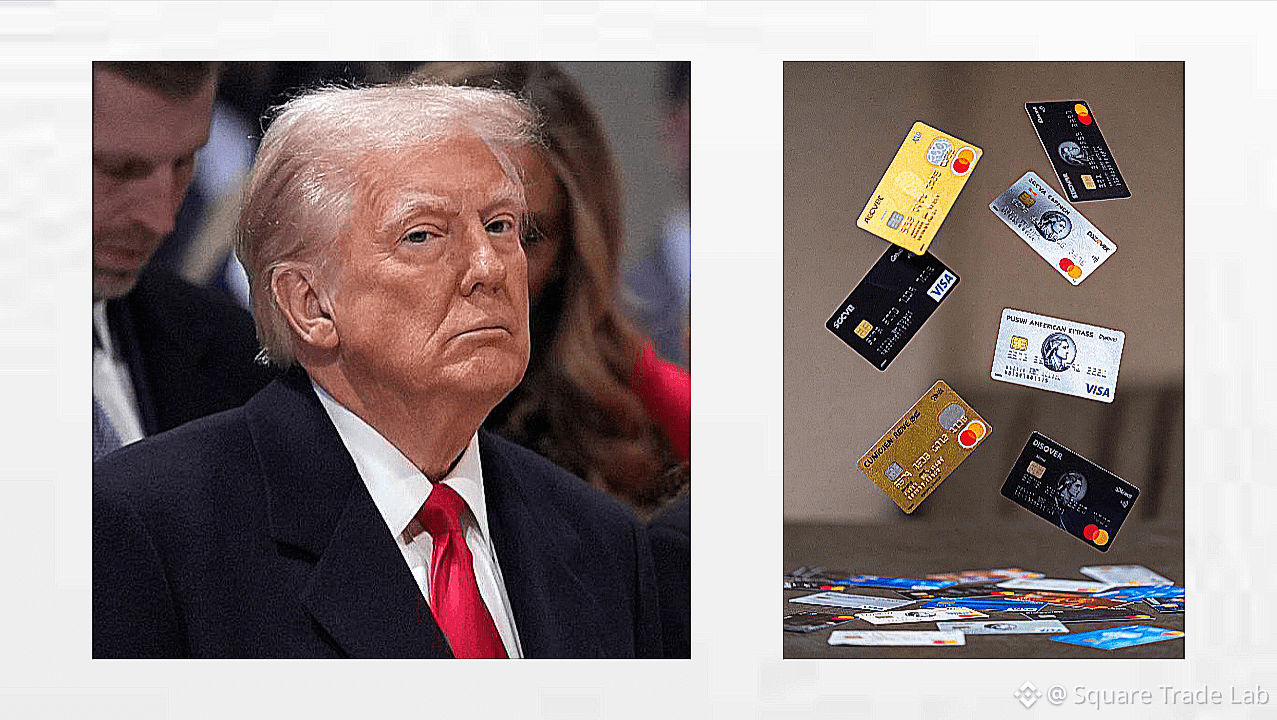

💥BREAKING: 🇺🇸 PRESIDENT TRUMP ISSUES MASSIVE CREDIT CARD INTEREST RATE CAP WARNING

President Donald J. Trump has officially warned all credit card companies operating in the United States that charging interest rates above 10% after January 20th, 2026 will constitute a violation of the law.

"They really abuse the public, I am not going to let it happen," Trump stated, making it clear that consumer protection and fairness in finance are top priorities for his administration.

This announcement has immediately shocked the financial world, triggered widespread discussion across policy, banking, and crypto circles, and could represent one of the most significant domestic economic interventions in recent U.S. history.

⚡ Immediate Implications for U.S. Consumers

Reduced Household Debt Burden: Millions of Americans currently pay credit card interest rates ranging from 20% to 30%. With a legal cap of 10%, consumers will save hundreds or thousands of dollars per year, freeing up disposable income.

Boost to Consumer Spending: Lower debt obligations often translate into increased consumption, which can have a ripple effect across retail, e-commerce, and service sectors. Analysts expect a short-term surge in consumer confidence, particularly among middle- and lower-income households.

Financial Relief Across Demographics: Young professionals, families carrying high debt, and retirees reliant on credit will experience immediate financial relief, potentially reducing defaults and late payment fees.

Pressure on Credit Card Companies: Traditional banks and fintech firms reliant on high-interest revenues may be forced to revise business models, introduce alternative fee structures, or innovate new financial products.

Acceleration of Digital Finance Adoption: Reduced friction in borrowing could incentivize households to explore digital payment systems, stablecoins, and crypto assets for everyday transactions.

📊 Market and Economic Effects

Banking Sector: Major credit card issuers and financial institutions are likely to face short-term revenue compression. Some firms may adjust interest rates on other loans or promote premium subscription-based services to maintain profitability.

Stock Market Implications: Investors should anticipate volatility in banking stocks, with ripple effects potentially reaching financial ETFs, fintech equities, and consumer lending companies.

Crypto and Digital Asset Markets: Reduced interest expenses for households and higher disposable income could increase liquidity flows into risk assets, benefiting Bitcoin ($BTC), Ethereum ($ETH), XRP ($XRP), Solana ($SOL), and other major cryptocurrencies. Analysts see this as a structural bullish catalyst for 2026.

Capital Allocation: Individuals may redirect freed-up cash into equities, crypto, or savings, enhancing market depth and stability in digital and traditional finance markets.

🌎 Geopolitical and Global Relevance

Global Attention: The U.S. move is likely to draw attention from international banks and governments, reinforcing the U.S. position as a financial policy leader.

Impact on Global Crypto Adoption: With Americans gaining access to cheaper credit and fewer barriers, crypto adoption may accelerate, potentially driving the U.S. to compete with Dubai, Singapore, and Hong Kong as a top destination for digital finance innovation.

Investor Confidence: Retail and institutional investors worldwide may interpret this policy as a pro-consumer and pro-market signal, possibly triggering inflows into U.S.-based crypto and fintech platforms.

🔥 Key Takeaways

Credit card interest rates above 10% after January 20th will be illegal.

Millions of Americans immediately benefit, reducing financial stress and increasing disposable income.

Consumer spending, liquidity, and risk appetite may surge, providing tailwinds to crypto and equity markets.

Traditional banks must adapt revenue models or explore innovative solutions.

The policy reinforces Trump’s pro-consumer, pro-market agenda for 2026, positioning him as a champion of financial fairness.

Could spark accelerated adoption of Bitcoin and other cryptocurrencies as frictionless payment systems gain appeal.

Likely to create short-term volatility in banking, credit, and crypto markets, but long-term fundamentals for adoption and consumer protection strengthen.

💰 Crypto Market Implications

Bitcoin ($BTC): Could see increased inflows as consumers and investors seek alternative stores of value.

Ethereum ($ETH): Higher liquidity in markets may boost staking, DeFi adoption, and network activity.

XRP ($XRP) and Solana ($SOL): Likely to benefit from increased transaction volumes and wallet adoption.

Altcoins: Consumers seeking diversified exposure may explore smaller-cap crypto assets as part of newfound disposable income allocation.

Market Structure: The move highlights U.S. regulatory clarity, which is historically correlated with institutional crypto adoption.