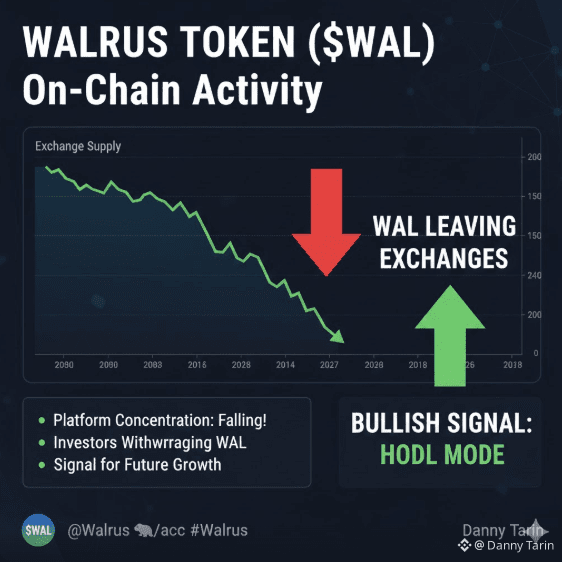

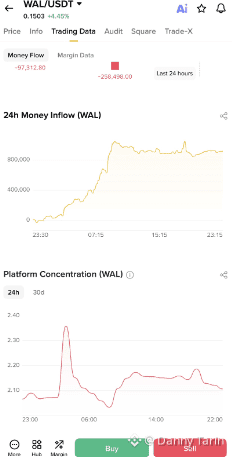

Many new investors do not understand platform concentration. But this is actually one of the most important tools to understand what people are really doing inside crypto exchanges.

When we look at the data shown in the image, one thing is very clear. The line is going down. This means something important is happening behind the scenes. People are withdrawing their WAL tokens from centralized exchanges and moving them to external wallets. These can be hot wallets, cold wallets, or even decentralized exchanges.

This behavior usually sends a strong signal. When investors move their tokens out of exchanges, it often means they are not planning to sell anytime soon. You do not withdraw coins if your goal is to dump them on the market. Instead, people withdraw when they want to hold long term, keep their assets safer, or prepare for future opportunities.

This pattern is not new in crypto. We have seen it many times with strong projects in the past. With Bitcoin, large outflows from exchanges often happened before major price recoveries. The same thing was seen with Ethereum in its early bull cycles. Whales and long term holders moved their coins to private wallets before big upward moves started.

For WAL, this kind of exchange outflow can be taken as a positive sign. It shows confidence from holders. It suggests that people are positioning early instead of chasing the price later when it is already high. Early positioning is often what separates smart money from emotional traders.

However, it is very important not to rush blindly. Crypto markets can still surprise everyone. No single indicator should be used alone. Always combine this information with volume analysis, price trends, and your own research. Risk management is key. In crypto, one wrong decision can wipe out gains very quickly.

Trade smart. Stay patient. And always remember that real opportunities usually come quietly, before the crowd notices.