Trade Execution, Patience, and Why Small Decisions Create Big Results

Today’s trade is a perfect example of how consistency, timing, and emotional control matter far more than hype or overconfidence. The market once again proved that it rewards discipline, not noise. What looks like a simple position on the screen is actually the result of preparation, patience, and correct execution at the right moment.

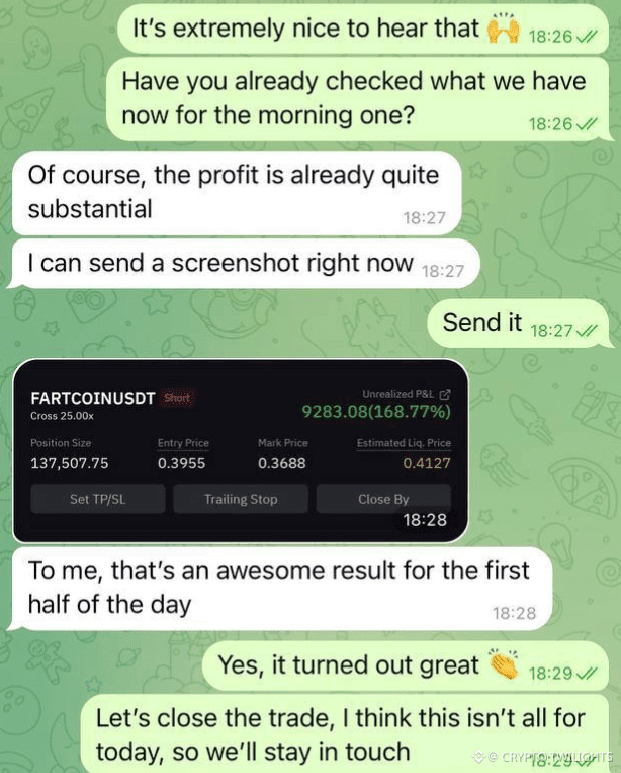

The short position on FARTCOINUSDT was not taken randomly. It was based on structure, momentum loss, and confirmation from price behavior. When price starts showing weakness after an extended move, the smart approach is not to chase but to wait. Waiting is uncomfortable for most traders, but that discomfort is exactly where opportunities are born.

Once the entry was triggered, the focus shifted immediately from excitement to risk management. Leverage magnifies everything—both profits and mistakes. That’s why position size, liquidation level, and price reaction must always be respected. The goal was not to gamble, but to let probability do its job.

As price moved in favor of the position, unrealized profit increased steadily. This is where most traders fail. They either close too early out of fear or hold too long out of greed. The key is balance. Letting the trade breathe while remaining objective is a skill that only comes with experience and self-control.

The screenshot shared shows a strong unrealized P&L, but the real win is not the number. The real win is clarity. No panic, no rush, no emotional decisions. Just reading the market and responding logically. When a trade performs well early in the day, it sets the tone—but it should never create overconfidence. One good trade does not mean the day is over, and it definitely does not mean the market owes you more.

Closing a profitable trade is also a decision that requires discipline. Many traders think only entry matters, but exits define long-term success. Locking in profit when conditions are met is not weakness—it’s professionalism. There will always be another setup, another candle, another opportunity.

What stands out in this trade is timing. The market doesn’t move according to our wishes; it moves according to liquidity, sentiment, and structure. When all three align, the move becomes clean. When they don’t, forcing trades leads to losses. Today, alignment was clear, and execution followed the plan.

Another important lesson here is communication and transparency. Clear updates, screenshots, and confirmations build trust—not only with others, but with yourself. When you track your actions honestly, you improve faster. Trading in silence with hidden mistakes only delays growth.

This trade also highlights why mornings and early sessions can be powerful. Volatility combined with fresh liquidity often creates sharp, readable moves. But again, only if you are patient enough to wait for confirmation instead of predicting outcomes.

Remember this:

✔ Strategy gives direction

✔ Risk management gives survival

✔ Discipline gives consistency

Profit is just the byproduct.

Today’s result is a reminder that trading is not about winning every move. It’s about managing risk, executing cleanly, and staying mentally stable. Some days will be slow. Some days will be fast. Some days will test your patience. But if your process is strong, the results will eventually follow.

Stay focused. Stay disciplined. Let the market come to you—not the other way around.