Urgent Update: Tariff Verdict & Retailers’ Legal Strike Status as of Monday Night, January 12, 2026

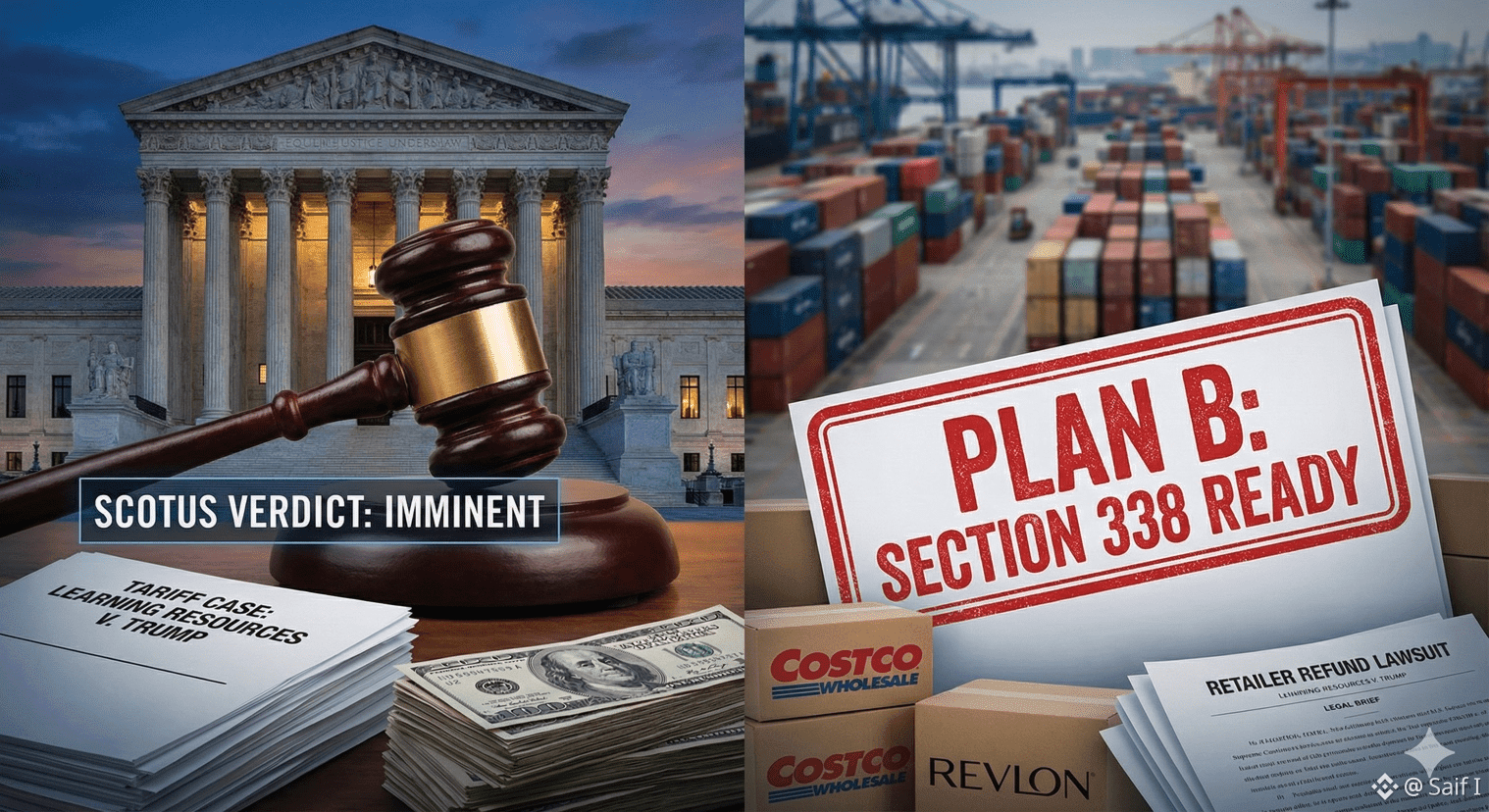

The Supreme Court did not issue a ruling today. However, the Court has updated its schedule, and the next major "Opinion Day" is set for Wednesday, January 14, 2026.

The tension has reached a boiling point as the Treasury and major retailers square off over a potential $133B to $190B refund.

1. Retailer "Heads Out of the Sand": The Lawsuit Surge

Major retailers have moved from quiet negotiation to aggressive litigation. They are terrified of a legal trap called "Liquidation."

• The Problem: Under U.S. law, once a tariff entry is "liquidated" (finalized), the money is often gone forever. Many companies face a mid-January deadline.

• The Plaintiffs:

• Costco: Has filed a massive suit calling the tariffs "unlawfully collected duties." They are specifically targeting tariffs on goods from Canada, Mexico, and China.

• Revlon & Kawasaki: Joined the "refund queue" to ensure that if the Court rules against Trump, they are legally entitled to their specific payments back with interest.

• Bumble Bee Foods & Ray-Ban (EssilorLuxottica): Have also filed suits in the Court of International Trade to "suspend liquidation" and keep their refund rights alive.

2. Treasury’s Response: "Corporate Boondoggle"

Treasury Secretary Scott Bessent addressed the refund issue today (Jan 12).

• The Cash Flow: Bessent confirmed the Treasury has $774 Billion on hand—more than enough to cover the refunds.

• The Rhetoric: He dismissed the lawsuits as a "corporate boondoggle," questioning whether companies like Costco would actually pass the refunds back to consumers or simply pocket the cash for shareholders.

• The Warning: He noted that even if the government loses, payments would not go out in a single day; it would likely take "weeks, months, or over a year" to process the claims.

3. White House "Plan B": The Section 338 Pivot

NEC Director Kevin Hassett reiterated that the administration is ready to replicate the existing tariffs "basically immediately" using other laws if IEEPA is struck down.

• Section 338: This is the "nuclear option" from the 1930s. It allows Trump to slap up to 50% tariffs on any country he deems is "discriminating" against the U.S.

• The Logic: By switching to Section 338, the White House bypasses the "National Emergency" requirement that the Supreme Court is currently skeptical of.

Crypto & Market Impact (Immediate)

• Bitcoin (BTC): Rose ~2% on Friday when the ruling was delayed, touching $91,800. Traders are viewing the delay as a sign that the Court might be struggling to find a consensus, which some see as a "mild win" for the status quo.

• Volatility Alert: Expect massive swings on Wednesday morning (10:00 AM ET).

• If Struck Down: Massive rally for retail stocks and crypto (liquidity injection narrative).

• If Upheld: Strong USD, likely temporary dip for crypto.

#TrumpTariffs #WriteToEarnUpgrade #BTCVSGOLD #CPIWatch #StrategyBTCPurchase