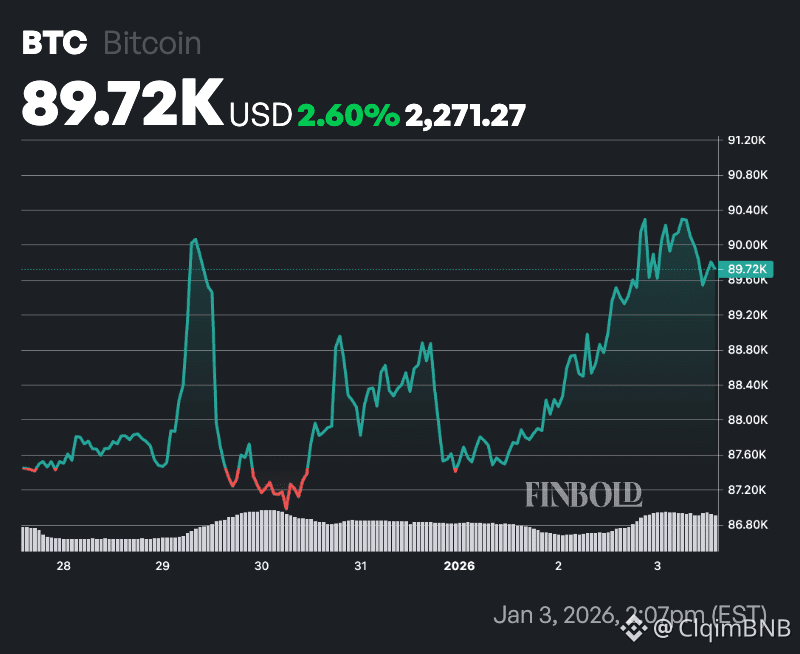

As of today (January 12, 2026), Bitcoin (BTC) is trading in the $90,000–$92,000 range, with live prices hovering around **$90,500–$91,500** USD across major exchanges (slight variations due to real-time fluctuations). It has shown modest gains of about **0.5–1.5%** in the last 24 hours, recovering from recent dips while remaining within a consolidation phase after the late-2025 highs.

Key Market Drivers Today

The primary catalyst influencing BTC today is the escalating **feud between President Donald Trump and Federal Reserve Chairman Jerome Powell**. Reports indicate tensions, including potential DOJ subpoenas related to Fed policies, have rattled traditional markets sending Nasdaq futures and the U.S. dollar lower. Bitcoin, often viewed as a "risk-on" or alternative asset, has reacted positively in this environment, rising modestly as investors treat crypto (alongside gold) as a potential hedge against uncertainty and possible monetary policy shifts.

Geopolitical & macro uncertainty→ Supports BTC as a "debasement trade" play.

No major direct crypto-positive news** → Keeps gains capped for now.

