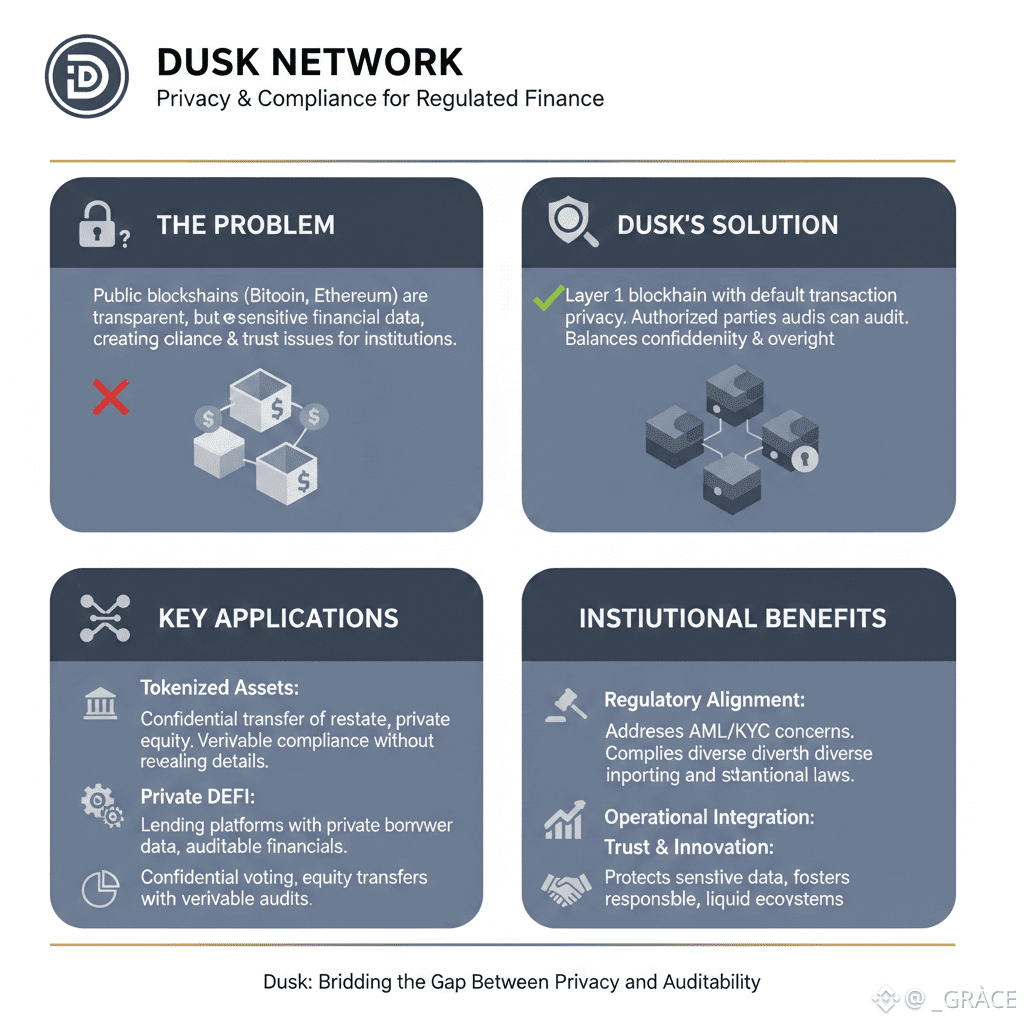

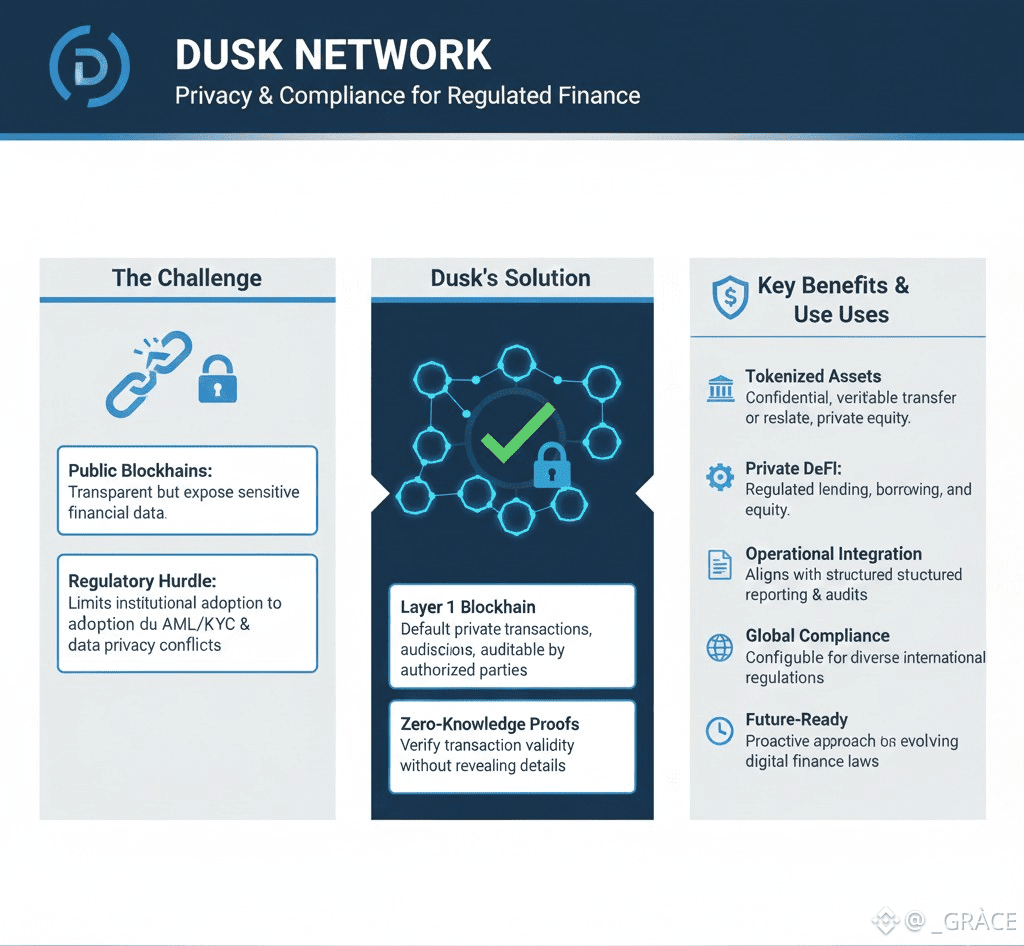

In the world of blockchain, privacy and transparency have always needed careful balance. Public blockchains like Bitcoin and Ethereum make every transaction visible to everyone. That’s great for trust and accountability, but it creates a big problem for financial institutions. Banks, investment firms, and other regulated entities can’t just put sensitive transaction data on a public ledger without risking compliance issues or client trust. For blockchain to be truly useful for regulated finance, it needs to protect privacy while still allowing oversight. That’s where Dusk Network comes in. It’s a blockchain built specifically to handle these challenges, giving institutions a way to innovate without compromising compliance.

Dusk is a layer 1 blockchain designed for privacy-focused financial applications. Unlike public blockchains, it keeps transactions private by default, while regulators and authorized parties can still audit them. This combination of privacy and transparency is what makes Dusk different. Institutions can operate on-chain without exposing sensitive information, but they can still prove that everything is compliant. It’s not just a tech experiment, it’s a carefully designed system that fits the realities of regulated finance.

One of the areas where Dusk shines is in the tokenization of real-world assets. Tokenization is becoming more popular because it can unlock liquidity in markets that are usually hard to trade, like real estate or private equity. But these markets are tightly regulated, and transactions can’t be completely public. On a standard blockchain, publishing all transaction details could violate privacy laws or reveal sensitive information to competitors. Dusk solves this by