Dusk didn’t emerge from noise or speculation. It came from a deep, almost uncomfortable truth that many in crypto preferred to ignore: finance cannot move forward if privacy and regulation are treated like enemies. Founded in 2018, Dusk was built with a calm but powerful conviction—that real financial systems need Confidentiality, Accountability, and legal clarity to survive on-chain.

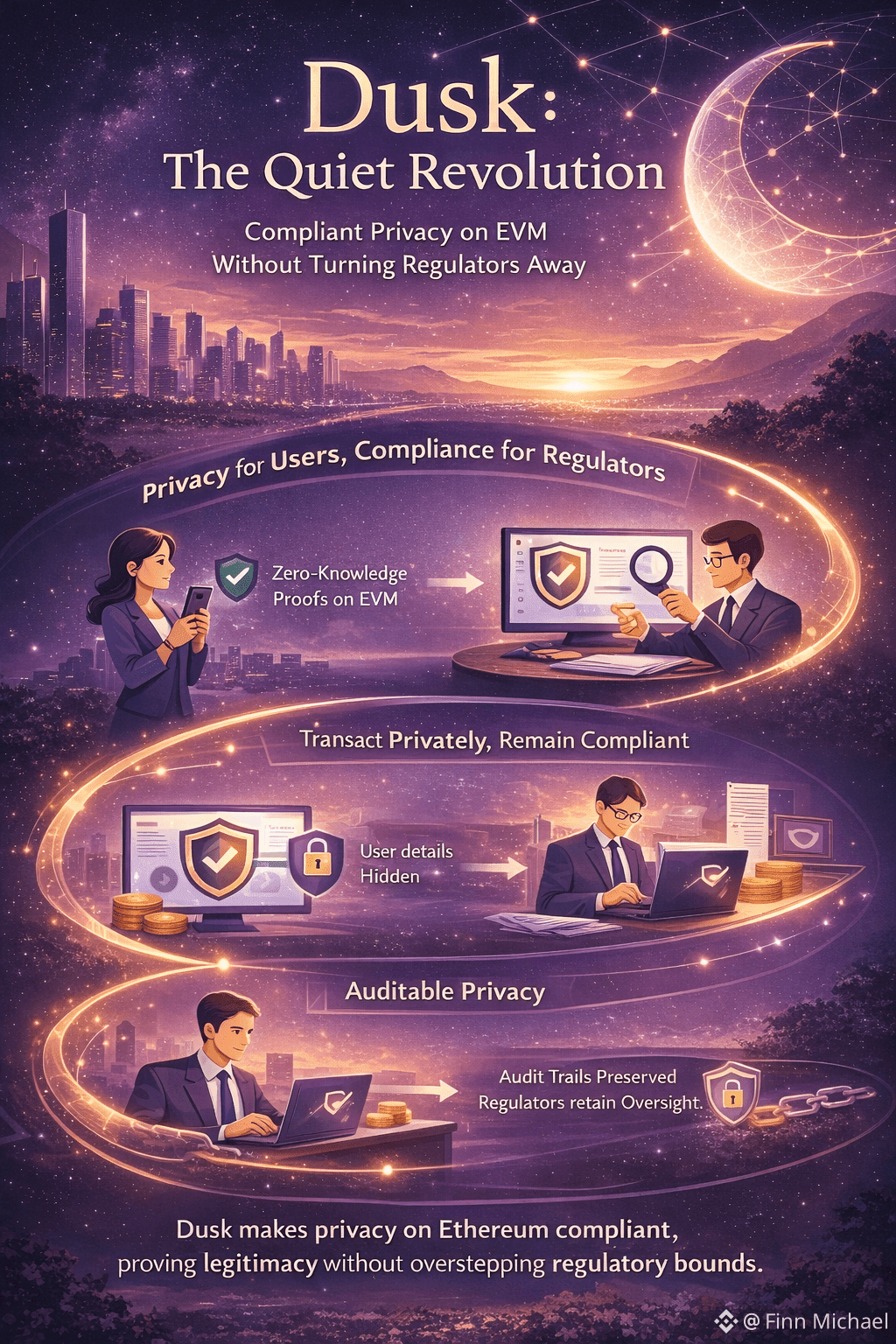

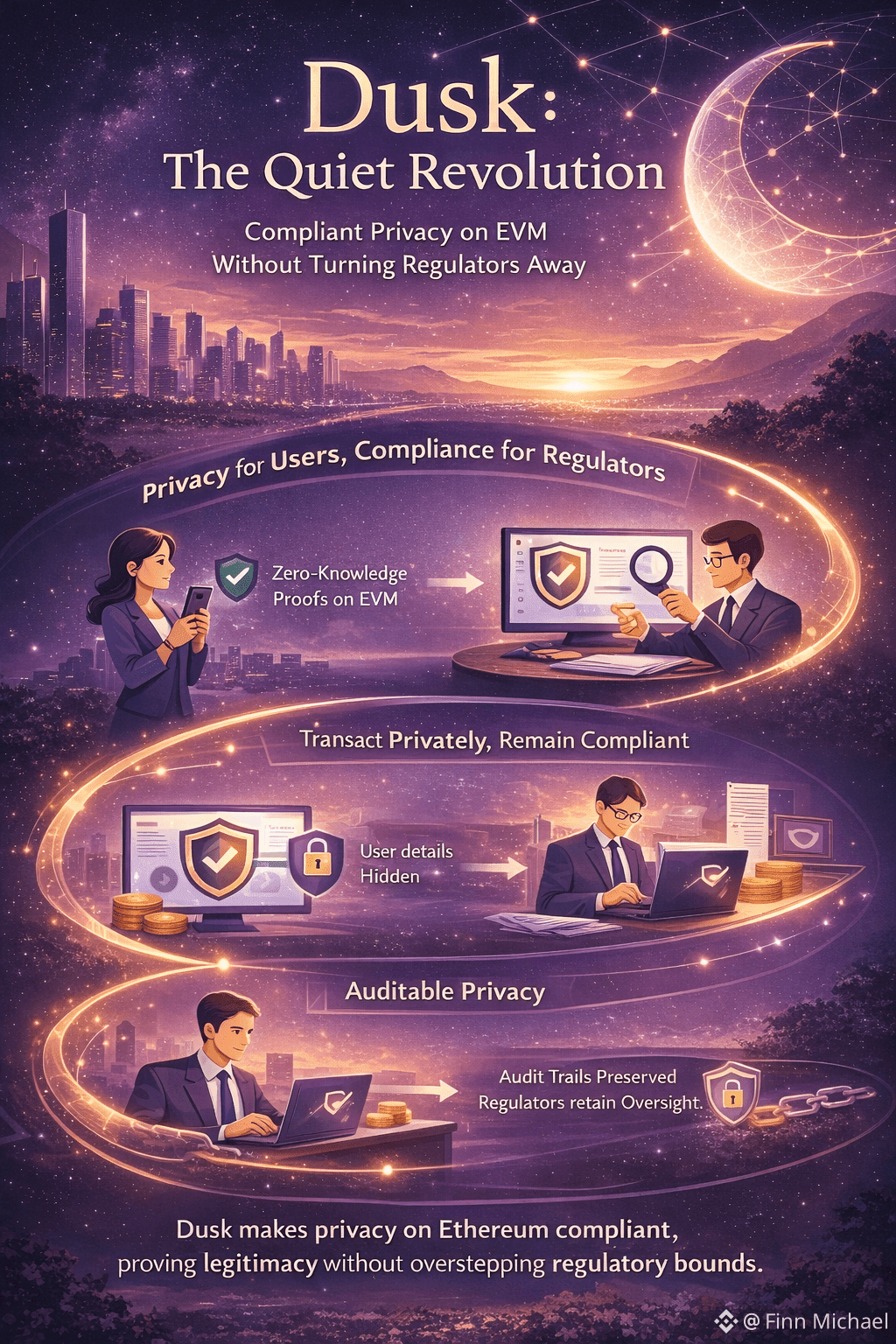

For institutions, privacy isn’t about hiding; it’s about protection. Exposing sensitive transactions, balance sheets, or counterparties to the public is not transparency—it’s risk. Dusk understands this at a human level. It uses zero-knowledge cryptography to protect financial data while still allowing proof, verification, and selective disclosure when required. Nothing is hidden blindly, and nothing is revealed unnecessarily. This balance is what makes Dusk feel less like an experiment and more like infrastructure.

The architecture reflects that same maturity. Dusk is modular, designed to separate settlement, execution, and privacy so each can evolve without breaking the system. Transactions reach finality with certainty, something traditional finance depends on but many blockchains overlook. On top of this foundation, Dusk supports an EVM-compatible environment, allowing developers to build with familiar tools while inheriting privacy and compliance by design. It’s not a fork chasing trends—it’s an environment carefully shaped for real-world use.

