In the world of macro investing, there is a golden rule: Liquidity leads, price follows.

Recent data highlights a powerful example of this:

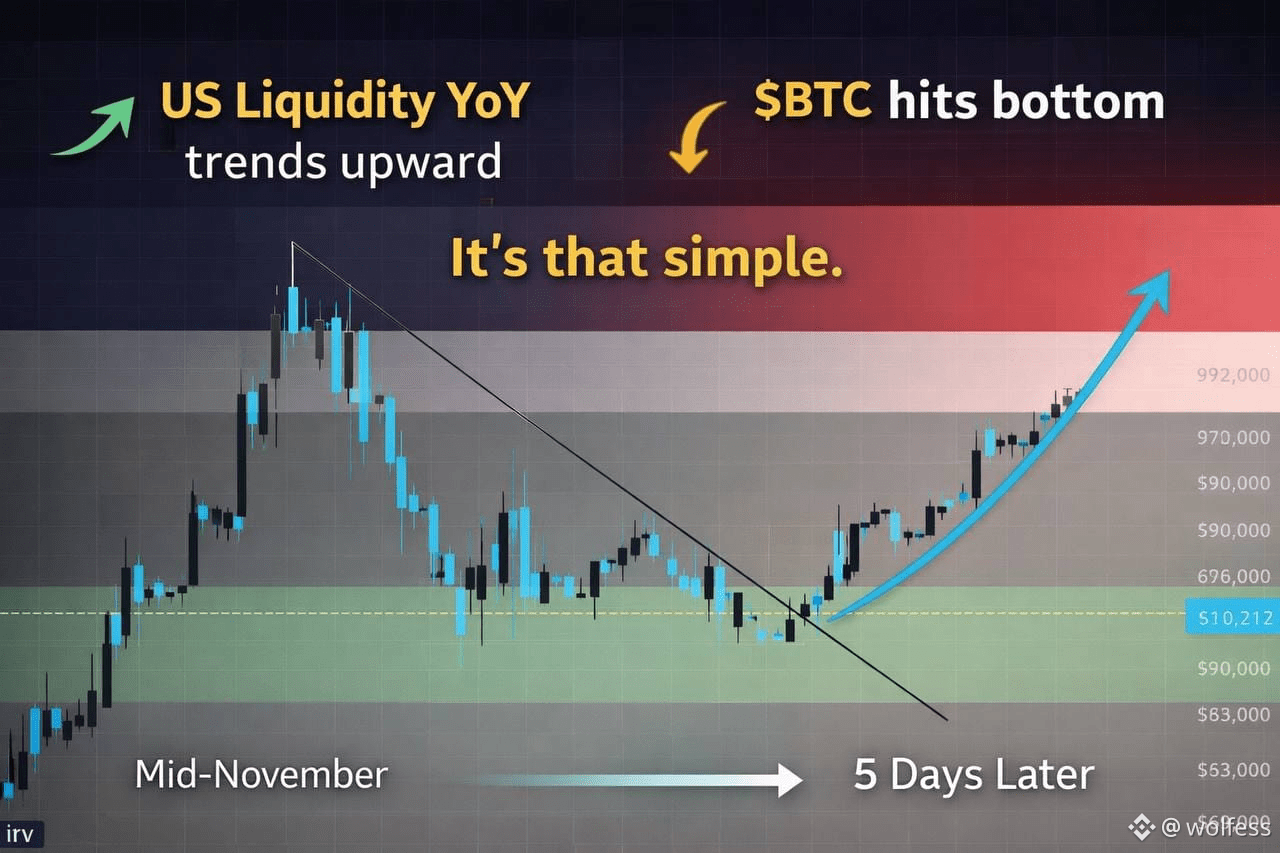

Mid-November: US liquidity (YoY) officially bottomed and started its upward trend.

5 Days Later: Bitcoin printed its local bottom and began to stabilize.

Why does this happen?

Bitcoin acts as a "high-beta" liquidity barometer. Because of its fixed supply, it is incredibly sensitive to the expansion of the monetary base. When the YoY money supply turns positive, it signals that "new money" is entering the system, often flowing first into the most sensitive risk assets like $BTC .

The Takeaway for 2026: Don't just watch the candles; watch the "plumbing" of the financial system. Liquidity expansion doesn't just support price—it often creates the floor before the reversal becomes obvious to the crowd.

Do you follow M2 money supply in your analysis, or do you stick to pure technicals? 👇

#BTC #Bitcoin #MacroInsights #LiquidityCycle #CryptoEducation💡🚀