Most token narratives feel like paint on a wall: bright, glossy, and unrelated to the building’s structure. Walrus is different because tokenization is the structure. The protocol’s big bet is that data storage should be programmable, enforceable, and economically legible across decentralized infrastructure, so it turns storage itself into an asset class you can control inside smart contracts. It’s a thesis that fits the AI era, where datasets, provenance, and verifiable content aren’t side quests; they are the product.

Start with fundamentals: Walrus is a decentralized blob storage protocol for large binary objects—media files, datasets, PDFs, long-form content, rollup data availability payloads—anything too big or too awkward to store directly on a replicated execution layer. The docs describe the core mechanics: blobs are encoded into redundant “slivers” and distributed across storage nodes, and the original blob can be reconstructed even if up to two-thirds of slivers are missing. That recovery property, combined with a minimal 4x–5x replication factor, is the key reason Walrus can aim for robustness without the costs typically associated with full replication.

The whitepaper pushes the engineering angle further. Walrus introduces Red Stuff, a two-dimensional erasure coding protocol designed to keep overhead low while improving recovery under churn. It reports high security with a 4.5x replication factor and self-healing recovery where bandwidth is proportional to the lost data, not the entire blob. If you’ve ever watched a distributed system buckle during node churn, you understand why this matters: storage networks fail less from “no nodes exist” and more from “nodes changed at the wrong time and recovery was too expensive.”

Now to the part that makes Walrus feel like a new category: tokenization of storage capacity as a programmable asset. Walrus uses Sui as a secure control plane, storing metadata and publishing onchain proofs-of-availability (PoA) certificates. In that design, storage resources can be represented as objects on Sui, immediately usable in Move smart contracts, so storage becomes ownable, transferable, and tradable—something contracts can hold, split, and manage. This is the opposite of the usual “upload file, get hash, hope pinning works” model. Here, storage rights become a resource with lifecycle logic.

That lifecycle logic changes what “data products” can be. Consider a dataset marketplace: you don’t just sell access to bytes; you sell access bound to renewal policies, escrow conditions, proof-of-availability thresholds, and even automated takedown rules for expired entitlements. Consider an NFT collection: metadata and media can be stored under programmable renewal guarantees instead of relying on centralized hosting. Consider rollups: sequencers can publish transaction data into a layer designed for availability, and executors can reconstruct it without downloading the full blob every time. Walrus explicitly frames itself as a data availability layer option for rollups, and as infrastructure for everything from decentralized apps to AI provenance.

Interoperability is handled with a pragmatic split: Sui is the control plane, but Walrus is chain-agnostic for builders. The Walrus blog notes developers can bring data from other ecosystems like Solana and Ethereum using tools and SDKs, and the mainnet announcement emphasizes Walrus is designed to serve virtually any decentralized storage need—from decentralized websites to entire blockchain ecosystems. The message is clear: Walrus wants to be the neutral data layer, not a tribal accessory.

The $WAL token is where the programmable asset story becomes an incentive machine. WAL is the payment token for storage, and Walrus intentionally designs payments to keep storage costs stable in fiat terms while buffering token price volatility. Users pay upfront for storage over a fixed time, and those payments are streamed out over time to storage nodes and stakers. This is an underrated design choice because it matches the time horizon of the obligation (store my data for months) with the time horizon of the compensation (receive value over months), rather than dumping all incentives into a single moment.

Early-phase adoption is supported by an explicit subsidy allocation: 10% of WAL is earmarked for subsidies, intended to let users access storage below market while ensuring operators can cover fixed costs. The staking rewards model also formalizes how fees and subsidies flow through the system, explicitly tying user price, node revenue, and staker revenue to a storage price and subsidy rate. It’s not just “fees happen.” It’s a designed value flow.

