Blockchain technology has demonstrated its potential to transform financial systems by enabling programmable trust decentralized settlement and global accessibility. However most existing blockchain networks fall short of meeting the fundamental requirements of real world finance. Regulated markets demand confidentiality legal compliance auditability and reliability at scale. Public blockchains often sacrifice privacy while private ledgers compromise decentralization.

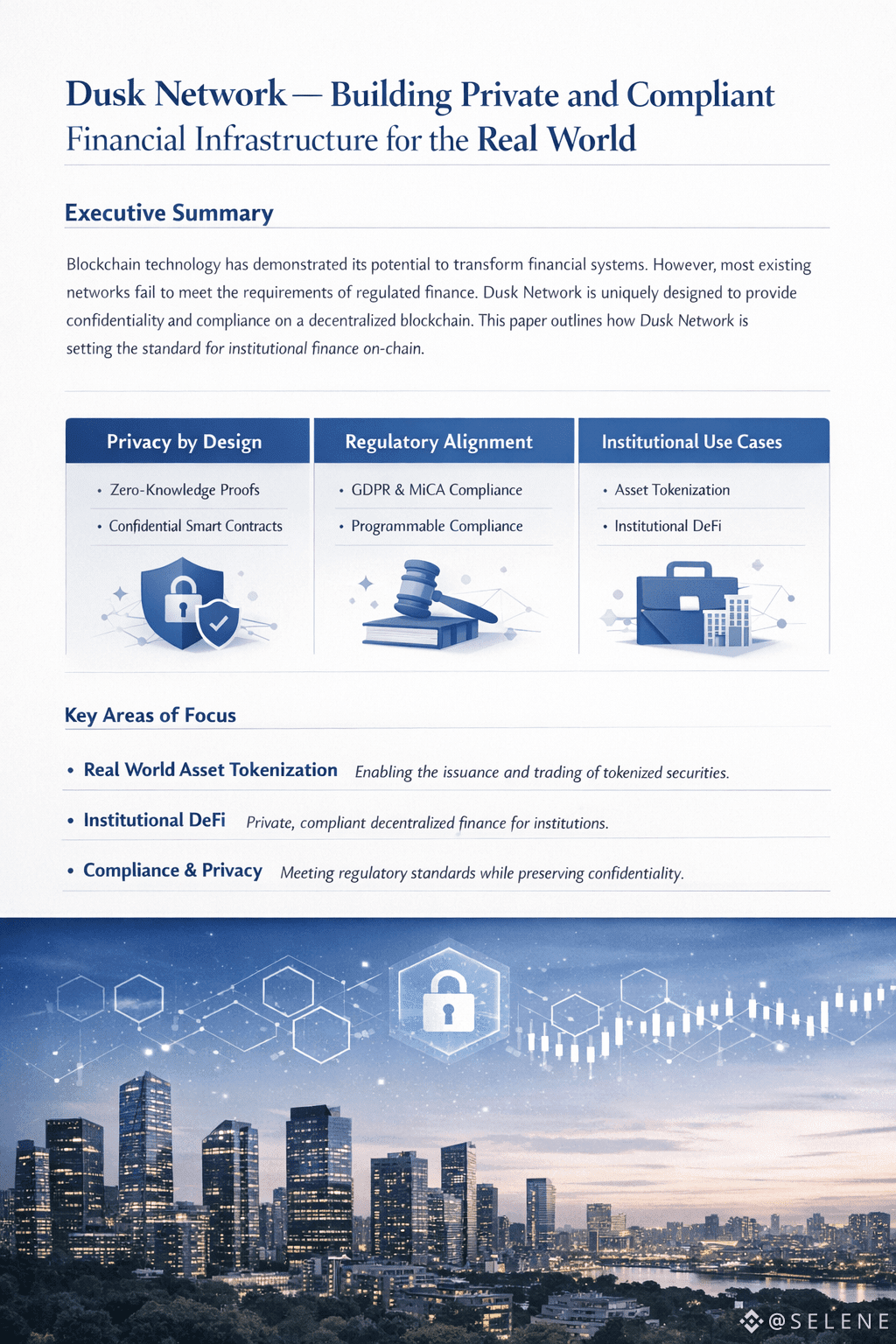

Dusk Network addresses this structural gap by delivering a blockchain purpose built for private and compliant financial applications. Through the integration of zero knowledge cryptography confidential smart contracts and compliance aware design principles Dusk enables institutions to operate on public infrastructure without exposing sensitive data or violating regulatory obligations. This document presents a professional overview of Dusk Network its architecture and its role in the future of regulated on chain finance.

Industry Context

The financial sector is undergoing a structural transition. Tokenization of assets digital settlement and on chain financial instruments are moving from experimentation to implementation. Governments regulators and institutions increasingly acknowledge that blockchain technology will play a role in future capital markets.

Despite this momentum adoption remains constrained by several unresolved challenges:

Public visibility of transactional data

Incompatibility with data protection laws

Limited support for regulated asset issuance

Lack of institutional grade smart contract privacy

Without addressing these constraints blockchain systems cannot serve as foundational infrastructure for capital markets. Dusk Network is designed to overcome these limitations through a privacy first and regulation aligned approach.

Problem Definition

Traditional public blockchains are transparent by default. While transparency supports trust it also exposes sensitive information such as transaction flows counterparties and trading strategies. For institutional participants this level of disclosure is commercially unacceptable and legally problematic.

Conversely private and permissioned ledgers restrict access but undermine decentralization and composability. They often reintroduce centralized trust and limit interoperability with broader ecosystems.

