Every financial system in history has had to balance two forces that are always in tension. One is privacy. The other is oversight. People and institutions need their financial lives to remain confidential. At the same time, societies need markets to be fair, legal, and safe from abuse. This tension is what can be called the compliance paradox. The more you try to regulate, the more you risk destroying privacy. The more you try to protect privacy, the harder it becomes to regulate. Most blockchain systems fail because they choose one side and ignore the other. @Dusk was built specifically to resolve this paradox.

To understand why this is so important, it helps to look at how both traditional finance and crypto approach the problem. In traditional finance, privacy is enforced by law and institutional controls. Banks, brokers, and exchanges protect customer data. They do not publish balances or trades. Regulators and auditors, however, have legal authority to inspect those records. This creates a layered system of visibility. Most people see nothing. Authorized parties see what they need. The public sees almost nothing at all.

Crypto broke this model. Public blockchains made everything transparent. Anyone can see every balance, every transaction, and every smart contract interaction. This was originally framed as a way to create trust, but it came at a huge cost. Financial privacy disappeared. Front running, surveillance, and strategy leakage became normal. For retail users this is uncomfortable. For institutions it is unacceptable.

Privacy focused blockchains tried to fix this by hiding everything. They use cryptography to obscure senders, receivers, and amounts. This protects users, but it creates a new problem. Regulators cannot verify what is happening. There is no way to audit markets, enforce rules, or investigate wrongdoing. These systems become legally toxic.

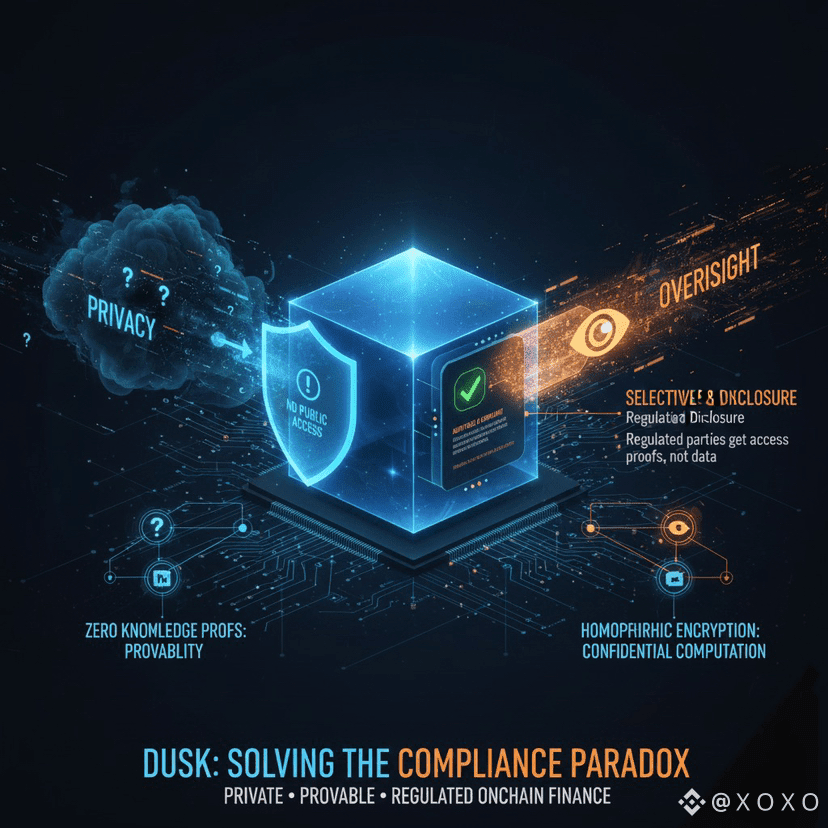

This is the compliance paradox. Transparency destroys privacy. Secrecy destroys legitimacy. Dusk solves this by refusing to accept that these are the only two options.

Dusk’s core insight is that financial data should not be public, but it should be provable. Instead of exposing raw information, Dusk exposes cryptographic guarantees. Transactions, balances, and ownership exist in encrypted form. Zero knowledge proofs show that everything is correct. Homomorphic encryption allows values to change without being revealed. Selective disclosure allows authorized parties to see what they need.

This creates a system that behaves like traditional finance, but with cryptographic enforcement instead of institutional trust. Users get confidentiality. Institutions get compliance. Regulators get auditability.

Consider a simple transfer. On a public chain, everyone sees who sent how much to whom. On Dusk, the amounts and balances are encrypted. The network only sees a proof that the sender had enough funds and that the total supply was conserved. Nothing else is revealed. Privacy is preserved.

Now consider a regulator. They may need to verify that a financial institution is not exceeding exposure limits or that customer funds are properly backed. On Dusk, the institution can provide cryptographic proofs or selectively disclose data to the regulator. The regulator can verify compliance without gaining access to everyone’s data. Oversight exists without mass surveillance.

This same mechanism extends to more complex products. Tokenized stocks, bonds, funds and derivatives all require confidentiality and reporting. Dusk supports both because its ledger is encrypted but verifiable. Ownership records are hidden from the public but provable to those who need them.

The result is a financial system where rules can be enforced without turning the blockchain into a spy network. That is the core of how Dusk resolves the compliance paradox.

There is also a market level benefit. When privacy and compliance coexist, institutions can actually use the network. Banks, asset managers, and issuers do not need to choose between innovation and regulation. They get both.

My take is that this is the only way Web3 becomes real finance. Either blockchains evolve to support privacy with accountability, or they remain a niche. Dusk is showing that the paradox was never real. With the right cryptography and architecture, markets can be private, compliant and onchain at the same time.