The officially released discussion draft of the Digital Asset Market Clarity Act (CLARITY Act) is generating strong optimism in the crypto space, particularly for altcoins already supported by spot exchange-traded funds (ETFs) on major U.S. exchanges.

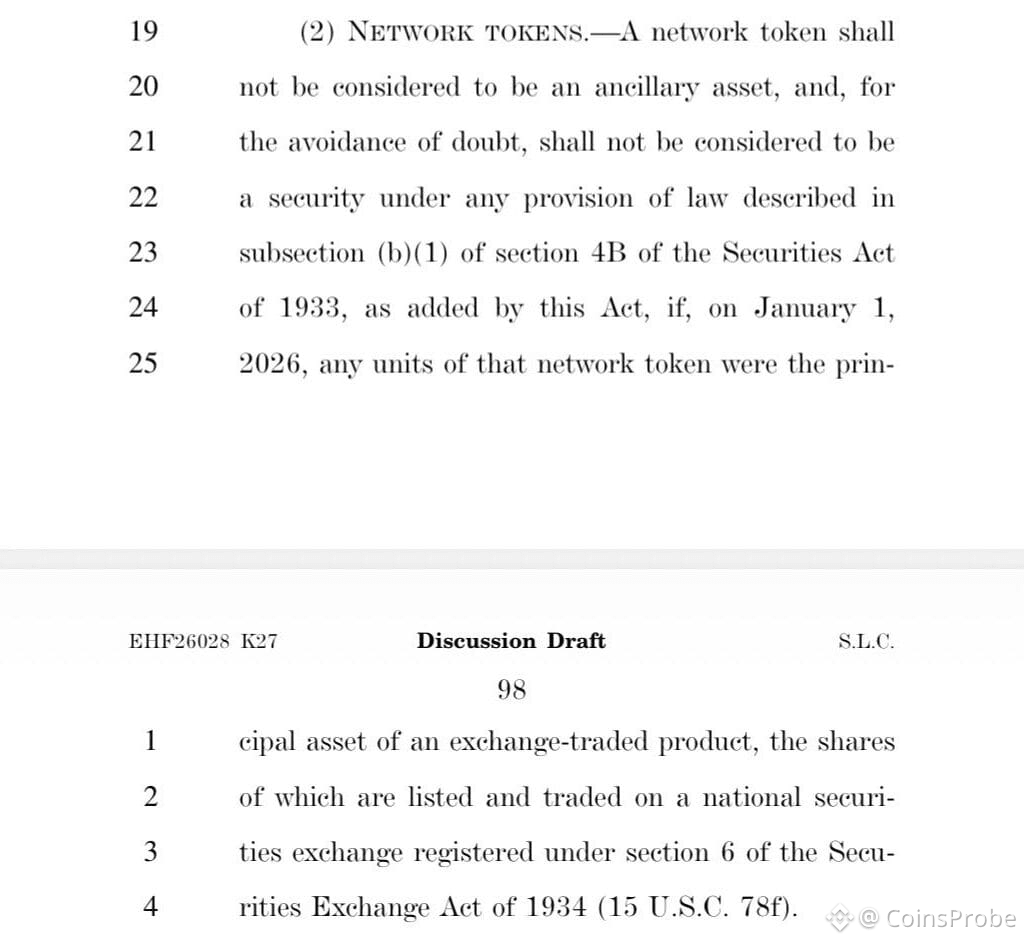

A key provision (around page 98 of the draft, referenced as EHF26028 K27) classifies certain network tokens as non-ancillary assets — and explicitly not securities under amended provisions of the Securities Act of 1933. This exemption applies automatically if, as of January 1, 2026, the token served as the principal (main) asset in an exchange-traded product (such as a spot ETF) whose shares are listed and traded on a national securities exchange (e.g., NYSE or Nasdaq) registered under Section 6 of the 1934 Securities Exchange Act.

Crypto Clarity Act Discussion Draft/Source: @EleanorTerrett (X)

Crypto Clarity Act Discussion Draft/Source: @EleanorTerrett (X)

Crypto America journalist Eleanor Terrett summarized the impact succinctly on X today:

“In other words, under this bill, $XRP, $SOL, $LTC, $HBAR, $DOGE, and $LINK are treated the same as $BTC and $ETH from day one.”

This “grandfather clause” offers a fast-track to lighter regulation for qualifying tokens, sparing them from the heavy disclosure requirements and potential SEC enforcement actions that other tokens might face if classified as securities or ancillary assets.Why This Is Bullish for ETF-Listed AltcoinsThe rule rewards projects that successfully launched spot ETFs in late 2025 — a process that demands rigorous SEC approval, surveillance-sharing agreements, and institutional-grade custody. Tokens meeting the January 1, 2026 cutoff gain:

Reduced compliance burdens and legal risks

Greater legitimacy in the eyes of traditional finance

Easier path for institutional inflows and broader adoption

Solana (SOL), XRP and Other stand out as prime beneficiaries:

$SOL — Multiple spot ETFs (from Bitwise, Fidelity, Canary, and others) were trading well before the cutoff, highlighting Solana’s high-performance blockchain ecosystem.

$XRP — Spot products (including offerings from Canary, Franklin Templeton, and Bitwise) went live in November 2025 and were actively traded by January 1, reinforcing its utility in cross-border payments.

Other qualifiers like Litecoin (LTC), Hedera (HBAR), Dogecoin (DOGE), and Chainlink (LINK) also fit the criteria, positioning them alongside BTC and ETH for favorable treatment.

Broader Context and Next Steps

The CLARITY Act aims to create a clear regulatory framework by dividing oversight between the SEC (for investment-like assets) and the CFTC (for commodity-like digital assets). This draft section is part of ongoing bipartisan discussions, with a key Senate Banking Committee markup scheduled for January 15, 2026.

If enacted as written, the provision could mark a major turning point: established ETF-backed tokens gain reduced regulatory friction, potentially unlocking billions in institutional capital and driving stronger price momentum for assets like XRP and SOL.

The market is watching closely — this officially released draft could be the clarity the industry has long awaited.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield anticipated results. Traders should perform independent research and make decisions aligned with their personal risk tolerance.