Dusk Network identifies the core problem as a false dichotomy between privacy and compliance. Real world finance requires both. The absence of a public blockchain that satisfies these requirements has slowed institutional adoption and limited the scope of on chain financial innovation.

Dusk Network Vision

Dusk Network is engineered as a public blockchain optimized for regulated finance. Its objective is to enable financial applications that are:

Confidential by default

Verifiably compliant

Decentralized and censorship resistant

Suitable for long term institutional use

Rather than competing on transaction throughput or consumer applications Dusk focuses on correctness security and regulatory compatibility. The network is positioned as infrastructure for capital markets rather than a general purpose execution layer.

Architectural Principles

Privacy by Design

Privacy within Dusk Network is embedded at the protocol level. Transactions and smart contract execution are designed to minimize information leakage while maintaining verifiability. Confidentiality is not optional or external but intrinsic to the system.

Compliance Enablement

Dusk does not attempt to circumvent regulation. Instead it provides cryptographic tools that allow compliance rules to be enforced directly within smart contracts. This enables regulatory alignment without reliance on centralized intermediaries.

Institutional Reliability

The network prioritizes stability predictable behavior and formal correctness. These attributes are essential for financial institutions operating within strict risk and governance frameworks.

Core Technologies

Zero Knowledge Cryptography

Dusk Network employs advanced zero knowledge proof systems to allow verification of transactions and contract logic without revealing underlying data.

This enables:

Confidential transfer of assets

Private verification of identity attributes

Selective disclosure for regulatory reporting

Proof of compliance without data exposure

Zero knowledge proofs allow Dusk to reconcile privacy with transparency where required.

Confidential Smart Contracts

Conventional smart contracts expose state and logic to all network participants. Dusk introduces confidential smart contracts that allow sensitive business logic and data to remain private while execution correctness remains verifiable.

Key capabilities include:

Hidden contract state

Protected pricing and trading strategies

Confidential settlement logic

Controlled disclosure to authorized parties

This functionality is essential for regulated financial instruments and institutional trading environments.

Consensus and Network Security

Dusk Network operates using a Proof of Stake consensus mechanism. Validators secure the network by staking the native DUSK token and participating in block production.

This approach provides:

Energy efficient security

Economic alignment between validators and the network

Support for professional and institutional validators

The consensus design emphasizes reliability and long term participation over speculative incentives.

Regulatory Compatibility

Data Protection and Privacy Law

Public blockchains often conflict with data protection regulations due to immutable storage of personal information. Dusk mitigates this risk by avoiding unnecessary on chain exposure of personal data.

Through cryptographic proofs compliance conditions can be satisfied without storing sensitive information publicly. This design supports alignment with frameworks such as GDPR while preserving blockchain integrity.

Financial Market Regulation

Regulatory regimes increasingly require programmable controls over asset issuance and transfer. Dusk enables issuers to embed compliance rules directly into smart contracts.

These controls can include:

Investor qualification requirements

Transfer and holding restrictions

Jurisdiction specific rules

Reporting and audit provisions

As a result compliance becomes an enforceable property of the asset rather than an external process.

Real World Asset Tokenization

Tokenization of securities and financial instruments is a primary use case for Dusk Network. Traditional capital markets depend on intermediaries complex settlement processes and limited transparency.

Dusk enables:

Issuance of tokenized equities and debt instruments

Automated compliance enforcement

Private secondary market trading

Near real time settlement

By combining privacy with regulatory controls Dusk provides infrastructure suitable for institutional asset tokenization.

Institutional Decentralized Finance

Decentralized finance has demonstrated efficiency and innovation but remains largely unsuitable for institutional adoption due to transparency and compliance limitations.

Dusk enables a new category of institutional DeFi where:

Trading activity remains confidential

Counterparty exposure is minimized

Compliance requirements are enforced on chain

Settlement occurs without intermediaries

This creates a bridge between traditional financial systems and decentralized architectures.

Token Economics and Governance

The DUSK token is integral to network operation and governance.

Its primary functions include:

Staking for validator participation

Payment of transaction and execution fees

Incentivization of network security

Participation in protocol governance

Token economics are structured to encourage long term alignment rather than short term speculation.

Developer and Ecosystem Strategy

Dusk Network supports developers building regulated financial applications through dedicated tooling and infrastructure.

This includes:

Privacy aware smart contract frameworks

Compliance focused development libraries

Documentation for institutional use cases

Support for asset issuance and lifecycle management

The ecosystem strategy prioritizes quality applications over rapid expansion.

Market Positioning

Dusk Network occupies a distinct position within the blockchain landscape. It does not compete directly with consumer focused or high throughput chains.

Its competitive domain includes:

Confidential financial infrastructure

Regulated asset issuance platforms

Institutional smart contract execution

This focused positioning allows Dusk to develop defensible expertise and long term relevance.

Strategic Outlook

As regulatory clarity improves and tokenization initiatives expand the demand for compliant blockchain infrastructure will increase. Financial institutions require systems that respect confidentiality legal frameworks and operational reliability.

Dusk Network is designed to serve this emerging market by providing infrastructure that integrates privacy decentralization and compliance at the protocol level.

Conclusion

Dusk Network represents a deliberate and professional approach to blockchain based finance. By addressing the structural requirements of real world financial systems it enables a new class of applications that cannot exist on transparent or permissioned ledgers alone.

Through zero knowledge cryptography confidential smart contracts and compliance aware design Dusk establishes a foundation for private and regulated finance on public infrastructure. As capital markets continue their transition on chain Dusk Network is positioned to serve as a critical layer for institutions seeking privacy without sacrificing decentralization or compliance.