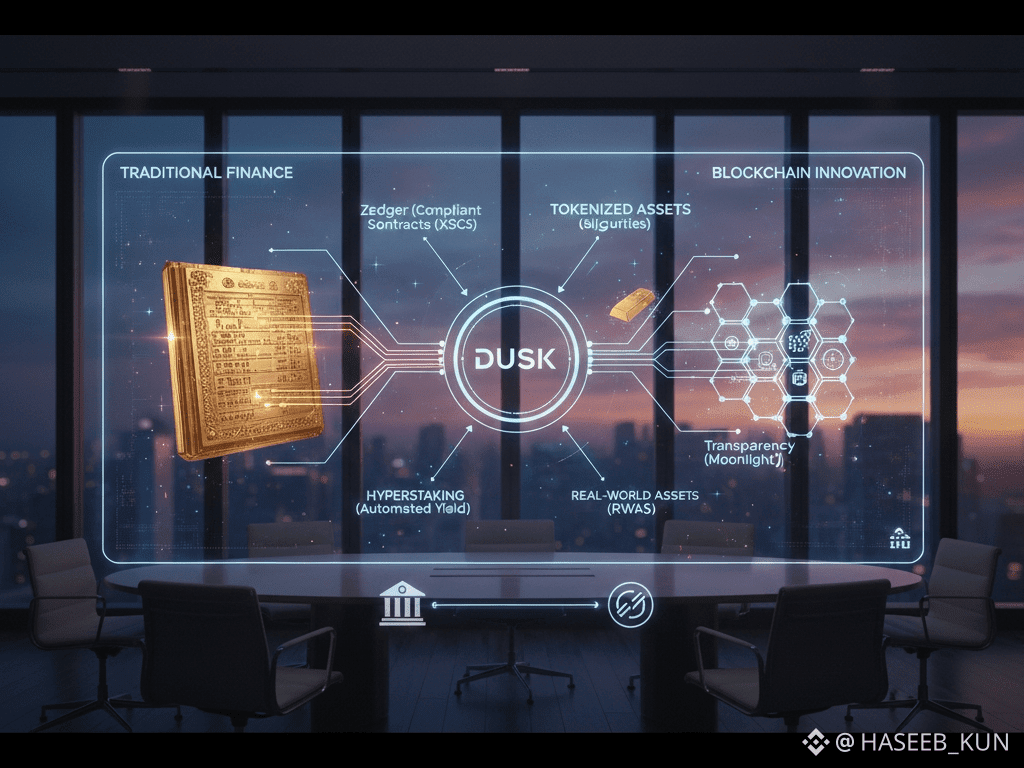

I didn’t come to the idea of tokenized assets through hype or headlines. I came to it through frustration. Years of watching traditional finance struggle with slow settlement cycles, fragmented infrastructure, and layers of intermediaries made one thing clear to me: the system works, but it works inefficiently. At the same time, I watched blockchain promise efficiency and transparency, only to fall short when real regulation and institutional requirements entered the picture. Somewhere between these two worlds—traditional finance and blockchain innovation—there was a gap that neither side could fully bridge. That gap is where I believe Dusk quietly positions itself.

When people talk about blockchain disrupting finance, they often focus on speculation or permissionless experimentation. That conversation misses a deeper transformation that’s already underway. Real progress happens when infrastructure evolves in a way that institutions, regulators, and markets can actually adopt. Dusk doesn’t try to replace traditional finance overnight. Instead, it reimagines how financial assets can exist, move, and settle in a digital world—without abandoning compliance, accountability, or trust.

At its core, Dusk is not a blockchain built for entertainment or short-term trends. It was designed, from the beginning, as infrastructure for regulated financial activity. That design choice shapes everything: how assets are issued, how transactions are executed, how privacy is preserved, and how compliance is enforced. When I looked deeper into the protocol, what stood out wasn’t a single feature, but a coherent philosophy—one that treats tokenization not as a gimmick, but as a serious evolution of financial market infrastructure.

Tokenization, in simple terms, is the process of representing real-world assets digitally on a blockchain. But in practice, it’s far more complex than minting a token and calling it a security. Traditional assets carry legal rights, compliance obligations, transfer restrictions, and reporting requirements. Most blockchains ignore these realities. Dusk embraces them.

What convinced me of Dusk’s seriousness is how it treats compliance as a protocol-level concern, not an afterthought. Instead of asking institutions to adapt to blockchain limitations, Dusk adapts blockchain architecture to institutional realities. That shift changes everything. It means assets like shares, bonds, funds, and even real estate can be issued and managed on-chain without breaking the legal frameworks that govern them.

A key pillar of this approach is Zedger, Dusk’s protocol for compliant tokenized securities. When I first explored Zedger, I realized it wasn’t trying to reinvent finance—it was digitizing it responsibly. Zedger allows issuers to tokenize securities while preserving shareholder registries, transfer rules, and auditability. Ownership isn’t just recorded; it’s enforceable. Transfers don’t just happen; they follow encoded legal constraints.

This matters more than most people realize. In traditional markets, compliance is enforced off-chain through lawyers, registrars, and custodians. Dusk brings those rules on-chain, turning compliance into code rather than paperwork. For issuers, this reduces overhead. For investors, it increases transparency. For regulators, it provides clarity instead of ambiguity.

As I followed this logic further, I saw how Dusk’s Confidential Security Contracts (XSCs) fit naturally into the picture. These contracts allow financial logic to be programmed with regulatory awareness. Trading limits, eligibility checks, lock-up periods, dividend rules—these aren’t optional features; they’re part of the asset itself. This transforms smart contracts from experimental tools into legally meaningful instruments.

