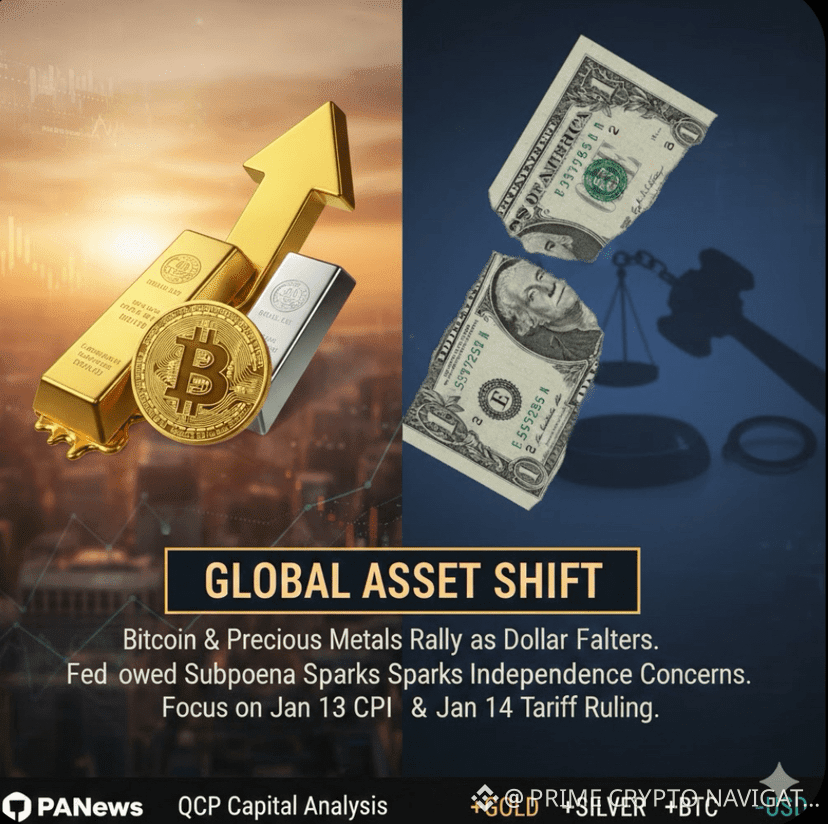

According to PANews, QCP Capital's analysis indicates that Bitcoin, gold, and silver experienced simultaneous gains during the Asian market's early trading hours, driven by a significant weakening of the U.S. dollar. The market perceives the U.S. Department of Justice's subpoena and criminal charges threat against the Federal Reserve as retaliation against its policy independence.

Although the event's economic impact is limited, it raises concerns about central bank independence, increasing demand for alternative value reserves.Gold and silver continued their upward trend, while Bitcoin initially rose but failed to surpass $92,000, subsequently declining as the European market opened, following a pattern observed in the fourth quarter of last year. The derivatives market also shows a delay in bullish sentiment, with investors opting to extend high-priced call options to March.The market's attention is now focused on the U.S. Consumer Price Index (CPI) release on January 13 and the Supreme Court's tariff ruling on January 14.

#USNonFarmPayrollReport #USTradeDeficitShrink #ZTCBinanceTGE #BinanceHODLerBREV #CPIWatch