According to the latest 2026 Crypto Crime Report from TRM Labs, illegal crypto activity reached a staggering $158 billion in 2025, up 145% from the $64.5 billion recorded in 2024. This marks a new all-time high in illicit blockchain flows.

TRM noted that this dramatic rebound came after years of steady decline. From $85.9 billion in 2021, criminal crypto volumes dropped to $73.3 billion by 2023 — only to skyrocket again in 2025.

The Paradox: More Crime in Dollars, Less Crime in Percentage

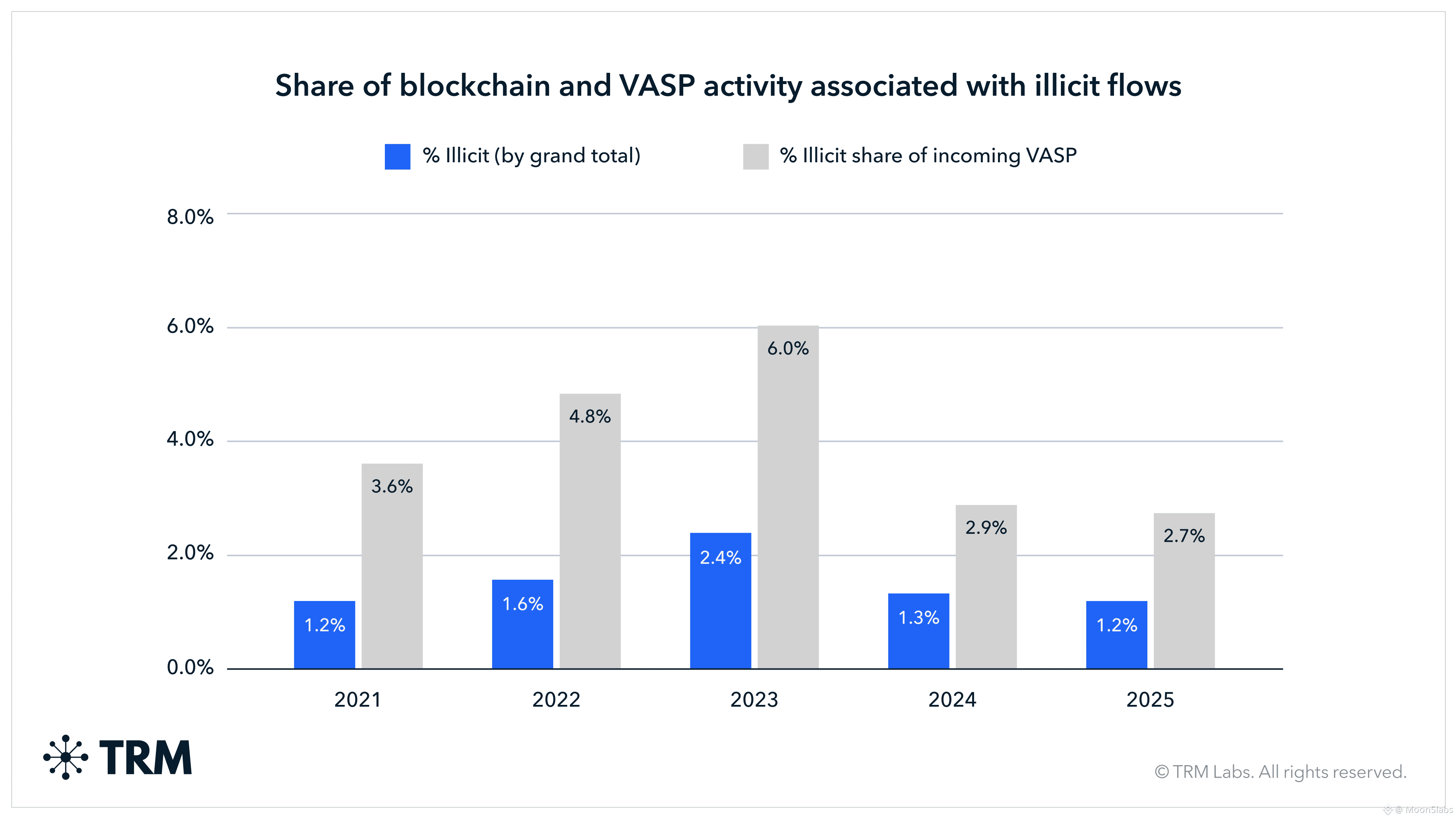

TRM’s data reveals a twist: the percentage of illegal activity is actually shrinking.

