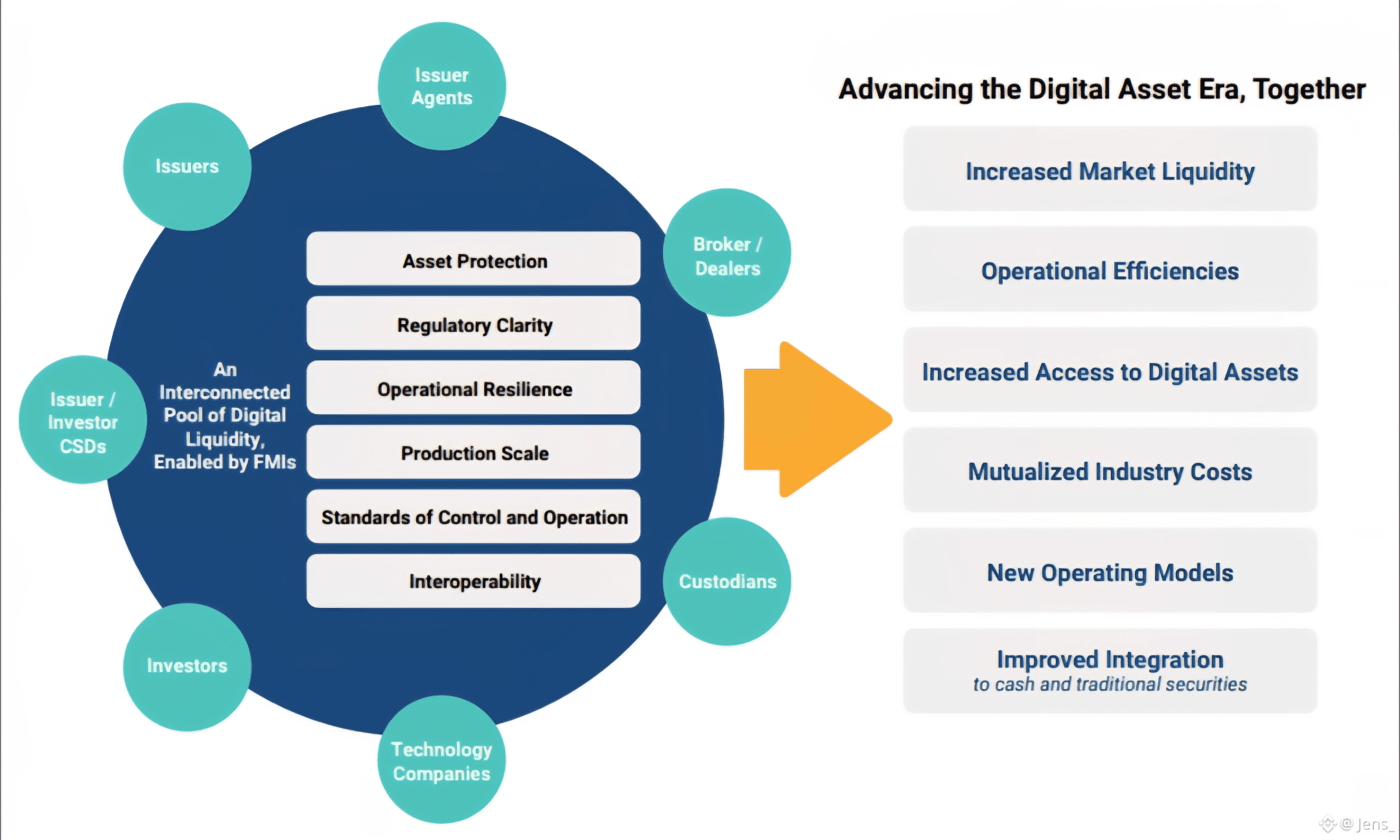

Tokenization is where this becomes especially important. As bonds, equities, funds, and other financial instruments move on-chain, the underlying blockchain must support transfer restrictions, investor privacy, jurisdictional controls, and auditability. Without these features at the base layer, tokenization remains limited to experiments. Dusk provides a foundation where these requirements are native, making it a realistic settlement layer for institutional-grade assets rather than just a conceptual one.

Dusk also recognizes that institutional adoption is not about replacing traditional finance overnight. It is about integration. Existing systems, reporting standards, and regulatory processes will continue to exist. Dusk positions itself as a bridge between traditional financial infrastructure and decentralized technology, allowing institutions to move on-chain without abandoning the structures they rely on today. This makes adoption gradual, controlled, and far more likely to succeed.

What truly sets Dusk apart is its long-term focus. It is not chasing short-term attention or speculative narratives. It is building infrastructure that becomes more valuable as regulation increases and institutions demand higher standards from blockchain technology. This kind of patience is rare in crypto, but it aligns perfectly with how institutional capital thinks.

Institutional money does not move because something is popular. It moves when the environment feels safe, compliant, and familiar enough to trust. A blockchain that ignores privacy, regulation, and structure will always struggle to attract serious capital. Dusk Foundation was built for the world institutions actually operate in, not an idealized version of crypto.

If crypto is going to become part of the global financial system, it needs blockchains that respect financial reality. That is exactly what Dusk is trying to build, and that is why institutional capital will ultimately need infrastructure like it.