NPEX didn't just partner with another blockchain.

They partnered with the ONLY blockchain that won't get them sued.

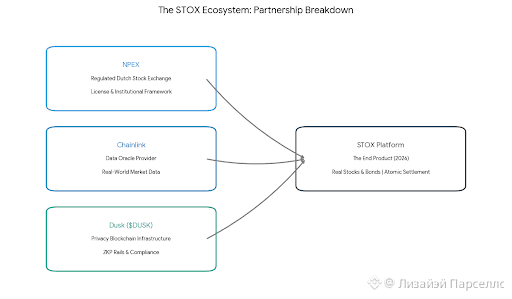

Here's what nobody's talking about: when @Dusk announced their collaboration with NPEX (a fully regulated Dutch stock exchange) and Chainlink, they weren't celebrating a "partnership." They were announcing the death of public blockchain fantasies for institutional finance.

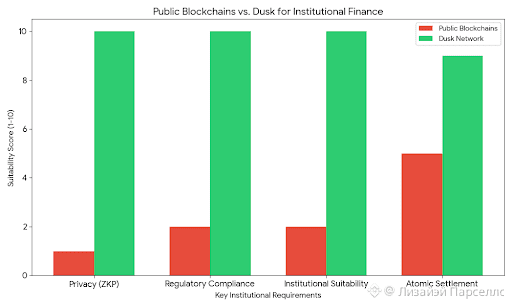

Think about it. A licensed stock exchange can't put securities on Ethereum where every hedge fund sees every trade. They can't use chains where compliance is an afterthought. They need privacy that regulators actually approve.

Dusk built that. Seven years of work. Zero shortcuts.

The result? European securities going on-chain with Chainlink oracles feeding data and $DUSK providing the privacy-compliant rails. Not "coming soon." Actually happening.

STOX platform rolls out in 2026. Real stocks. Real bonds. Real regulatory approval. Atomic settlement in 10 seconds through DuskDS while maintaining privacy through zero-knowledge proofs.

While everyone else argues about which chain will onboard institutions, NPEX already chose. They picked the one that won't land them in regulatory hell.

Sometimes the quietest project in the room is the one actually solving the problem. Sometimes a Dutch stock exchange knows something crypto X doesn't.

The bridge between traditional finance and blockchain isn't theoretical anymore. It has a name. It's called Dusk.

And NPEX just proved it works.