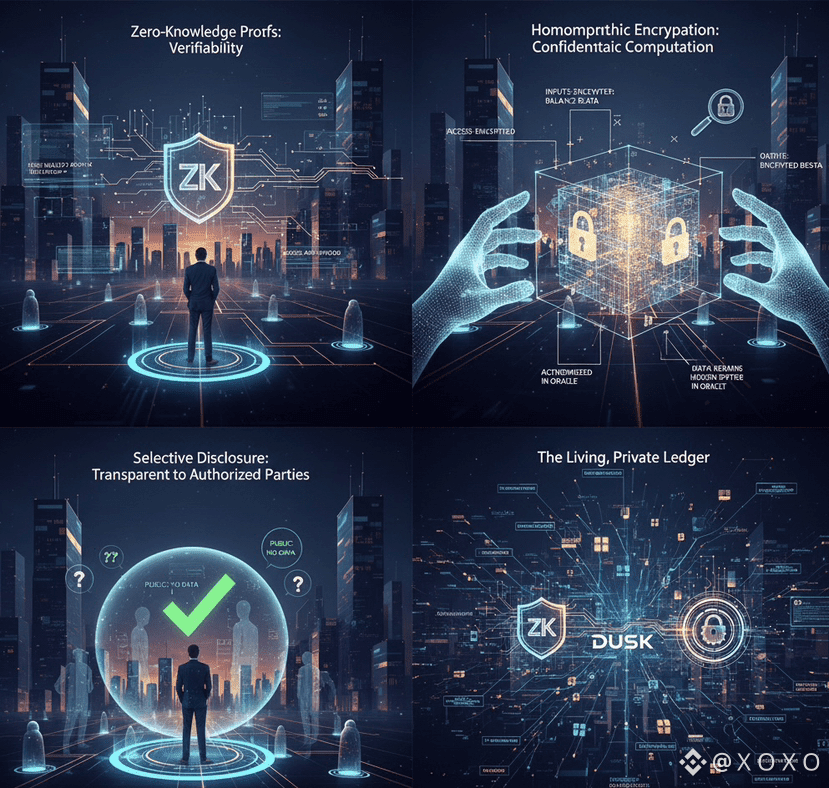

When people talk about privacy in crypto, the conversation usually collapses into a single word: zero knowledge. ZK has become a kind of shorthand for everything from private payments to scalable rollups. But in regulated financial systems, ZK alone is not enough. Markets do not just need privacy. They need privacy that can still be verified, audited, and enforced when required. This is where @Dusk becomes fundamentally different from most blockchains. It does not rely on a single cryptographic trick. It combines zero knowledge proofs with homomorphic encryption to create something much closer to how real financial infrastructure actually works.

To understand why this matters, it helps to look at how privacy works in traditional finance. When you make a bank transfer, the amount and your balance are not visible to the entire world. They are confidential. But they are not invisible. Banks, auditors and regulators can still verify that the transaction was legal, that the money existed, and that nothing was double spent or fabricated. The system is private to the public, but transparent to authorized parties. That balance is exactly what Dusk is trying to recreate onchain.

Zero knowledge proofs are extremely good at one thing: proving that a statement is true without revealing the underlying data. For example, you can prove that you have enough balance to make a payment without revealing how much you actually have. You can prove that a transaction follows the rules without showing the inputs. This is powerful, but it is not enough for full financial operations. ZK proofs are static. They prove that something was valid at a moment in time. They do not allow you to perform calculations on encrypted data over time.

That is where homomorphic encryption enters the picture. Homomorphic encryption allows computations to be performed directly on encrypted values. In simple terms, you can add, subtract, or otherwise manipulate numbers without ever decrypting them. When the result is finally decrypted, it is exactly what you would have gotten if you had done the calculation on the plain data. This means balances can be updated, interest can be applied, and trades can be settled without anyone ever seeing the actual numbers.

Dusk uses ZK proofs to ensure that every step of a transaction is valid and follows the rules, and homomorphic encryption to keep the underlying financial data hidden while still allowing it to change over time. This combination is what makes it possible to build real financial products onchain without exposing sensitive information.

Consider a simple example: a private transfer. In most privacy coins, the sender and receiver prove that the transaction is valid using ZK. The network sees that no money was created or destroyed, but it cannot see the amounts. That works for payments, but what about a more complex system like a security token, a lending protocol, or a regulated asset? Those systems need to track balances, apply corporate actions, calculate dividends, and enforce compliance rules. With ZK alone, you would need to constantly generate new proofs for every possible state. It becomes complex and inefficient.

With homomorphic encryption, the balance itself stays encrypted but still changes as transactions occur. The network does not need to see the number. It just needs to know that the encrypted value was updated correctly. ZK proofs then wrap around this process to prove that each update followed the rules. Together, they create a living, private ledger.

This is why Dusk is particularly well suited for real world assets and institutional finance. When a bank issues a tokenized bond, it cannot reveal every investor’s position to the public. That would violate privacy laws and commercial confidentiality. At the same time, regulators must be able to verify that ownership, interest payments, and redemptions are correct. Dusk’s cryptographic stack allows both to exist at the same time.

Selective disclosure is the practical expression of this design. Users and institutions can keep their data hidden by default, but they can generate proofs or decrypt specific information for authorized parties. A regulator might see total exposure, while the public sees nothing. An auditor might verify compliance without accessing personal data. This is not a bolt on feature. It is built into how balances and transactions are represented in the first place.

From a technical perspective, this also changes how smart contracts can be written. On Dusk, contracts do not operate on plain numbers. They operate on encrypted values. This means developers can build financial logic that respects privacy by design. A lending contract can calculate interest on an encrypted balance. A trading engine can match orders without revealing sizes. ZK proofs ensure that no one is cheating, while homomorphic encryption keeps the data sealed.

This is very different from most EVM based privacy solutions, which often try to hide data at the transaction layer but still expose it once it enters a contract. Dusk extends privacy all the way through execution. That is what allows it to support complex, regulated financial products.

There is also a strategic reason for this approach. Regulation is not going away. If anything, it is becoming more demanding. Institutions cannot use systems that are black boxes. They need to be able to demonstrate compliance, manage risk, and report activity. Dusk’s architecture gives them the tools to do that without sacrificing client confidentiality.

At the same time, users benefit because their financial lives are not broadcast to the world. In a public blockchain, anyone can see your balances, your trades, and your history. That is not how real finance works. Dusk restores a level of dignity and safety that has been missing from most of Web3.

The combination of ZK and homomorphic encryption also future proofs the network. As AI driven trading, automated compliance, and onchain analytics grow, the ability to compute on private data becomes more important. Dusk is building a platform where algorithms can interact with financial data without exposing it.

My take is that this dual approach is what gives Dusk its unique position. Many projects talk about privacy. Very few can support the full complexity of financial markets. By combining zero knowledge proofs for verifiability with homomorphic encryption for confidential computation, Dusk is not just hiding data. It is building a private, programmable financial system that regulators, institutions, and users can all live with. That is what it will take to bring real world finance onchain.