allowing confidential token transfers that are still verifiable. Each transaction can be proven compliant without revealing the parties involved or the underlying asset. This opens up blockchain opportunities for assets that were previously too sensitive for public networks.

Financial institutions have long been cautious about public blockchains. A 2024 report from the Global Digital Finance Consortium found that over 60% of regulated institutions saw blockchain as too risky because of compliance concerns. Many said that public ledger visibility clashed with anti-money laundering (AML), know-your-customer (KYC), and reporting obligations. Dusk directly addresses these concerns. Institutions can now operate on-chain while staying fully compliant, removing a major barrier to blockchain adoption.

Dusk isn’t just for tokenized assets, it’s also useful for privacy-focused DeFi platforms. DeFi is often criticized for being opaque and unregulated. With Dusk, decentralized applications can operate under regulatory oversight. For example, a lending platform built on Dusk can keep borrower and lender information private while proving that interest calculations, collateral ratios, and liquidity management follow regulations. Essentially, Dusk lets DeFi combine the flexibility of blockchain with the structure and safety required by regulated finance.

Zero-knowledge proofs are a key part of Dusk’s system. These cryptographic tools allow one party to prove that a transaction is valid without revealing any details about it. For example, a bank could process cross-border payments on Dusk, showing that everything is AML-compliant without exposing its clients’ information. This kind of privacy is crucial for regulated finance because it protects sensitive data while satisfying oversight requirements.

