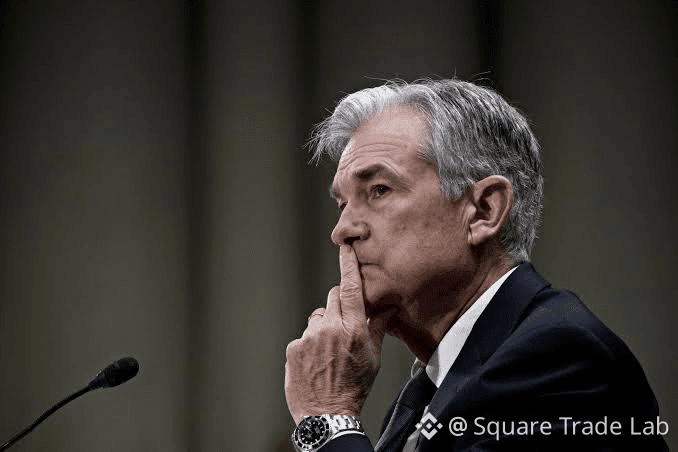

💥BREAKING: Fed Chair Jerome Powell Responds Amid Criminal Probe and Trump Criticism

For the first time in his tenure, Fed Chair Jerome Powell has broken his silence after months of staying quiet amid repeated criticisms from President Donald Trump. Powell’s response comes after federal prosecutors launched a criminal investigation into his office regarding the central bank’s decisions and compliance with presidential directives on interest rates.

Powell stated that this “threat is a consequence of not following the preferences of the President”, signaling a historic clash between political authority and the independence of the Federal Reserve.

This moment is unprecedented in modern U.S. history and carries global economic, political, and market implications.

⚡ Market Reaction

U.S. equities futures fell sharply, with the S&P 500, Nasdaq, and Dow Jones futures all down over 0.5% immediately following Powell’s comments.

Treasury yields rose as traders evaluated the increased risk of political interference in monetary policy.

Safe-haven assets such as gold and Bitcoin (#BTC) surged as investors sought protection against U.S. policy uncertainty.

The VIX volatility index spiked, reflecting heightened investor anxiety about the Fed’s independence and potential future policy conflicts.

🏛️ Federal Reserve Implications

The Fed is expected to pause further rate cuts during the January 28 meeting, signaling a cautious stance on monetary policy.

Powell’s public defense emphasizes the importance of Fed independence, a cornerstone principle that ensures U.S. financial stability.

Analysts warn that continued political pressure may trigger prolonged volatility in equities, bonds, and credit markets.

Market participants should monitor liquidity flows, interest-rate sensitive sectors, and risk assets carefully.

🪙 Crypto Market Implications

Cryptocurrencies are often reactive to political and macroeconomic uncertainty:

Bitcoin (#BTC) may see upward momentum as investors seek a hedge against fiat currency risk and political instability.

Ethereum (#ETH) could attract increased inflows, especially through staking and DeFi protocols, offering yield outside traditional banking systems.

Altcoins such as XRP (#XRP), Solana (#SOL), Cardano (#ADA), and Polkadot (#DOT) may experience heightened volatility, with speculative trading volumes rising sharply.

Crypto adoption may accelerate as individuals and institutions diversify away from traditional financial markets, anticipating potential policy-driven turbulence.

🔍 Historical Context

Powell’s open confrontation with the Executive Branch is rare in modern history, with previous Fed Chairs generally avoiding direct political conflict.

The last comparable situation occurred during Paul Volcker’s tenure in the early 1980s, when the Fed’s policies directly clashed with political pressures amid economic stress.

Powell’s actions may set a new precedent for Fed-Executive relations, impacting policy decisions and investor behavior for years to come.

📊 Market Strategy & Investor Takeaways

Prepare for high volatility across equities, bonds, and crypto.

Monitor BTC, ETH, XRP, and top altcoins as potential safe-haven or speculative assets.

Interest-rate sensitive sectors may require portfolio hedging or exposure adjustments.

Expect short-term speculative spikes in altcoins and DeFi tokens.

Defensive sectors like utilities, consumer staples, and precious metals may outperform temporarily.

Global markets, including emerging economies, should watch U.S. policy closely to anticipate ripple effects.

Crypto investors may capitalize on safe-haven demand driven by Fed vs. political tension.

🌐 Global Implications

Central banks globally may reassess USD reserve allocations or consider diversification into Bitcoin, Ethereum, and other digital assets.

Foreign investors may adjust exposure to U.S. Treasuries, risk assets, and crypto depending on ongoing political developments.

Powell’s stand represents a unique convergence of political and monetary risk, potentially influencing global asset allocation and cross-border investment flows.

⚡ Conclusion

Fed Chair Powell is asserting independence in the face of unprecedented political pressure.

U.S. equity markets responded with immediate downside, while cryptocurrencies are poised to benefit as alternative safe-haven assets.

With six months remaining as Fed Chair, Powell’s actions set the stage for heightened volatility and market uncertainty.

Investors, traders, and institutions globally should prepare for rapid shifts in risk assets and crypto markets.

Crypto markets, in particular, may see accelerated adoption and inflows, reflecting the decentralized alternative to fiat policy risk.