What makes Dusk quietly powerful is how compliance is embedded, not patched on later. Assets on the network are aware of rules. Who can own them, how they can move, and under which conditions they can be transferred are enforced automatically. This allows tokenized securities, bonds, and other real-world assets to exist on-chain without legal gray areas. It’s finance that respects the law without losing efficiency.

Even decentralized finance feels different here. On Dusk, DeFi doesn’t reject structure—it refines it. Identity, jurisdiction, and regulation coexist with automation and smart contracts. The result isn’t chaos or speculation, but financial tools that institutions can actually use without fear of regulatory backlash.

The DUSK token plays its role quietly as well. It secures the network through staking, powers transactions, and aligns incentives across validators, builders, and users. It isn’t designed for hype-driven cycles, but for long-term participation in a system meant to last.

While many blockchains chase attention, Dusk chooses patience. Its partnerships with regulated entities and licensed financial platforms are not marketing stunts—they are proof points. Each integration shows that blockchain doesn’t have to fight regulators to succeed. It can work with them, without surrendering its core principles.

Dusk doesn’t promise to overthrow finance. It doesn’t shout about revolution. Instead, it builds something more dangerous to the status quo: a system that actually works. One where privacy is respected, rules are enforced by code, and institutions don’t have to choose between innovation and compliance.

In a space full of noise, Dusk moves quietly.

And sometimes, quiet is exactly how real change begins.