Dusk’s story recently moved from “almost there” to “the network is running and the economics are finally measurable.” The cleanest anchor for that shift is the mainnet launch announcement and the 2025 roadmap framing that came with it, because it turns #dusk from a concept into an operating system for private, compliant on-chain finance. That mainnet note also set expectations for what matters next: practical features that institutions ask for, not hype features that look good on a pitch deck. In the same roadmap snapshot, $DUSK highlighted near-term deliverables such as Dusk Pay, Lightspeed (EVM-compatible L2 direction), Hyperstaking, and Zedger Beta, which together form a single narrative: regulated finance needs privacy, programmability, and settlement that doesn’t leak sensitive data, and Dusk is trying to ship those pieces as one stack rather than scattered experiments.

From a token lens, the most important “recent update” isn’t a new slogan—it’s the clarity around the native-token migration era and the long emission schedule that defines how $DUSK behaves in cycles. @Dusk documentation spells out the token metrics plainly: an initial supply of 500,000,000 DUSK (ERC20/BEP20 representations that can be migrated to native DUSK via a burner contract), plus 500,000,000 DUSK emitted over 36 years for staking rewards, yielding a maximum supply of 1,000,000,000 DUSK. That structure matters in 2026 because traders stop debating the theory of inflation and start trading the schedule—especially when staking participation grows and liquid float tightens during strong narrative windows. The same documentation also makes the staking mechanics more concrete (for example, minimum staking amount and maturity period), which is the kind of detail larger players check before treating staking yield as “real yield” versus “marketing yield.”

The #BinanceSquar CreatorPad campaign is another very recent signal worth treating like market data, because it shows attention and distribution moving through a structured funnel rather than random social noise. #Binance announced a CreatorPad campaign with a defined activity period (2026-01-08 to 2026-02-09 UTC) and a reward pool of 3,059,210 DUSK in token vouchers, with explicit participation tasks tied to publishing original content and using #Dusk, $DUSK, and the project mention. Even without guessing outcomes, this is straightforward: campaigns like this typically increase short-term content velocity, increase token visibility on Binance surfaces, and can produce measurable changes in search, watchlists, and spot/futures flow—especially when the campaign overlaps with a broader “privacy + RWA” narrative wave.

Now plug those recent milestones into how “top traders” tend to think in 2026. Larger traders rarely fall in love with ideology; they fall in love with repeatable catalysts and predictable positioning windows. For Dusk, the catalyst set is unusually clean because it’s mostly network/stack delivery, token migration mechanics, and staking-driven supply behavior. In 2026, the first question many serious traders ask is not “Is privacy cool?” but “Is the chain actually live, are upgrades shipping, and is there a reason liquidity will concentrate here rather than somewhere else this quarter?” Dusk’s mainnet announcement and the subsequent roadmap items provide the first part, and tokenomics documentation provides the second part: a long, defined emission schedule and staking incentives that can reduce effective float when participation rises.

