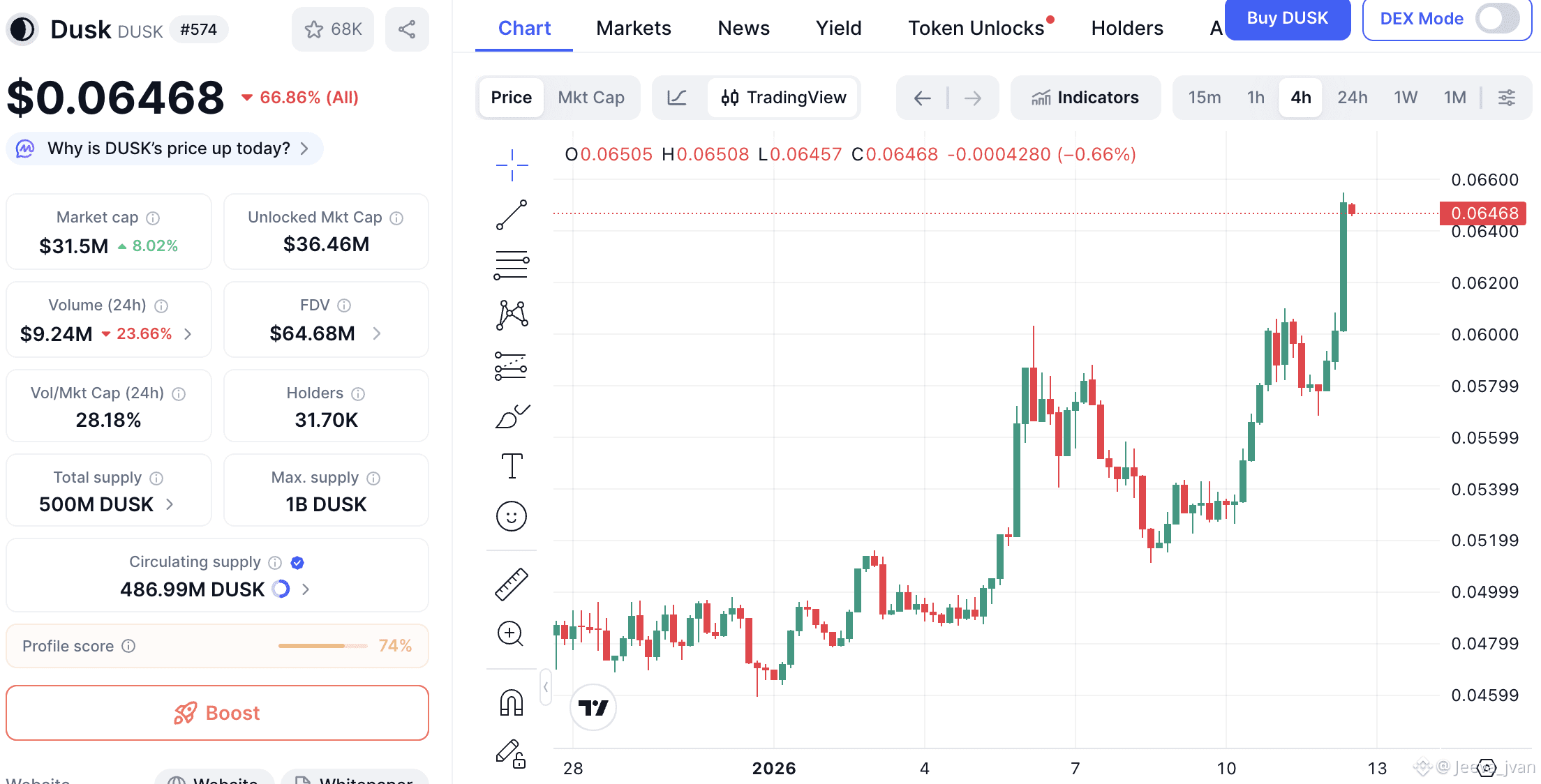

As blockchain adoption expands beyond retail crypto into institutional finance, a fundamental problem becomes impossible to ignore: public blockchains were never designed for regulated markets. Financial institutions need compliance, privacy, fast settlement, and legal clarity—without sacrificing decentralization.

