Public blockchains are brilliant until you try to use them for anything that resembles real finance.

Because in real finance, the “transaction” isn’t just value moving. It’s strategy, inventory, timing, counterparties, risk exposure—basically a company’s bloodstream. Making that bloodstream public by default is like requiring every bank to post its internal ledger on a billboard downtown.

And yet, the industry has spent years acting surprised that institutions are cautious.

This is where Dusk’s approach gets genuinely interesting: instead of pitching privacy as an escape hatch, Dusk frames privacy as a compliance-aware capability—the kind you can deploy in regulated settings without sparking a legal bonfire.

The key word is compliant privacy, and the mechanism that ties it together (in the EVM environment) is Hedger.

The privacy dilemma everyone pretends isn’t there

Traditional EVM environments are transparent. That’s great for verification, terrible for:

- institutional trading

- private credit

- payroll

- treasury management

- security issuance

- any competitive strategy that depends on confidentiality

Meanwhile, privacy systems historically lean into full opacity—great for personal sovereignty, but difficult for regulated adoption.

So the real question for 2026 is not “Can we do privacy?”

It’s: Can we do privacy that still supports accountability?

Dusk’s answer is “yes,” using cryptographic techniques like zero-knowledge proofs and homomorphic encryption, built around the idea that transactions can be private and still auditable.

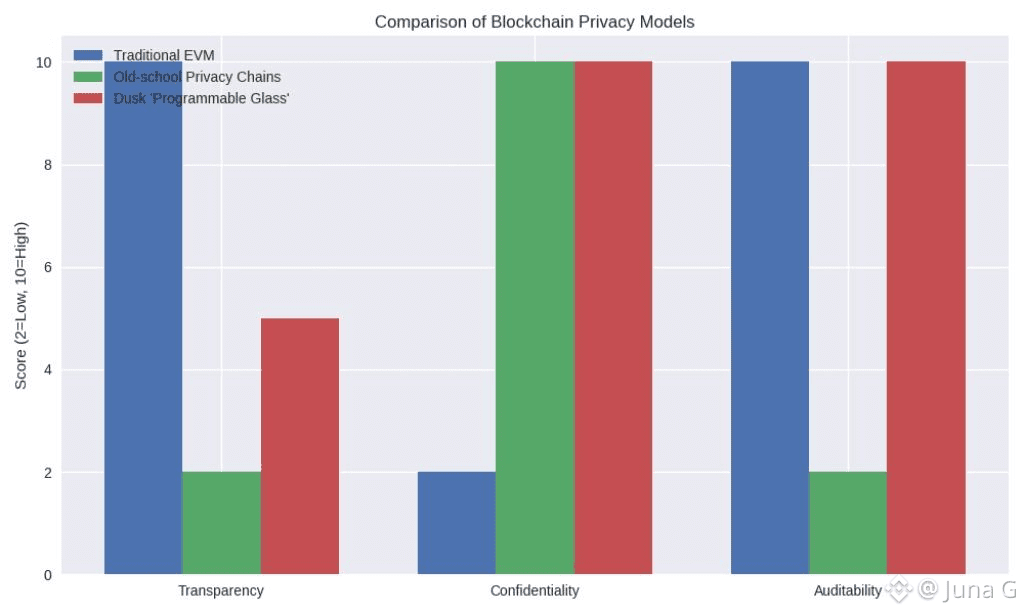

Think of it as “programmable glass”

Here’s the metaphor that makes it click:

Public chains are like a house made of clear glass. Everyone sees everything, all the time.

Old-school privacy chains are like a concrete bunker. Nobody sees anything, ever.

Dusk aims for programmable glass: opaque by default, transparent when it must be—and only to the right parties under the right conditions.

That concept is exactly what regulated markets require:

- users and institutions get confidentiality

- auditors get proofs

- regulators get lawful visibility pathways

the network still maintains integrity

Hedger: privacy-preserving, yet auditable EVM transactions

“Hedger” is positioned as the layer that enables privacy on EVM-compatible deployments. When people hear “privacy + EVM,” they often assume it means awkward constraints, developer pain, or slow cryptography that breaks UX.

But the direction here is more practical: DuskEVM lets standard Solidity contracts run while settling on Dusk Layer 1, and Hedger enables the privacy properties needed for regulated use cases.

The fact that Hedger Alpha is live matters because privacy isn’t a slide deck feature. Alpha means:

engineers can actually test flows

performance can be measured

developer experience can be evaluated

security assumptions can be reviewed in real environments

In other words: it’s entering the arena.

