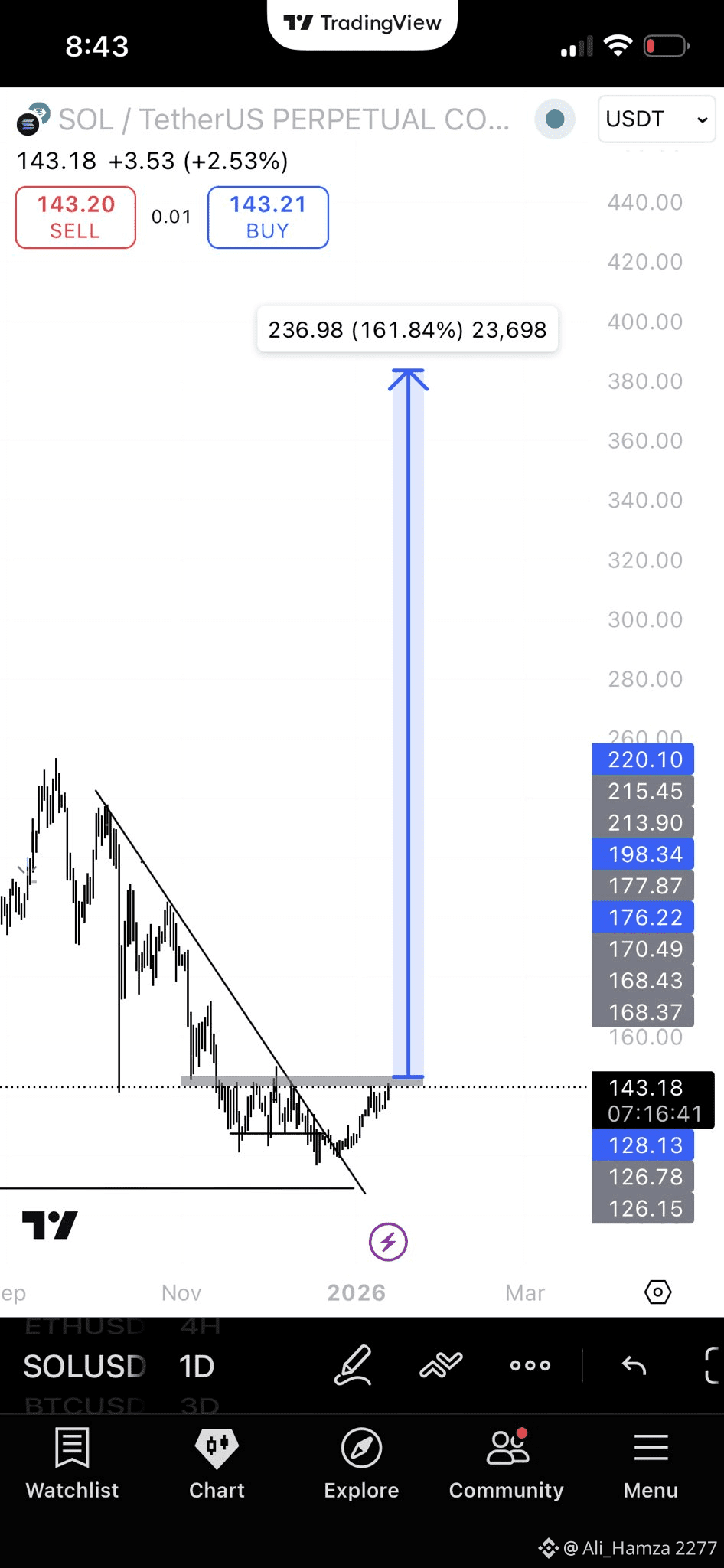

SOLUSDT Breaks $150 Resistance — Is a Bigger Rally Loading?

Solana ($SOL ) has delivered a decisive bullish breakout, reclaiming and holding above the key psychological resistance at $150. This move marks a clear trend continuation signal, supported by strong price structure and expanding volume — a combination that often precedes powerful upside extensions.

📊 Technical Breakdown

🔹 Breakout Validation

The $150 level, which previously acted as a major supply zone, has now been successfully flipped into support. Price acceptance above this zone confirms bullish control and reduces the probability of a false breakout.

🔹 Market Structure

$SOL continues to print higher highs and higher lows on the higher timeframes, confirming a healthy bullish trend. Pullbacks remain shallow, indicating aggressive dip-buying behavior.

🔹 Measured Move Target

Using the range expansion (measured move) technique, the projected upside target comes near $236.98, aligning with a 161.8% Fibonacci extension of the prior consolidation — a common magnet level during strong momentum phases.

📍 Key Price Levels to Watch

Support Zones

$143.18 — Immediate demand zone

$128.13 — Major structural support (trend invalidation level)

Resistance / Targets

$177.87 — First upside reaction zone

$198.34 — Intermediate resistance

$236.98 — Primary bullish extension target 🎯

📈 Volume & Momentum

The breakout is backed by rising trading volume, signaling genuine participation rather than a low-liquidity spike. This volume confirmation significantly strengthens the bullish thesis and suggests institutional involvement.

🧠 Trading Plan (Swing / Position Traders)

Entry: Long above $150, ideally on a 4H or Daily close

Targets:

TP1: $177.87

TP2: $198.34

TP3: $236.98

Stop Loss: Below $128.13 (structure invalidation)

💡 Risk Tip: Once TP1 is achieved, consider moving stop loss to breakeven to protect capital.

🌐 Market Sentiment & Fundamentals

Bullish price action aligns with positive sentiment around Solana’s ecosystem, including growing on-chain activity, developer traction, and increasing institutional interest. As long as SOL holds above its reclaimed support, momentum favors continuation.

⚠️ Risk Management Reminder

Avoid over-leveraging during high-volatility phases

Always size positions according to your account risk model

Stay alert to macro or ecosystem-related news

🔥 Final Outlook

As long as $150 remains defended, Solana remains technically strong and positioned for further upside expansion. Pullbacks toward support may offer strategic re-entry opportunities in a broader bullish trend.

📌 Trade smart. Follow the structure. Let the trend work.

#SOLANA #USNonFarmPayrollReport