Dusk Network is built specifically to solve this gap. It is a privacy-enabled, regulation-aware blockchain designed to bring real-world financial markets on-chain while meeting strict regulatory and institutional requirements.

What Is Dusk?

Dusk is a Layer-1 blockchain purpose-built for regulated financial activity. It allows institutions and developers to launch and operate markets where:

Regulatory compliance is enforced on-chain

User balances and transfers remain confidential

Settlement is fast, final, and deterministic

Developers work with familiar EVM tools enhanced with native privacy

At its core, Dusk combines:

Zero-knowledge cryptography for confidentiality

On-chain compliance logic aligned with MiCA, MiFID II, GDPR, and the EU DLT Pilot Regime

Succinct Attestation, a proof-of-stake consensus protocol with instant finality

A modular architecture separating settlement from execution

Dusk is not a general-purpose blockchain retrofitted for finance—it is designed for finance from day one.

Why Dusk Exists

Most global financial markets still run on opaque, centralized infrastructure. While blockchains promise transparency and automation, fully public ledgers conflict with regulatory obligations around privacy, disclosure, and data protection.

Dusk bridges this divide by enabling:

Confidential transactions without sacrificing auditability

Permissioned and public flows within the same protocol

On-chain enforcement of real-world financial rules

In short, Dusk enables institutional finance to move on-chain without breaking the rules.

Built for Regulated Markets

Dusk is designed around the needs of regulated institutions such as banks, exchanges, asset issuers, and payment providers.

Key capabilities include:

Compliant issuance of securities and RWAs

Identity-aware transaction flows

Permissioning at the protocol level

Smart contracts that enforce eligibility, limits, and reporting

This allows institutions to issue, trade, and settle assets directly on-chain while remaining compliant with existing legal frameworks.

Privacy by Design, Transparency When Required

Dusk introduces a dual transaction model that lets users choose how much information is revealed:

Public transactions for transparent market activity

Shielded transactions for confidential balances and transfers

Using zero-knowledge proofs, Dusk ensures that sensitive financial data stays private by default—but can be selectively disclosed to regulators, auditors, or authorized parties when legally required.

This balance between privacy and accountability is critical for real-world financial adoption.

Fast, Final Settlement

Dusk runs on Succinct Attestation, a proof-of-stake, committee-based consensus mechanism designed for financial markets.

Key properties:

Deterministic finality once a block is ratified

No user-facing chain reorganizations

Low-latency, high-throughput settlement

This makes Dusk suitable for use cases where certainty and speed are non-negotiable, such as trading, payments, and delivery-versus-payment (DvP) settlement.

