In most conversations about crypto, privacy is treated like a feature. Something you add when users complain. Something you toggle on or off. Something you wrap around transactions after the core system is already built. That approach works if all you are trying to do is hide payments. It completely fails when what you are trying to build is a financial system.

Real financial markets do not run on optional privacy. They run on structural privacy. Banks do not choose whether to keep balances confidential. It is a legal and operational requirement. Trading desks do not flip a switch to hide positions. Their entire infrastructure is built so that only the right parties can see them. Regulators have access, but competitors and the public do not. Privacy is not a setting. It is the architecture.

@Dusk was designed with that reality in mind.

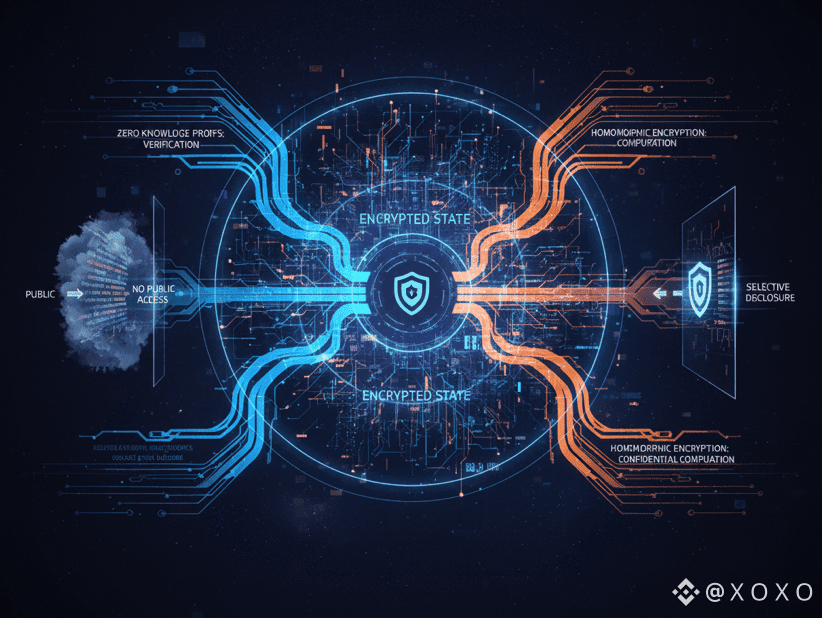

Instead of starting with a transparent blockchain and then trying to patch privacy on top, Dusk starts with encrypted state. Balances, transaction values, and asset ownership are not stored in plain text. They are cryptographically protected by default. This single design choice changes everything about how financial applications can be built onchain.

On most public blockchains, every wallet is an open book. Anyone can see how much you have, what you trade, and who you interact with. That might be acceptable for retail speculation, but it is unusable for institutions, corporations, and serious financial products. Exposure creates risk. It allows front running. It leaks strategies. It violates privacy laws. Dusk removes that exposure at the base layer.

Privacy on Dusk is not achieved by hiding transactions from the network. It is achieved by allowing the network to verify transactions without seeing their contents. Zero knowledge proofs prove that the rules were followed. Homomorphic encryption allows balances to be updated without revealing them. The blockchain remains secure and verifiable, but it no longer functions as a global surveillance system.

This is what it means for privacy to be infrastructure. Every application built on Dusk inherits this protection automatically. Developers do not need to implement their own privacy schemes. Users do not need to trust third party mixers or bridges. The ledger itself is private.

This has profound implications for how finance can move onchain.

Take tokenized securities. A stock or bond is not just a number. It represents legal rights, corporate actions, and regulatory obligations. Ownership records must be accurate and auditable, but they cannot be public. On a transparent blockchain, anyone could map who owns what. On Dusk, ownership exists in encrypted form. Issuers and regulators can see what they need. The public cannot.

The same applies to trading. Markets only work when participants can place orders without revealing their intentions. If a large institution wants to buy or sell, exposing that order in advance moves the price against them. Public DeFi suffers from this constantly through front running and sandwich attacks. Dusk’s private execution prevents that. Orders and balances remain confidential, yet trades still settle correctly.

Privacy as infrastructure also enables something else that most blockchains cannot support: compliance. Regulation does not mean surveillance. It means accountability. Regulators do not need to watch every transaction in real time. They need the ability to inspect, audit, and enforce when required. Dusk supports selective disclosure, allowing authorized parties to view or verify data without making it public.

This aligns perfectly with how real financial oversight works. Banks file reports. Auditors inspect books. Regulators investigate suspicious activity. None of this requires broadcasting everyone’s financial life to the world. Dusk brings that same model onchain.

There is also a human side to this. People do not want their salaries, savings, or investments to be public. In a world where blockchain adoption grows, public ledgers become dangerous. They enable profiling, targeting, and even physical risk. Dusk gives users something simple but powerful: financial dignity.

By making privacy foundational, Dusk also future proofs itself. As AI driven trading, automated compliance, and onchain analytics expand, the ability to compute on encrypted data becomes more important. Dusk is building a platform where algorithms can operate on financial information without exposing it. This is what will allow sophisticated financial systems to run onchain.

My take is that privacy as infrastructure is the only way Web3 becomes real finance. You cannot build global markets on a system that forces everyone to live in public. You cannot bring institutions, corporations, and everyday users into an economy that exposes them by default. Dusk understands this. It is not trying to be another blockchain. It is building the private, compliant, programmable financial layer that Web3 has been missing.