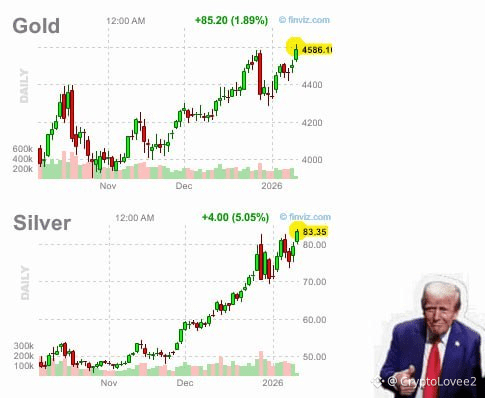

The "Safe Haven" trade just hit overdrive. On January 12, 2026, Gold and Silver didn't just rise—they exploded into price discovery mode, setting fresh all-time historical records.

The "Safe Haven" trade just hit overdrive. On January 12, 2026, Gold and Silver didn't just rise—they exploded into price discovery mode, setting fresh all-time historical records.

A total breakdown in trust between the White House and the Federal Reserve.

📊 The Record-Breaking Numbers:

Gold surged past the psychological $4,600/oz barrier for the first time in history, hitting an intraday peak of $4,601.

Silver outperformed Gold with a massive 4.5% daily surge, touching a record high of $84.59.

Momentum: Silver has now gained a staggering 181.78% over the past year.

Why the Panic-Buy is Real❓️

- US Federal prosecutors opened a criminal investigation into Fed Chair Jerome Powell over headquarters renovation costs. Powell has publicly called this "extortion" to force rate cuts, leading investors to flee the US Dollar for the safety of "hard money".

- The Supreme Court set to rule on the legality of Trump's 50-500% tariffs on January 14, the market is pricing in totaltrade chaos.

- Major banks like J.P. Morgan are now forecasting Gold to hit $5,000 before the end of the year as central banks aggressively increase their physical reserves....

While Gold gets the headlines, take a look at the structural supply deficit in Silver.

Industrial demand for Silver—driven by the record-breaking EV adoption and renewable energy infrastructure in 2026—is now outstripping mine supply.

Unlike Gold, Silver is being consumed, not just stored.

In terms of ratio, the Gold/Silver ratio is collapsing, signaling that Silver's high-beta nature is finally playing catch-up to the decade-long Gold bull run.

Continue tracking these metal moves as they are considered "volatility hedges" alongside the metals.

We are witnessing the "Goldification" of the global portfolio. As long as the Fed-White House war continues, the upside for Gold(XAU) and Silver(XAG) and even BTC remains uncapped.

👀Add to watchlist: $WLFI I | $ID | $HYPER

STOCKS LIKE S&P 500 ARE FALLING

#USNonFarmPayrollReport #Powell #BTCVSGOLD