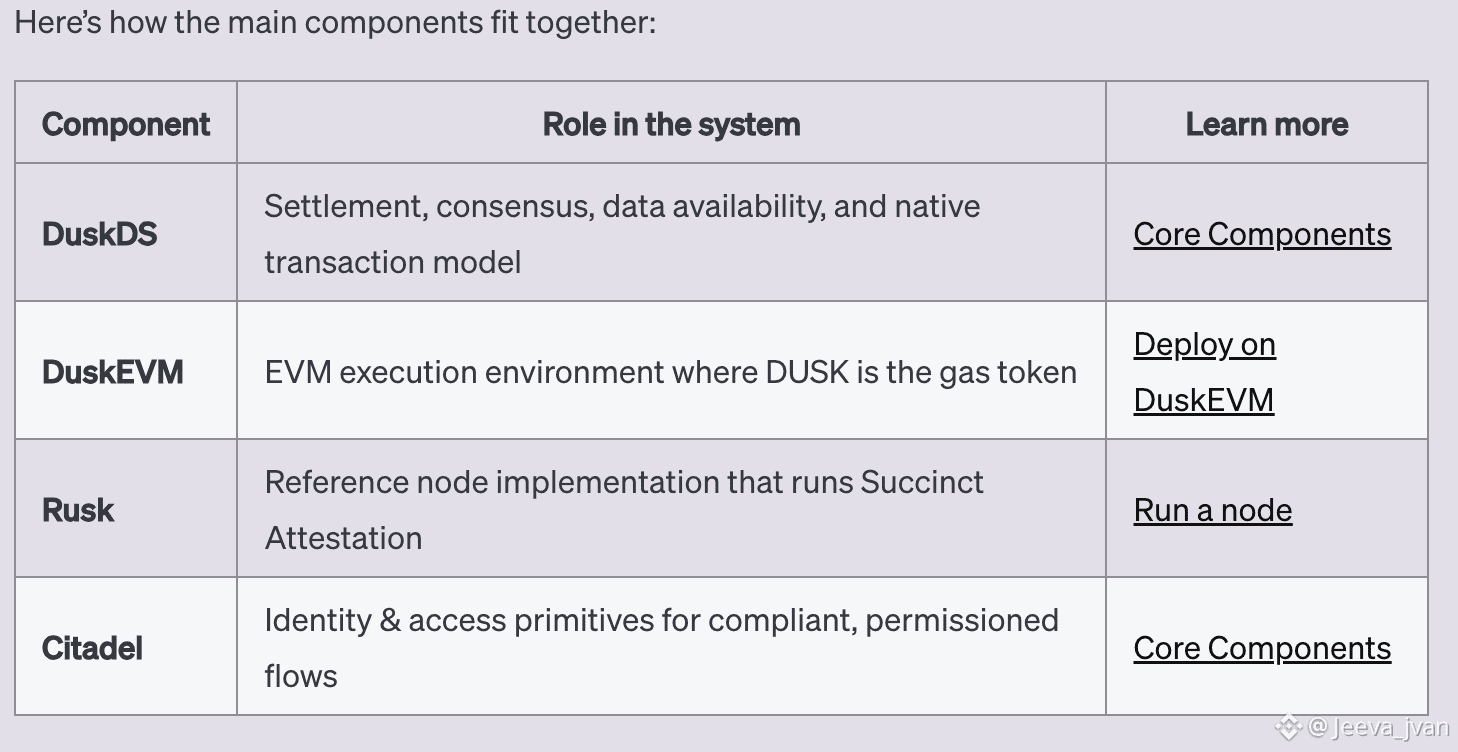

Modular and EVM-Friendly Architecture

Dusk separates execution from settlement to maximize flexibility and performance.

DuskDS

Handles:

Consensus and data availability

Settlement logic

Native privacy-preserving transactions

DuskEVM

Ethereum-compatible execution environment

DUSK token used as native gas

Supports existing Solidity tooling

Assets can move seamlessly between layers, allowing developers to choose the right execution environment for each use case without compromising compliance or privacy.

What Can You Build on Dusk?

Dusk is designed to support a wide range of regulated and institutional applications:

Regulated Digital Securities

Tokenized equity, debt, and funds

Embedded compliance rules

Privacy-respecting cap tables

Institutional DeFi

KYC/AML-compliant lending and AMMs

Private positions with public market signals

Structured financial products

Payment & Settlement Infrastructure

Confidential inter-institution payments

Atomic DvP settlement of tokenized assets

Identity & Access Control

Permissioned markets using verifiable credentials

Smart-contract enforced access rules

Dusk enables developers to build real financial infrastructure, not experimental prototypes.

Architecture at a Glance

Component

Role

DuskDS

Settlement, consensus, privacy, data availability

DuskEVM

EVM execution environment

Rusk

Reference node implementation

Citadel

Identity and access primitives

Each component is designed to work together while remaining modular and upgradeable.

Getting Started with Dusk

Whether you’re a user, developer, or node operator, Dusk offers multiple ways to participate:

Use Dusk – Interact via the Web Wallet

Stake DUSK – Secure the network and earn rewards

Build on Dusk – Develop on DuskDS or DuskEVM

Join the Community – Collaborate and get support

For deeper technical exploration, developers can dive into the Core Components, Cryptography docs, or the Dusk Whitepaper.

Final Thoughts

Dusk is not trying to replace public blockchains—it complements them by solving what they cannot: regulated, private, on-chain finance at scale.

By combining privacy, compliance, fast settlement, and EVM compatibility, Dusk positions itself as the blockchain layer where institutional finance can finally operate without compromise.

As regulation tightens and institutions move on-chain, Dusk is built for what comes next. @Dusk #dusk $DUSK