In 2025, illicit transactions made up just 1.5% of known crypto flows, down from 1.7% in 2024 and 3.5% in 2023. Likewise, only 2.7% of inbound funds went into flagged wallets, compared to 2.9% the year before and 6.0% in 2023.

This means the market is growing faster than the criminals — but they’re still handling more money than ever before in raw numbers.

Russia Leads the Way — One Token Alone Moved $72 Billion

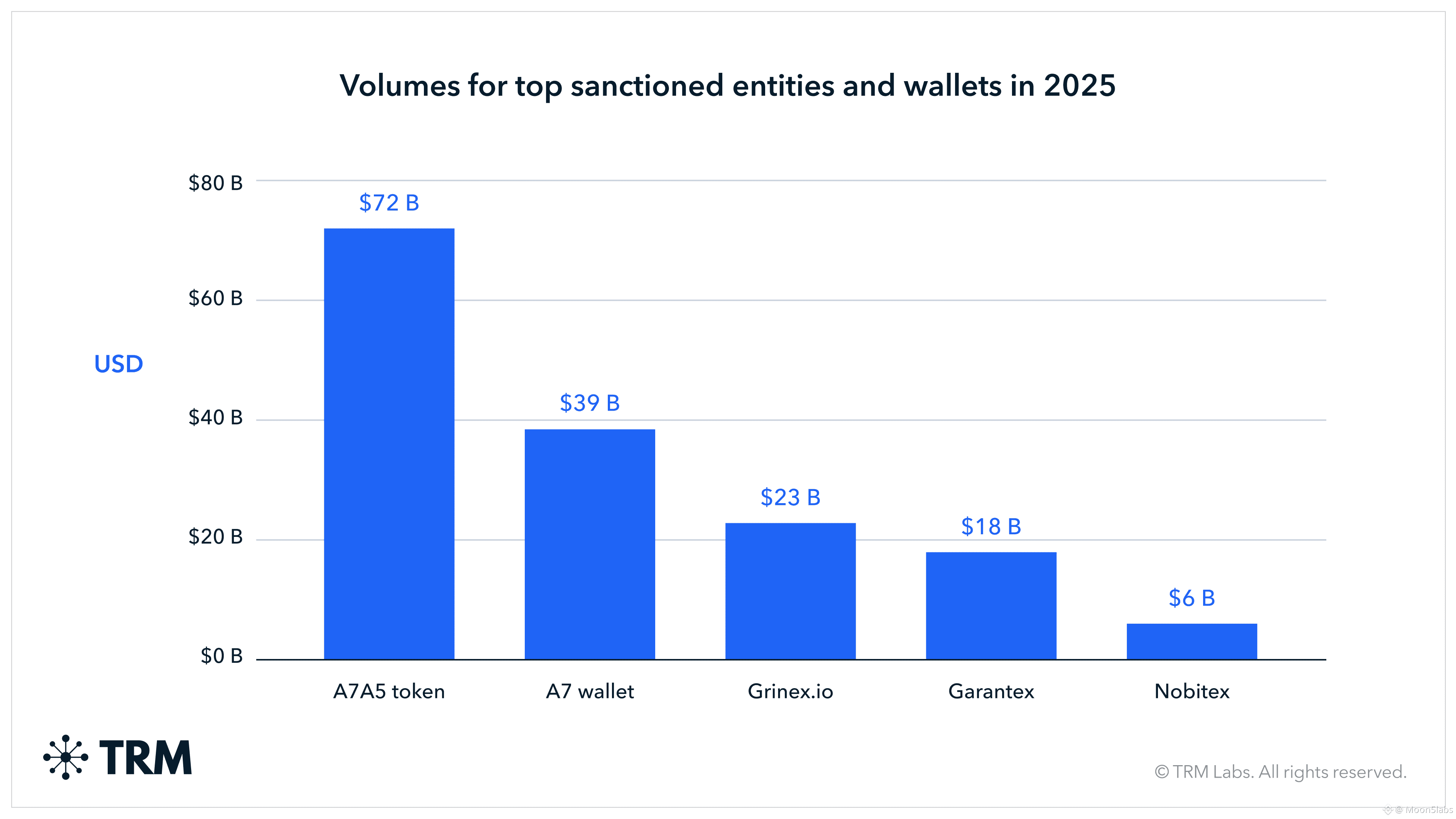

TRM identified Russia-linked addresses as the dominant players in the 2025 illicit crypto ecosystem.

🔹 Token A757 processed $72 billion in dirty money

🔹 Wallet cluster A7 received an additional $39 billion

Combined, they accounted for over 80% of all sanction-related volume.

Key actors include Garantex, Grinex, and the A7 network, with a spotlight on a ruble-backed stablecoin called A7A5. According to TRM, this token is central to Russia’s long-term strategy to reduce reliance on the U.S. dollar and build an independent payment infrastructure.

Stablecoins Take Over — Criminals Are Getting Smarter

TRM found that 95% of all funds entering sanctioned wallets came through stablecoins — a clear sign of tactical adaptation.

Today’s bad actors avoid major exchanges and instead use smaller, riskier platforms, private deals, and stealthy transaction tools.

In fact:

🔹 In 2020, this type of off-chain service moved about $123 million

🔹 By 2025, that number ballooned to over $103 billion

They now rely on OTC brokers, underground banking networks, Asian crypto casinos, and money mules to move huge sums of stablecoins into the regulated financial system.

Venezuela, China, and the Darknet — Where the Dirty Money Goes

TRM also highlighted cases where governments themselves use crypto to bypass sanctions.

🔹 In Venezuela, authorities reportedly rely on crypto to keep state functions running, from payroll to remittances — because banks are frozen.

🔹 In China, underground escrow services support fraud, money laundering, and cybercrime with little oversight.

Meanwhile, darknet markets for illegal goods and services grew by 20% year-over-year.

Enforcement Gets Faster — and TRM Updates Its Tracking Model

