As Web3 adoption accelerates, decentralized data availability is becoming a critical layer for scalable blockchain ecosystems. #walrus is positioning itself strongly in this space by offering efficient, cost-optimized data availability solutions that support next-generation decentralized applications. With builders increasingly prioritizing scalability and performance, @Walrus 🦭/acc continues to gain attention from both developers and traders.

From a market perspective, $WAL shows growing interest as infrastructure narratives gain momentum. In 2026, price action will likely be driven by three key factors: ecosystem adoption, network usage metrics, and broader crypto market cycles. If Walrus continues expanding integrations and real-world utility, demand for $WAL could increase steadily.

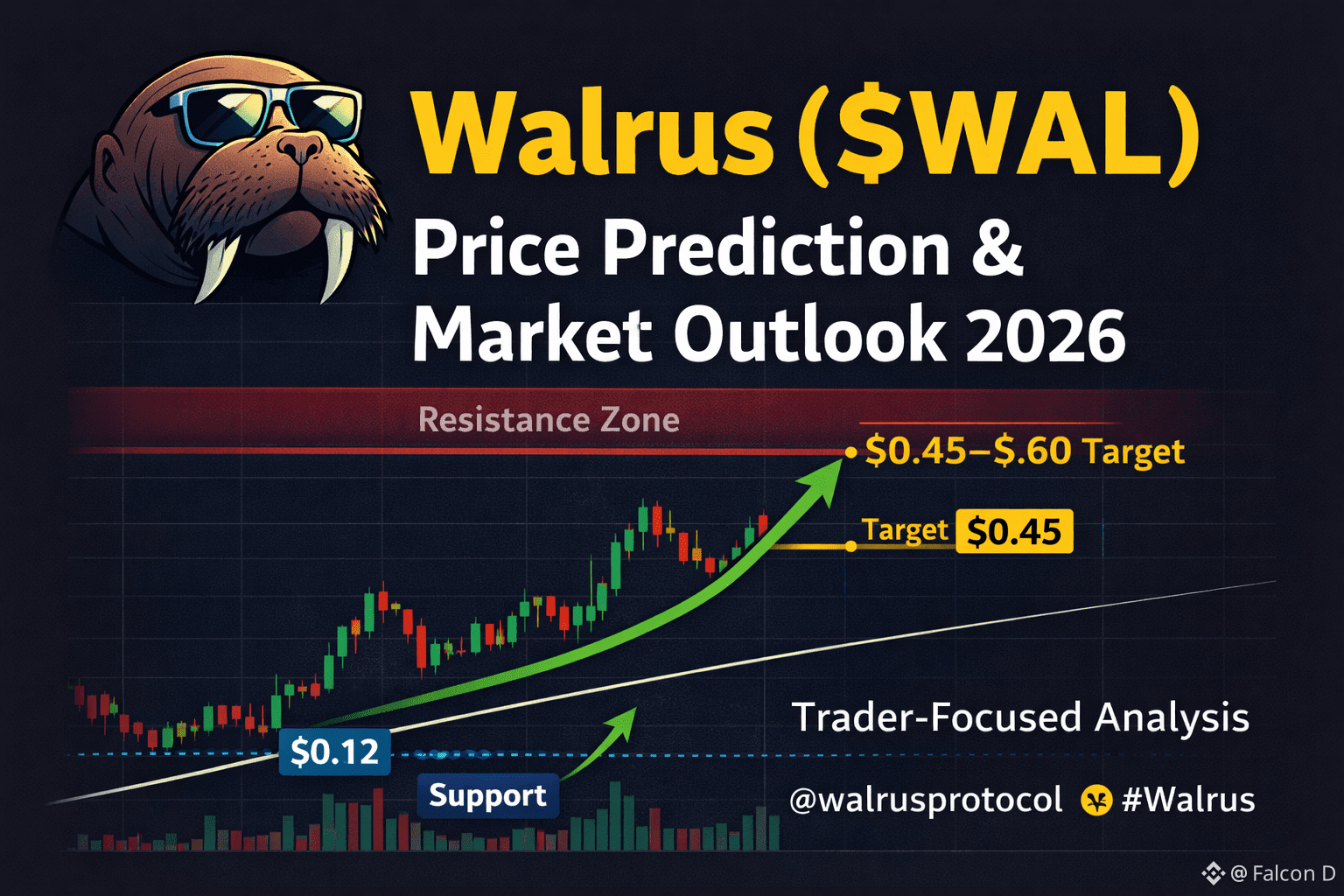

$WAL Price Prediction 2026 (Speculative Analysis)

Support Zone: $0.12 – $0.18 (strong accumulation range)

Mid-Term Target: $0.30 (breakout confirmation level)

Bullish Scenario Target: $0.45 – $0.60 if volume and adoption rise

Bearish Risk: Failure to hold support could lead to consolidation before the next cycle

Technically, a sustained move above resistance with rising volume may signal trend continuation, while long-term holders may view pullbacks as accumulation opportunities. Traders should always manage risk and watch on-chain activity closely.

Overall, Walrus stands out as a promising data availability project heading into 2026. While price predictions are never guaranteed, $WAL remains a token worth tracking as infrastructure narratives strengthen across the crypto market.