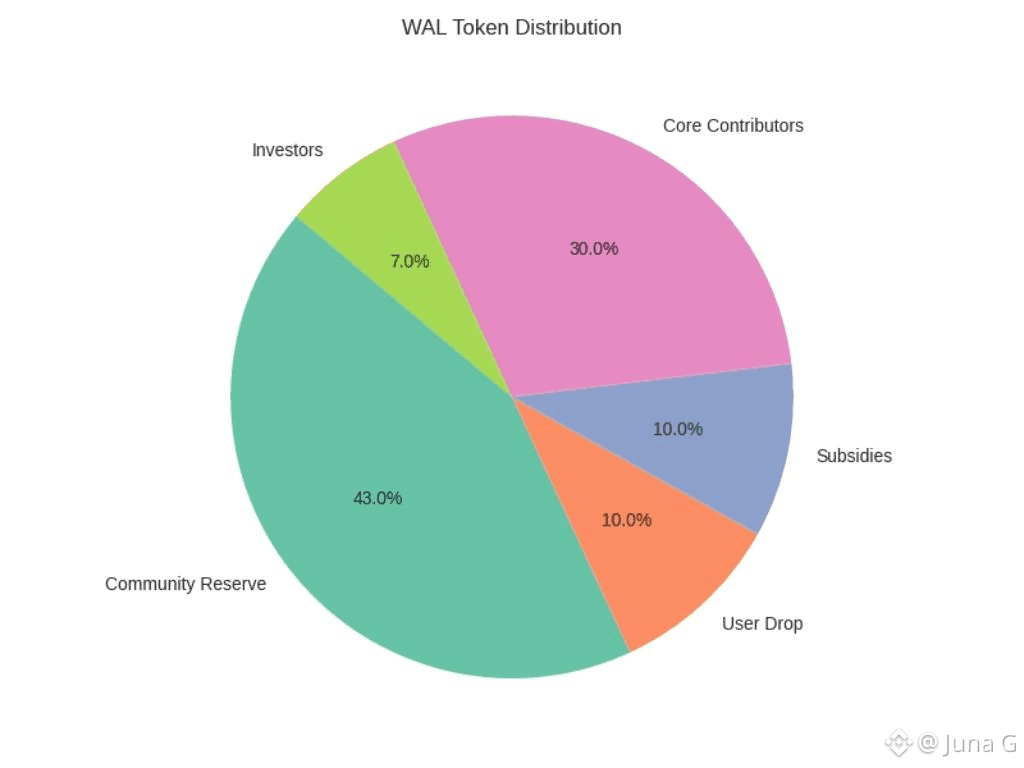

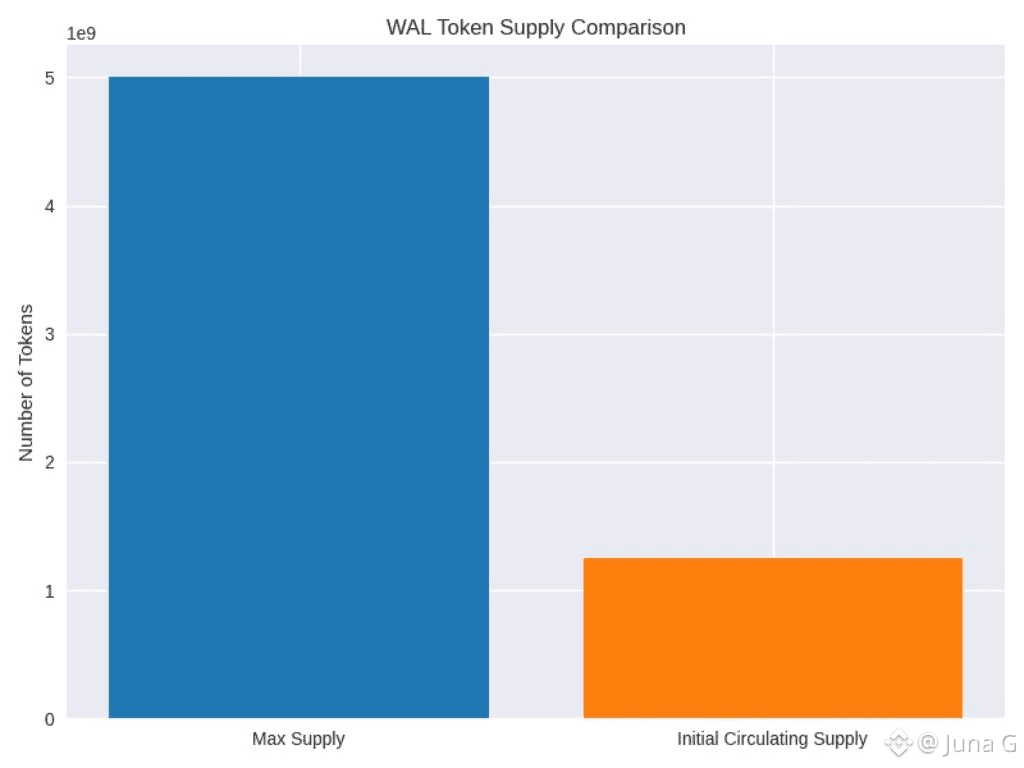

Token distribution matters because it defines who gets to steer the network’s long-run incentives. Walrus states that over 60% of WAL is allocated to the community via airdrops, subsidies, and the community reserve. The breakdown includes 43% community reserve, 10% user drop, 10% subsidies, 30% core contributors, and 7% investors, with a max supply of 5,000,000,000 WAL and an initial circulating supply of 1,250,000,000 WAL.

Even within that, the vesting details are built to reward patience: parts of the community reserve unlock linearly through March 2033, subsidies unlock over 50 months, and investors unlock 12 months from mainnet launch.

Governance is treated as parameter control, not ceremony. Walrus governance operates through the WAL token, with nodes collectively determining penalty levels using votes proportional to stake. The protocol also outlines burning mechanisms tied to system health: short-term stake shifts can face penalty fees that are partially burned, and (once enabled) slashing for low-performing nodes would burn a portion of slashed amounts. The goal is straightforward: punish behaviors that create network-wide externalities, and make the token reflect performance discipline.

Scalability isn’t a slogan either. The whitepaper describes a testbed with 105 independent storage node operators and 1,000 shards, with stake-weighted shard allocation and global distribution across at least 17 countries. Those details matter because decentralized storage fails when “decentralization” is just a marketing word for a handful of machines in one rack. Walrus is building the incentives and the mechanics for a geographically diverse storage committee to actually behave as a coherent system.

So the real story of Walrus isn’t “WAL is a token.” It’s that storage rights become composable, and a token coordinates the pricing, security, and governance of those rights. If Web3 wants data markets where data is reliable, valuable, and governable, then Walrus is aiming to make that governance enforceable at the protocol layer, not negotiated in backchannels. Again, not financial advice—but if you’re evaluating #Walrus evaluate it as an economic operating system for programmable storage, with $WAL as the governor and the fuel.