The global liquidity map is being redrawn. As the Trump administration shifts toward aggressive geopolitical leverage—targeting $50 oil and redefining alliances—the "Flight to Quality" has found a new home in decentralized assets.

1. The Energy Pivot: $50 Oil as a Crypto Catalyst

The ultimatum to oil giants regarding Venezuela isn't just a political play; it’s an intentional deflationary shock.

The Logic: By forcing oil toward $50, the administration aims to lower the global "inflation floor."

The Result: Lower energy-driven inflation gives the Federal Reserve room to stay neutral, creating a "Goldilocks" environment where Bitcoin thrives on high USD liquidity.

2. The Japan Pivot: A New "Safe Haven" Narrative

Prime Minister Takaichi’s historic defense surge has destabilized traditional hedges like the Yen.

The Shift: As sovereign debt risks rise in traditional markets, capital is rotating into Bitcoin as the "Geopolitically Neutral Reserve." It is the only asset without a "country risk" attached to it.

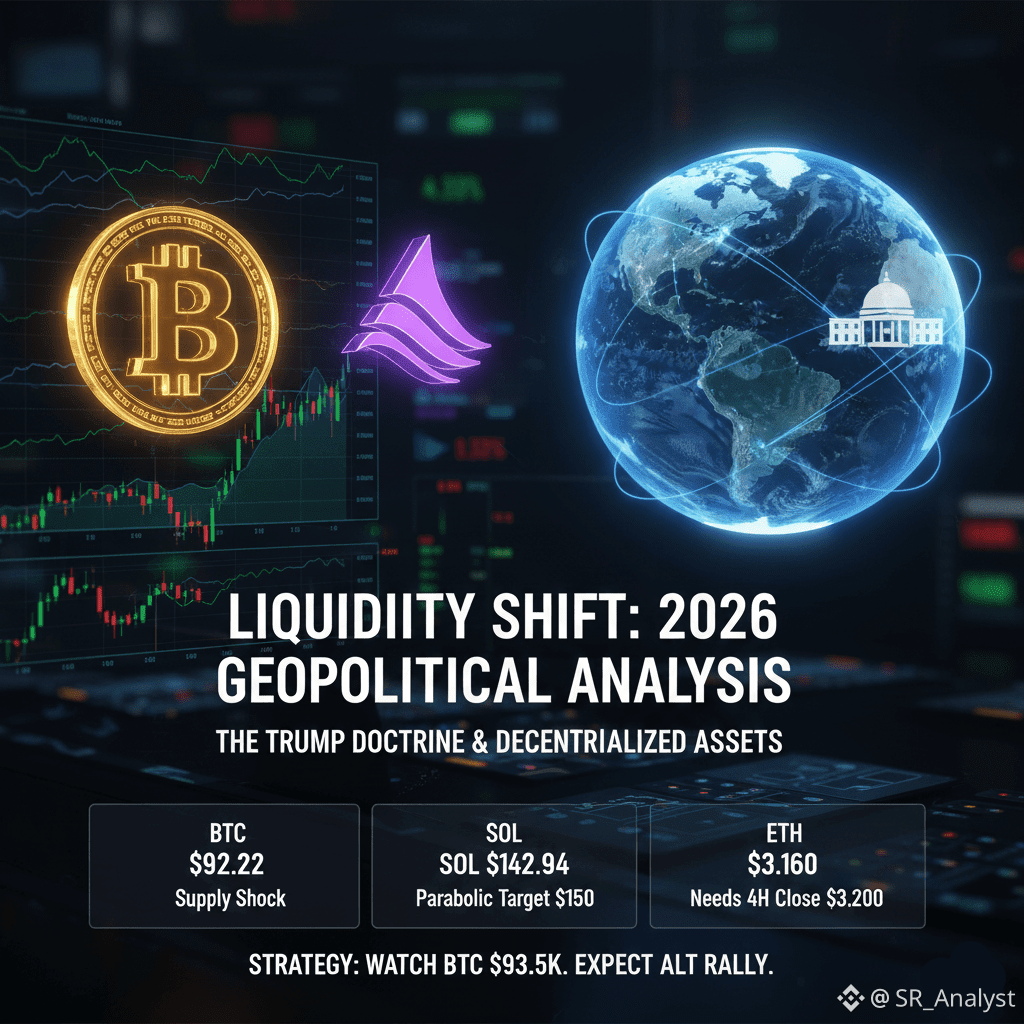

📊 Professional Market Study: Key Levels

Trade the levels, ignore the noise.

Thesis: The "Supply Shock" is being priced in.

Resistance: $93,500 (A break here signals a new discovery phase).

Support: $91,100 (The line in the sand for bulls).

Thesis: Leading the market recovery with high-speed capital inflows.

Target: $150.00 (Flipping this level suggests a parabolic move).

Support: $138.00 (Re-established base).

Thesis: Battling the Fib levels; needs institutional confirmation.

Confirmation: Needs a 4H candle close above $3,200 to confirm the reversal.

💡 Strategy Summary

The early morning "Red" was a classic liquidity shakeout. In a world of "Maximum Pressure" diplomacy, BTC math and SOL speed have become the preferred shelters for global capital.

Watch $93.5k BTC. If it breaks, expect an accelerated Altcoin rally.