What I found especially compelling is that Dusk doesn’t force transparency where it doesn’t belong. Financial markets rely on discretion as much as disclosure. Large trades, institutional positions, and strategic allocations often require confidentiality. Dusk’s dual transaction model, using Phoenix and Moonlight, reflects this reality in a nuanced way.

Phoenix allows confidential transactions where amounts, identities, or asset flows remain private. Moonlight enables transparent operations where reporting and public verification are required. Instead of choosing one model over the other, Dusk allows both to coexist. From my perspective, this is how financial infrastructure should work: flexible enough to support privacy, but structured enough to support oversight.

This duality becomes especially powerful when applied to real-world asset tokenization. Consider real estate, for example. Property transactions involve sensitive financial data, legal ownership records, and regulatory oversight. On Dusk, ownership transfers can remain confidential while compliance reporting remains transparent. That balance is hard to achieve elsewhere.

As I looked deeper, I realized that tokenization on Dusk isn’t just about digitizing assets—it’s about restructuring asset lifecycles. Issuance, trading, settlement, yield distribution, and governance can all happen within a single on-chain framework. That consolidation removes friction that has existed in traditional markets for decades.

One feature that illustrates this beautifully is Hyperstaking. Instead of staking being limited to network security, Dusk extends it into financial automation. Tokenized assets can distribute yields automatically, enforce delegation rules, or manage liquidity without manual intervention. Imagine a tokenized bond paying interest autonomously, or a fund distributing returns programmatically while maintaining investor privacy. That’s not speculative—it’s structurally possible on Dusk.

From an institutional perspective, automation isn’t about novelty. It’s about reducing operational risk. Manual processes introduce errors. Intermediaries introduce delays. By encoding financial logic directly into assets, Dusk reduces reliance on off-chain reconciliation and human oversight. That’s a subtle but powerful shift.

Security, of course, underpins everything. Tokenized assets represent real value. If the infrastructure fails, the consequences aren’t theoretical. Dusk’s Succinct Attestation Proof-of-Stake consensus provides fast finality and verifiable settlement, which is critical for financial use cases. Transactions aren’t just processed quickly; they’re finalized with certainty.

Under the hood, technologies like Kadcast and RUES ensure efficient data propagation and real-time monitoring. These aren’t features that retail users notice immediately, but institutions care deeply about them. Reliability, consistency, and observability are what separate experimental networks from production-grade systems.

Cryptography plays a quiet but essential role here. Dusk’s use of zero-knowledge-friendly primitives like Poseidon and Reinforced Concrete ensures that privacy doesn’t come at the cost of performance. Confidential transactions remain efficient, which is crucial when scaling tokenized markets.

Interoperability is another area where Dusk shows restraint and foresight. Rather than forcing all logic into a single execution environment, Dusk supports both WASM-based Dusk VM and DuskEVM. This allows regulated assets to live in a controlled execution layer, while still interacting with broader blockchain ecosystems when appropriate.

For tokenized assets, this matters. Institutions don’t want isolation, but they also don’t want uncontrolled exposure. Dusk allows assets to interact with DeFi, liquidity pools, and secondary markets without sacrificing compliance. That’s a rare balance.

From a user perspective, the experience remains surprisingly simple. Tools like Rusk Wallet and the Web Wallet abstract complexity without hiding control. Profiles combine shielded and public accounts, allowing users to decide when transparency or privacy is appropriate. For me, this design choice reflects respect for real users, not just technical elegance.

What excites me most about Dusk’s approach is its applicability beyond finance. Real-world assets (RWAs) extend far beyond securities. Commodities, intellectual property, carbon credits, and infrastructure projects all suffer from illiquidity and inefficient management. Tokenization on Dusk offers a path to unlock value while maintaining legal and regulatory coherence.

Carbon markets, for example, require strict reporting and verification. Dusk’s architecture allows these assets to be tokenized with embedded compliance rules, ensuring traceability without sacrificing confidentiality. The same logic applies to supply chains, licensing, and even public sector assets.

Throughout my exploration, one theme kept resurfacing: Dusk doesn’t chase disruption for its own sake. It builds continuity. It allows traditional finance to evolve rather than collapse. That mindset is often overlooked in crypto narratives, but it’s essential for real adoption.

Institutions don’t want to abandon decades of legal precedent and operational structure. They want better tools. Dusk offers those tools without demanding ideological alignment. It speaks the language of regulators, auditors, and financial operators while still leveraging blockchain’s strengths.

From an investor’s standpoint, this positioning matters. Infrastructure that aligns with regulation doesn’t just survive longer—it attracts more serious capital. Tokenized assets require trust, not just liquidity. Dusk builds trust through architecture, not marketing.

As I step back and reflect on the broader picture, I see Dusk as part of a quiet shift in the industry. The conversation is moving away from “can blockchain replace finance?” toward “how can blockchain improve finance responsibly?” That’s a much harder question—and a more meaningful one.

Dusk’s answer is clear: by embedding compliance, privacy, and programmability into a unified system for tokenized assets. By treating real-world assets with the seriousness they deserve. By building infrastructure that regulators can understand, institutions can trust, and developers can extend.

In the end, @Dusk doesn’t promise a revolution. It offers evolution. It doesn’t ask traditional finance to disappear. It gives it a better foundation.

And in a space often driven by noise, that kind of quiet, deliberate progress feels like the most powerful signal of all.