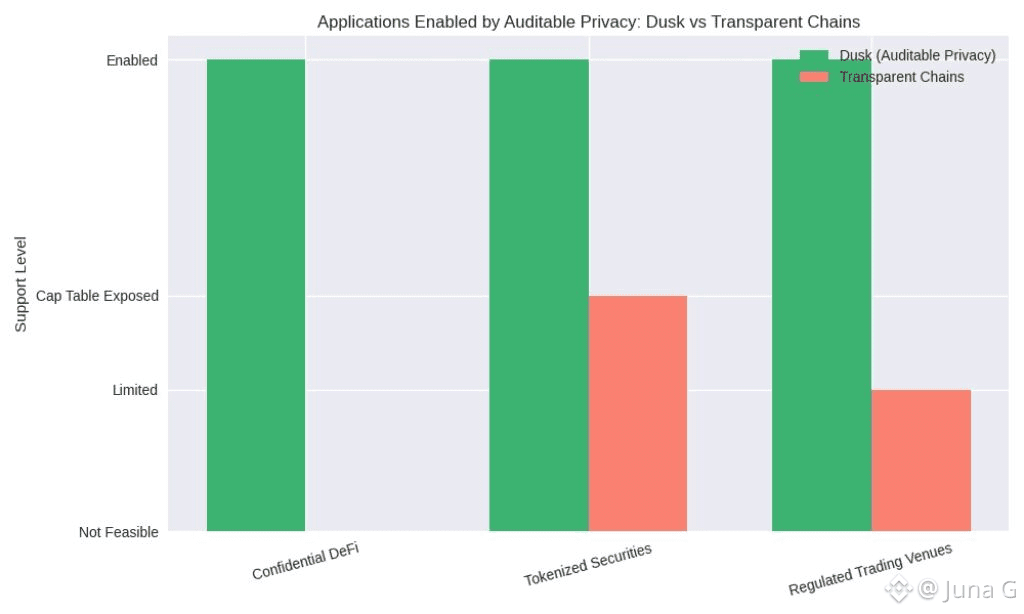

Why “auditable privacy” changes the kind of apps you can build

Let’s get specific. Auditable privacy unlocks entire classes of applications that are either impossible or strategically absurd on transparent ledgers.

1) Confidential DeFi for institutions

Institutions don’t want their positions, liquidation levels, or strategies broadcast. With compliant privacy, you can imagine:

private lending markets

confidential collateral management

protected liquidity provisioning

…while still allowing proof of solvency or risk constraints.

2) Tokenized securities that don’t leak the cap table

RWA enthusiasm often ignores a basic corporate reality: cap tables, allocations, and investor identities can be sensitive. Privacy with auditability allows tokenized securities to exist without turning corporate ownership into public metadata.

3) Regulated trading venues with credible compliance workflows

Which takes us to the other major catalyst: DuskTrade.

DuskTrade: the app that forces the stack to be real

In 2026, DuskTrade is positioned as Dusk’s first real-world asset application, built in collaboration with NPEX (a regulated Dutch exchange with MTF, Broker, and ECSP licenses). The intended scope—€300M+ in tokenized securities—signals that the platform is designed for real market activity, not sandbox demos.

Now connect that to privacy:

A compliant trading and investment platform isn’t just “a DEX with KYC.” It needs confidentiality for participants, but also robust reporting and oversight capabilities.

That’s where the Dusk approach looks coherent:

- DuskTrade as the regulated venue

- DuskEVM as the integration-friendly execution layer

- Hedger as the privacy + auditability engine

Also note: the waitlist opening in January suggests the onboarding pipeline is being staged—often the hardest part in regulated products.

DuskEVM: making integration boring (the best compliment)

If you want adoption, you need to remove friction. DuskEVM is positioned as Dusk’s EVM-compatible application layer, letting builders deploy Solidity contracts while settling on Dusk L1.

This matters because privacy systems often die on one hill: “Great tech, nobody wants to rebuild their world for it.”

DuskEVM is basically an off-ramp from that trap.

Mainnet timing is targeted for the second week of January, which implies this stack is moving from theory to deployment cadence—exactly what serious builders want.

What “expert-level” due diligence looks like here

If you want to evaluate this like a professional (not like a meme trader), focus on:

tooling maturity for DuskEVM (docs, RPC, explorer, indexers)

privacy UX (how hard is it to integrate Hedger? what are the developer primitives?)

compliance flows (selective disclosure, audit triggers, reporting)

real partner execution (NPEX integration milestones, asset onboarding)

security posture (audits, threat modeling, responsible disclosure culture)

The biggest tell will be whether the system makes regulated operations easier instead of merely possible.

If Dusk nails that, it won’t just be “a privacy chain.” It’ll be a financial infrastructure layer designed for the world that actually exists.

@Dusk $DUSK #Dusk