There’s a certain honesty in admitting that most blockchains were never built for real markets. They were built for ideals, experiments, and open participation, not for the messy reality of regulated finance. When I look at Dusk Foundation, what stands out is not a promise to reinvent money, but a quiet acceptance of how money already works. That acceptance changes everything.

Real markets are not loud. They are careful. They move slowly when stakes are high and demand certainty before trust is given. Privacy is not treated as a luxury but as a requirement. Rules are not seen as enemies but as guardrails that keep systems stable. Dusk feels like it was born from observing this world closely, not from trying to escape it.

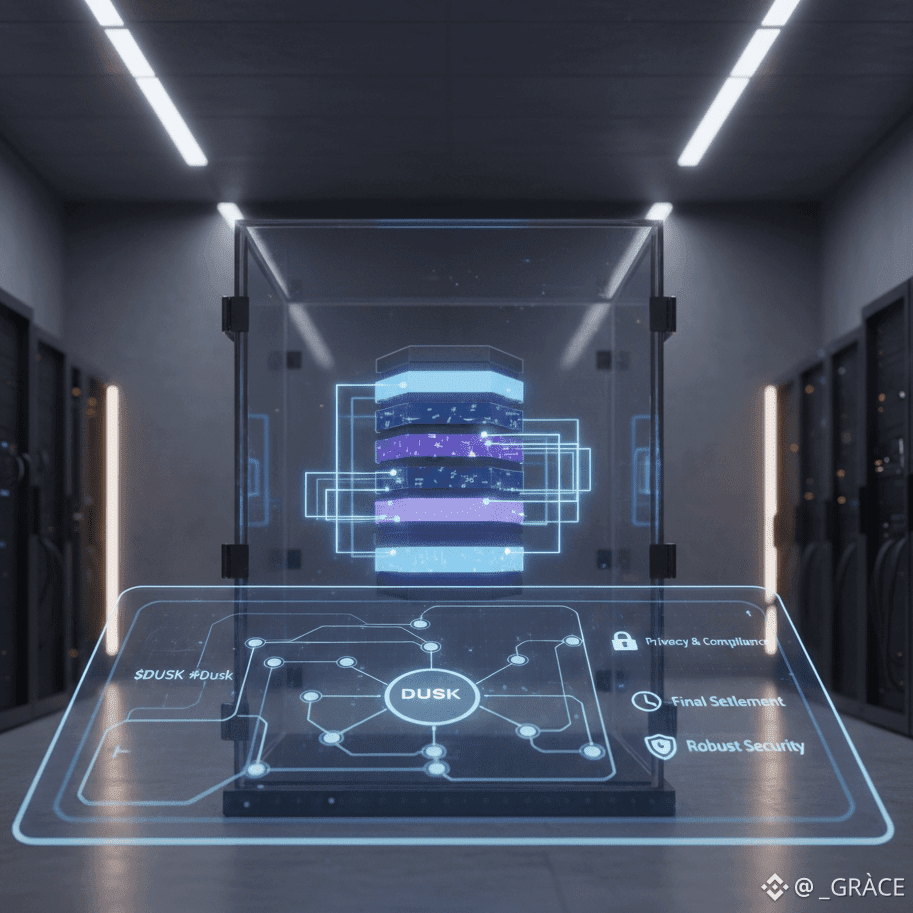

Most crypto projects start with a vision of disruption. They talk about breaking systems, bypassing institutions, and removing intermediaries. Dusk took a different route. It asked a simpler question: if institutions, funds, and regulated entities were to use a blockchain tomorrow, what would they actually need? The answer wasn’t faster memes or louder narratives. It was privacy that works with compliance, settlement that feels final, and infrastructure that doesn’t fall apart under legal scrutiny.

Finance does not function in full public view. Anyone who has worked around serious capital understands this instinctively. Strategies are confidential. Client relationships are protected. Contract terms are often private. When early blockchains made transparency the default for everything, they unintentionally excluded the very markets they claimed to want. Dusk did not treat this as a flaw to be patched later. It treated it as a design constraint from day one.

The idea that privacy equals secrecy is one of the most damaging misunderstandings in crypto. In real finance, privacy exists alongside accountability. You are not asked to publish your entire financial history to prove you are compliant. You are asked to demonstrate that rules were followed. Dusk’s approach mirrors this logic. The network can verify that transactions are valid, that conditions are met, and that assets obey their rules, without forcing participants to expose sensitive information.

At a human level, this matters. People don’t want to feel watched every time they move value. Companies don’t want competitors mapping their behavior. Institutions don’t want public scrutiny to distort their operations. Dusk acknowledges these realities without turning privacy into a shield for abuse. It builds a system where proof replaces exposure.

At the same time, Dusk does not pretend that all activity should be hidden. Financial systems require disclosure at the right moments. Audits, reporting, and public verification still play an important role. What feels refreshing is that Dusk doesn’t push users into extremes. It allows privacy where discretion is needed and transparency where openness is required. That balance feels closer to how finance actually operates than most blockchain designs.

