$DOLO Dolomite (DOLO) is the native utility and governance token of the Dolomite protocol, a decentralized money market and exchange (DEX) primarily operating on the Arbitrum and Berachain ecosystems. Launched in 2019 but gaining significant traction in late 2024 and 2025, it distinguishes itself from traditional lending protocols like Aave or Compound through its innovative "Dynamic Collateral" system.

Key Analysis Pillars:

Dynamic Collateral & Virtual Liquidity: Dolomite's standout feature allows users to keep the utility of their assets while using them as collateral. For instance, if a user deposits a yield-bearing token or a governance token, they can still earn staking rewards or participate in votes while borrowing against that asset. This significantly improves capital efficiency.

Tokenomics (DOLO, veDOLO, and oDOLO):

The ecosystem uses a triple-token model. DOLO is the tradable asset, while veDOLO (vote-escrowed DOLO) is used for governance and protocol revenue sharing. oDOLO acts as an incentive reward that can be converted to veDOLO at a discount, encouraging long-term alignment.

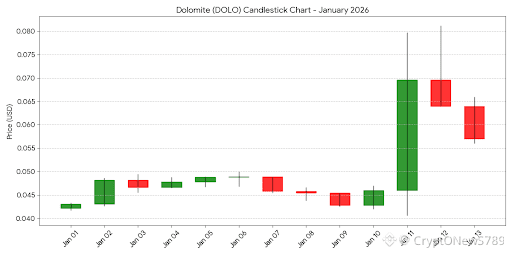

Market Performance (January 2026):

As of early January 2026, DOLO has experienced high volatility. After a relatively stable December 2025 around the \$0.04 mark, the token saw a massive surge in the second week of January, briefly touching \$0.08. This rally was largely attributed to integrations with the USD1 stablecoin and increased liquidity from major exchange listings (Coinbase and Binance). Following the peak, the price has entered a consolidation phase, currently trading around \$0.057.

Growth Potential & Risks:

Upside: Its expansion into Berachain and role as a liquidity hub for new L2 assets provide strong fundamentals.

Downside: Like many micro-cap DeFi tokens ($25M - $30M market cap), DOLO is subject to high slippage and volatility. Upcoming token unlocks in April 2026 (approx. 11% of supply) may also present sell-side pressure.

DOLO Candlestick Chart (Jan 1 – Jan 13, 2026)

The chart below illustrates the recent price action, highlighting the significant "short-squeeze" style rally that occurred between January 10th and 12th.

(See the generated chart at the top of this response)

Summary Stats (Approx. Jan 13, 2026):

Current Price: \$0.057

24H High / Low: \$0.066 / \$0.056

Market Cap: \approx \$26.04\text{M}

Circulating Supply: 460\text{M } DOLO

All-Time High: \approx \$0G .50 (October 2025)