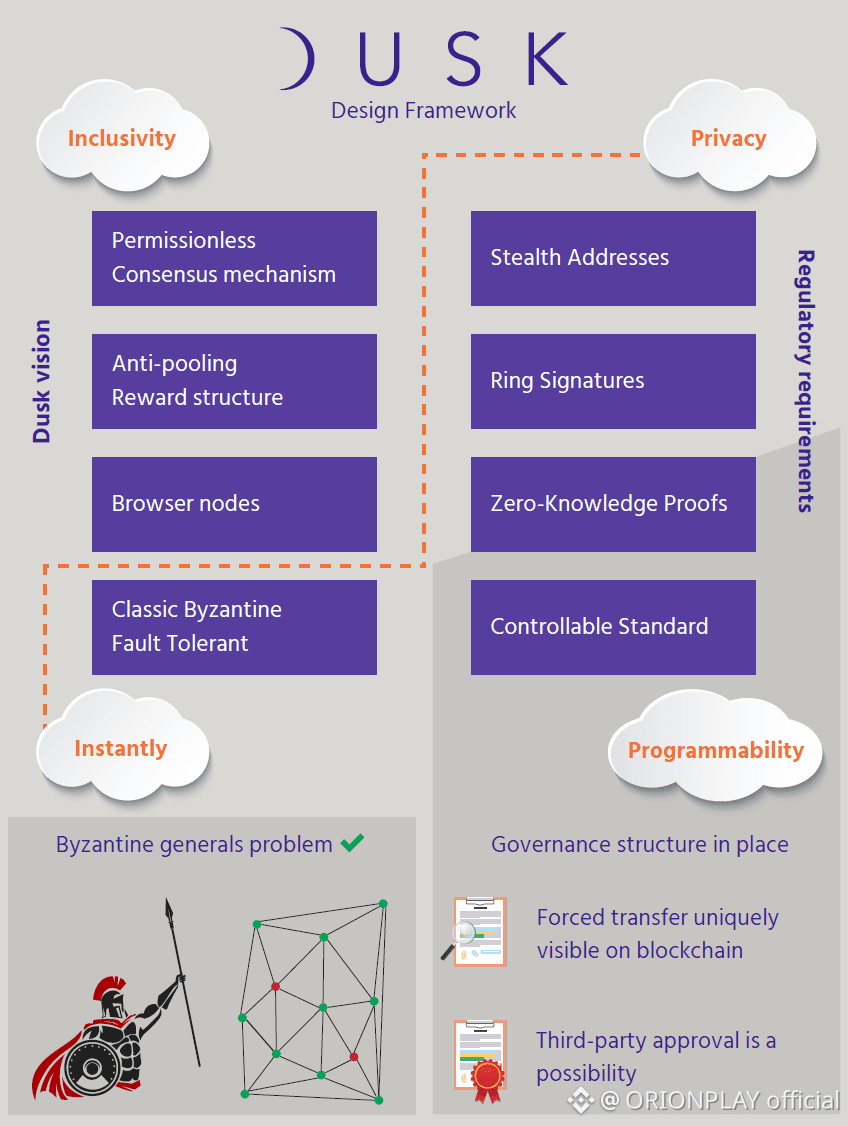

This is where Dusk’s positioning can become tradable beyond short pumps. “Privacy + compliance” sounds like a paradox until a network can credibly claim it can enforce rules without exposing sensitive information. On Binance Square, multiple Dusk-related posts in the last few days leaned heavily into that framing: confidentiality as default, with proof-based compliance rather than full public exposure. Whether one agrees with the rhetoric or not, the presence of that messaging on Binance Square during the CreatorPad window is itself a sentiment factor—because it can pull in the exact segment of users who care about regulation-friendly narratives. That matters in 2026, because markets tend to rotate narratives, and “RWA + compliance” is one of the narratives that keeps returning when institutions sniff around blockchain rails.

A practical way traders express this view is by mapping Dusk into three time horizons. The short horizon is campaign-driven flow (CreatorPad attention + content velocity) and whether that coincides with visible network activity and exchange liquidity. The medium horizon is product delivery and upgrade cadence—anything that reduces friction for builders or makes settlement and compliance tooling easier tends to become “sticky.” The long horizon is whether token utility remains essential: fees, staking, and network participation must stay meaningful, otherwise the token becomes a pure narrative chip. Dusk’s docs emphasize DUSK as the native currency and incentive for consensus participation, which supports the “token has a job” thesis—an important check-box for 2026 traders who have been burned by tokens that do nothing.

Risk is part of the “top trader” view too, because the best desks don’t buy stories; they buy asymmetric setups with defined invalidation. For Dusk in 2026, common invalidation signals would look like this: upgrades slipping without clear communication, staking incentives failing to attract participants despite the emission design, token migration remaining confusing for users, or liquidity drying up after campaign windows end. None of those require price prediction to monitor; they’re operational signals. That is also why the “mainnet is live” milestone is so important: it changes the scoreboard from promises to metrics.

The clean conclusion is that Dusk’s most recent phase has shifted from “build narrative” to “execute stack.” Mainnet being live, tokenomics being explicit, and Binance running a structured CreatorPad campaign around DUSK together create the kind of environment where traders can justify attention without stretching facts. In 2026, the most bullish version of the trader thesis is simple: if Dusk keeps delivering compliance-friendly privacy tooling while staking participation meaningfully reduces liquid supply during high-attention windows, $DUSK can behave like a narrative asset with an actual on-chain economic core. The most bearish version is equally simple: if attention is mostly campaign-based and execution doesn’t convert into usage, then $DUSK becomes another rotating ticker. The market will not need opinions to decide—only data.