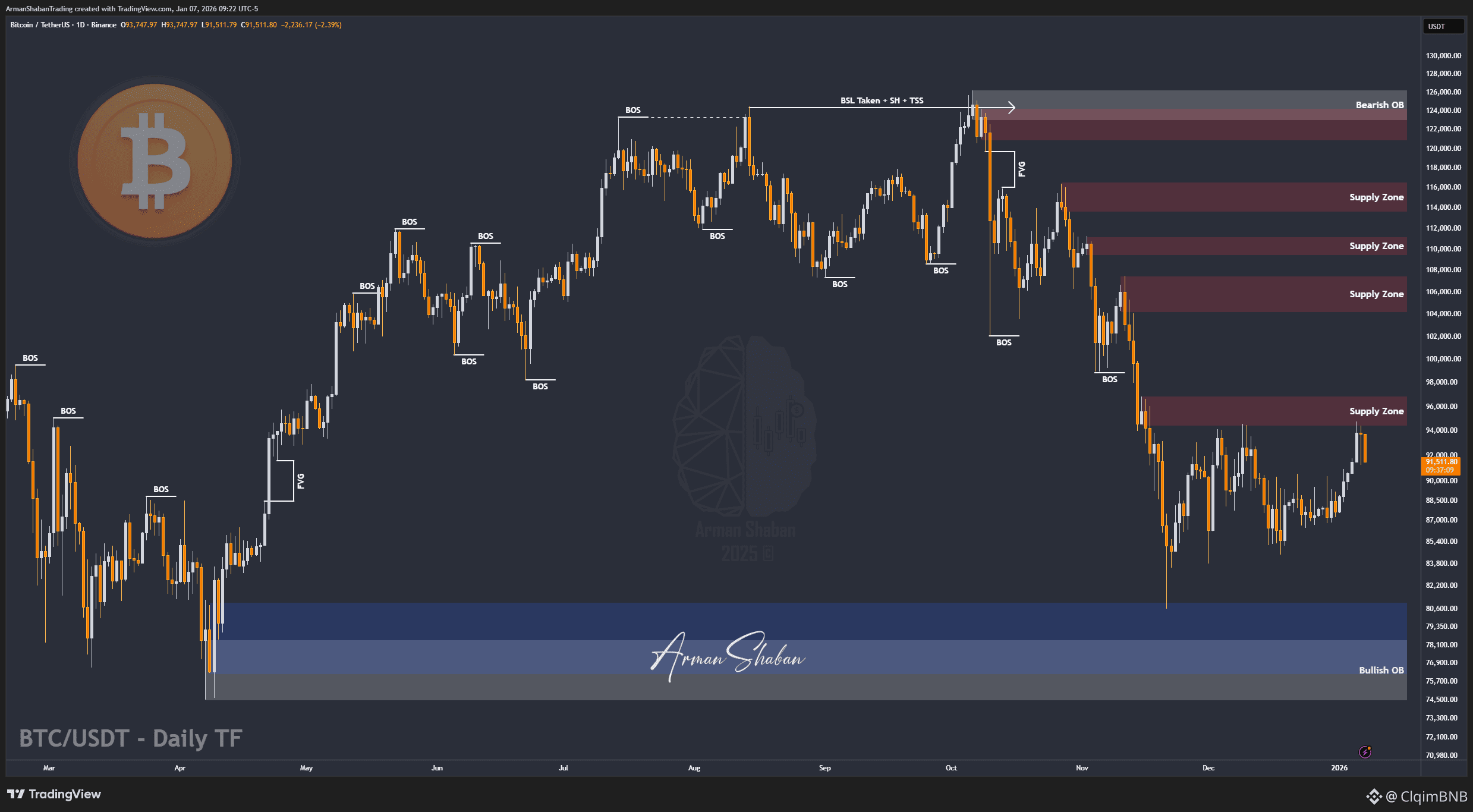

Technical view** → BTC is holding key support around **$90,000** and attempting to push toward resistance at **$92,000–$93,000**. Analysts note bullish momentum if it breaks higher, but a bear flag pattern on daily charts warns of possible downside if support fails.

Short-Term Outlook

Bitcoin remains resilient in the **$89K–$95K** range seen over the past week. Positive signals include:

Stability above the **$90K** psychological level.

Some recovery attempts amid the Trump-Powell drama.

Broader sentiment that crypto enters 2026 on "stronger footing" compared to late-2025 headwinds.

However, BTC is still ~28% below its all time high (around $126K from late 2025), and volatility persists.

Longer-Term Perspective for 2026

Analysts remain divided but generally optimistic:

Many forecast a high-volatility year with BTC potentially ranging from **$75K** (bear case) to **$150K–$225K** (bull case), centering around **$110K**.

Institutional demand, possible pro-crypto policy moves (e.g., strategic Bitcoin reserve under Trump), and macro factors like debt/debasement could fuel upside.

Predictions suggest BTC could end 2026 higher than it started, with renewed rallies possible if key resistances break.

Overall, today’s action reflects Bitcoin acting as a **relative safe haven** amid political noise, but the market remains choppy. Watch $90K support and **$92K–$95K** resistance closely for the next directional move. Always do your own research crypto markets move fast! 🚀#TrumpNFT $BTC