TRM emphasized that the spike in identified crime is not due to smarter criminals, but to faster enforcement.

The Beacon Network, a collaborative international platform, now lets investigators cross-reference wallets, transactions, and patterns in real time. The result: dirty wallets are flagged much faster.

Even stablecoin issuers have joined the effort. TRM notes that Tether has actively blocked wallets tied to terrorism, fraud, and hacking, which explains the surge in flagged stablecoin transactions.

New Methodology: Real Risk vs. Fake Volume

TRM has also changed how it measures risk. Previously, illegal crypto was calculated against total blockchain volume, but that included bots, wash trades, and internal exchange shuffling — inflating the numbers and hiding the truth.

Now, TRM compares illicit flows only to real, usable capital — money entering or exiting licensed VASPs (crypto exchanges, payment providers, etc.).

This shows the true criminal exposure — how much real money ends up in bad actors' hands.

They also removed:

🔹 Wash trading

🔹 Peel chains

🔹 Internal wallet loops

These activities create false movement without adding capital. They're now filtered out of the dataset.

$158 Billion May Just Be the Beginning

TRM calls its numbers conservative estimates. The report excludes:

🔹 Fiat crimes that later entered crypto

🔹 Unaudited or off-chain wallets

🔹 Full money laundering cycles

Moreover, investigations are ongoing. As more wallets are unmasked and sanctions updated, the real number could rise significantly.

Their final warning:

➡ Crypto crime is no longer a fringe issue. It's a fast-evolving, globally scaled threat.

#CryptoCrime , #BlockchainSecurity , #CryptoRegulation , #russia , #CyberSecurity

Stay one step ahead – follow our profile and stay informed about everything important in the world of cryptocurrencies!

Notice:

,,The information and views presented in this article are intended solely for educational purposes and should not be taken as investment advice in any situation. The content of these pages should not be regarded as financial, investment, or any other form of advice. We caution that investing in cryptocurrencies can be risky and may lead to financial losses.“