One of the challenges for institutions adopting blockchain is that standard networks don’t fit well with their existing workflows. Banks and other organizations rely on structured reporting, regular audits, and clear contractual obligations. Many blockchains prioritize transparency over structure, which makes compliance difficult. Dusk bridges that gap. Its architecture allows institutions to maintain their operational standards while taking advantage of blockchain’s efficiency. This makes adoption practical and less risky.

Dusk also makes corporate governance and financial reporting safer and more private. Companies issuing tokenized securities or participating in DeFi platforms can manage dividends, voting, or equity transfers confidentially while still allowing verifiable audits. This protects competitive information, prevents market manipulation, and safeguards client data. Privacy is built into the system, not added as an afterthought, which is what makes Dusk appealing to institutions.

The network also helps institutions navigate complex international regulations. Banks operating in multiple countries face different privacy and securities rules. Public blockchains often make this nearly impossible. Dusk’s configurable privacy and auditing features allow institutions to comply with multiple regulatory regimes at once. This flexibility is a game-changer for cross-border financial innovation.

Importantly, Dusk doesn’t enable secrecy for wrongdoing. Its purpose is to protect legitimate business data while keeping oversight possible. It’s a balance between fully public blockchains and fully private networks that operate unchecked. Privacy without auditability can lead to abuse, while auditability without privacy can block adoption. Dusk strikes a middle ground, giving institutions the confidence to explore blockchain innovation while staying compliant.

From a technical perspective, Dusk is built to handle confidential transactions efficiently. Privacy and auditability are native to the network, not added later. This makes the system scalable and simplifies integration with compliance processes. High-volume platforms, like institutional trading systems or tokenized exchanges, benefit from this approach because it keeps operations fast and secure without compromising privacy.

Dusk is also relevant outside traditional finance. Private equity funds, real estate platforms, and insurance companies can use the network to digitize operations while keeping sensitive data confidential. For example, a real estate tokenization platform can track property ownership, rental income, and regulatory filings privately but verifiably. Insurance companies can process claims or underwriting information confidentially while still satisfying audit requirements. The common theme is that Dusk allows real-world finance to move on-chain without exposing sensitive information.

Experts in blockchain adoption say privacy-compliant infrastructure is one of the top factors influencing institutional engagement. Dusk stands out because it is practical, not just theoretical. It focuses on enabling real-world applications instead of chasing hype. This is different from many blockchain projects that target general users or speculative investors without addressing compliance concerns.

Dusk also anticipates the direction of global regulations. Authorities are increasingly focused on transparency, reporting, and consumer protection in digital finance. Networks that don’t support these requirements may struggle to survive. Dusk helps institutions adopt blockchain in a way that aligns with regulations, not after the fact. This proactive approach ensures long-term viability and reduces operational risk.

By providing privacy without compromising compliance, Dusk encourages responsible innovation. Developers can build complex financial products structured instruments, derivatives, or lending protocols within a framework that satisfies legal requirements. This creates a healthier ecosystem for tokenized assets and DeFi, making it more attractive for institutional capital.

Trust is another key benefit. In finance, trust is both legal and operational. Institutions must protect sensitive client data and comply with regulations to maintain credibility. Dusk allows them to do both, offering a secure environment where stakeholders clients, regulators, and counterparties can interact confidently.

Dusk’s model also aligns with regional trends. In Europe, regulatory clarity is improving, and institutions are exploring blockchain for tokenized securities. Dusk’s privacy-and-compliance architecture makes it an obvious choice, reducing integration risks. In Asia, where privacy laws are evolving and cross-border operations are essential, Dusk’s flexibility is especially useful for multinational institutions.

Institutional adoption creates network effects. As more regulated entities join Dusk, liquidity grows for compliant assets, making tokenized assets and DeFi protocols more viable. Unlike public blockchains that cater to speculation, Dusk builds a professionalized ecosystem focused on long-term institutional participation and operational integrity.

Ultimately, Dusk represents a shift in how blockchain is designed. Early blockchains prioritized transparency above all else. Dusk understands that regulated finance needs both privacy and auditability. Privacy is critical for trust, client protection, and legal compliance. Auditability ensures accountability. By combining these at the protocol level, Dusk offers a practical, scalable platform for institutions to innovate confidently on-chain.

In short, Dusk bridges the gap between privacy and compliance. It allows confidential transactions to be verified by authorized parties, making it suitable for banks, tokenized asset platforms, and regulated DeFi. Its architecture is efficient, scalable, and regulatory-friendly. Beyond technology, Dusk provides institutions with a way to adopt blockchain while protecting sensitive data, maintaining trust, and staying compliant. As blockchain increasingly intersects with regulated finance, Dusk’s role is central, it enables institutions to embrace innovation without compromising privacy or legality.