Short, Bold & Punchy (Engaging Style)

Headline: The "War" on Fed Independence: Macro Update 2026 🚨

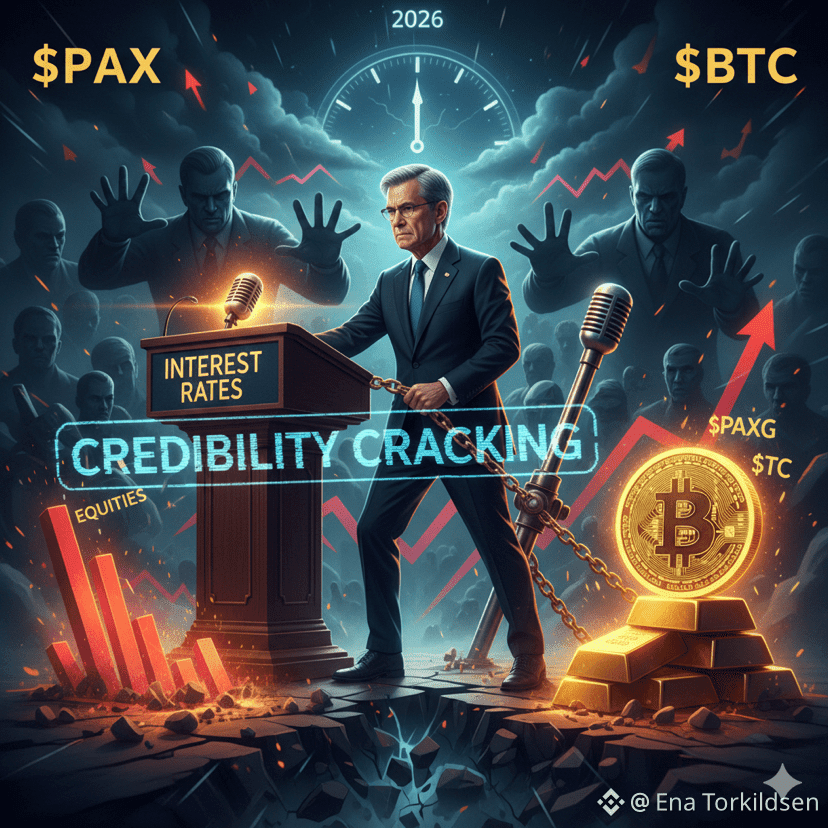

Powell's recent stance delivers a clear warning: Monetary policy is becoming a casualty of politics.

When a central bank faces pressure for rate cuts, its credibility is put at severe risk. This directly impacts your portfolio:

1. Inflation Risk: Forced rate cuts can cause inflation to spike again.

2. USD Weakness: The U.S. Dollar could lose its strength significantly.

3. Hard Assets Surge: $BTC and $PAXG (Gold) will be seen as essential hedges when faith in fiat systems wavers.

Expect potential instability in equities. Diversifying your assets is crucial now. This isn't just a U.S. issue; it's a critical global macro shift unfolding.

Be careful, be positioned.

#Fed #Powell #Bitcoin #PAXG #TradingStrategy #MarketWatch

Image Suggestion for Your Post:

Here's an image that visualizes the core themes of political pressure, market shifts, and the rise of gold and crypto.