The foundation of Dusk is settlement. This may sound unexciting, but it is one of the most important choices the project has made. Settlement is the moment where trust is either reinforced or broken. If a transaction can be reversed, delayed, or questioned indefinitely, uncertainty spreads. In regulated markets, uncertainty is not just inconvenient, it is dangerous.

Dusk is built to make settlement feel final. When a transaction is confirmed, it stays confirmed. There is no ambiguity hanging in the background. This sense of completion creates psychological safety for participants. It allows businesses to move forward without hesitation. In finance, that confidence is worth more than raw speed.

Many networks chase performance metrics because they are easy to market. Dusk appears less interested in impressive numbers and more focused on predictable behavior. It wants the network to feel stable, almost boring. That might disappoint traders looking for excitement, but it reassures institutions that value consistency over novelty.

The way Dusk is structured reflects this mindset. Instead of building a single massive system that tries to handle everything, it separates responsibilities. The base layer focuses on consensus, security, and settlement. Other layers can evolve above it. This design choice reduces fragility. It allows innovation without constant risk to the core.

This kind of architecture suggests patience. It assumes that tools will change, regulations will evolve, and use cases will mature. Rather than locking itself into today’s assumptions, Dusk leaves room for tomorrow’s reality. That flexibility is a hallmark of infrastructure meant to last.

Security on Dusk is maintained through proof of stake, but again, the emphasis is not hype. Validators commit value to the network and are responsible for maintaining its integrity. Their incentives are aligned with long-term health rather than short-term gain. When participants have something at risk, behavior changes. Responsibility replaces recklessness.

Finality plays a central role here as well. Once consensus is reached, the system moves forward decisively. This reduces operational risk and removes the gray areas that often plague decentralized systems. For markets that operate under legal obligations, clarity is essential. Dusk seems designed to provide that clarity consistently.

Participation is another area where Dusk takes a grounded approach. Staking is not treated as an exclusive activity reserved for technically advanced users. Flexible models allow broader involvement, including contract-based participation. This lowers barriers without sacrificing security. When more people can participate meaningfully, the network becomes stronger and more resilient.

The role of the DUSK token is straightforward. It exists to secure the network, facilitate transactions, and align incentives. There is no attempt to dress it up as something else. Its value is connected to usage and participation rather than speculation alone. Emissions are spread over time, supporting ongoing security instead of front-loading rewards.

This long-term view is critical for any system that hopes to support real-world assets. Tokenized securities, regulated instruments, and institutional products cannot rely on infrastructure that changes direction every year. They need predictability. Dusk appears designed with that responsibility in mind.

Compliance is where Dusk’s philosophy becomes especially clear. Rather than treating regulation as an external problem, it integrates compliance into the movement of assets themselves. Rules are not optional layers added by applications. They are part of how assets behave as they move through the system.

This approach solves a problem many blockchains struggle with. When compliance is enforced only at the application level, assets can lose their restrictions once they leave controlled environments. Dusk avoids this by ensuring that rules travel with the asset. This preserves compliance without destroying composability, something regulated finance depends on.

What stands out is that Dusk does not position itself against the legal world. It does not assume regulation will fade away. It does not bet on loopholes or gray areas. Instead, it builds with existing frameworks in mind. This is a harder path, but it is also the only path that leads to institutional trust.

Institutions do not experiment with systems that ignore reality. They adopt systems that respect it. Dusk’s willingness to align with legal and regulatory structures makes it usable where many blockchains remain theoretical.

For developers, this alignment removes friction. Instead of solving privacy and compliance from scratch, they can rely on the settlement layer to handle these concerns. This frees them to focus on products, user experience, and real utility. It also creates consistency across the ecosystem, which builds confidence over time.

What I find most compelling about Dusk is its tone. It does not shout. It does not overpromise. It feels like something built to be used quietly in the background. That is often how the most important infrastructure looks. Roads, payment rails, and clearing systems rarely attract attention, yet entire economies depend on them.

Dusk feels like it belongs in that category. It is not trying to dominate conversations. It is preparing for a future where blockchain is not a novelty but a utility. A future where privacy, regulation, and decentralization are not opposites but components of a functioning system.

As crypto matures, the gap between speculative platforms and real financial infrastructure will widen. Many projects will remain trapped in cycles of attention and abandonment. Others will fade quietly. A few will integrate into the fabric of real markets. Dusk appears to be aiming for the last category.

It is not building for applause. It is building for trust. And in finance, trust is not earned through noise. It is earned through consistency, restraint, and respect for reality.

When I think about what blockchain needs to become relevant beyond speculation, I don’t think about faster blocks or bigger narratives. I think about systems that institutions can rely on, users can feel safe using, and regulators can understand without fear. Dusk feels closer to that vision than most.

This is not a project promising a revolution tomorrow. It feels like a foundation preparing for adoption over years. Quietly. Methodically. Without asking the world to change its nature. That may not make headlines, but it is how lasting systems are built.