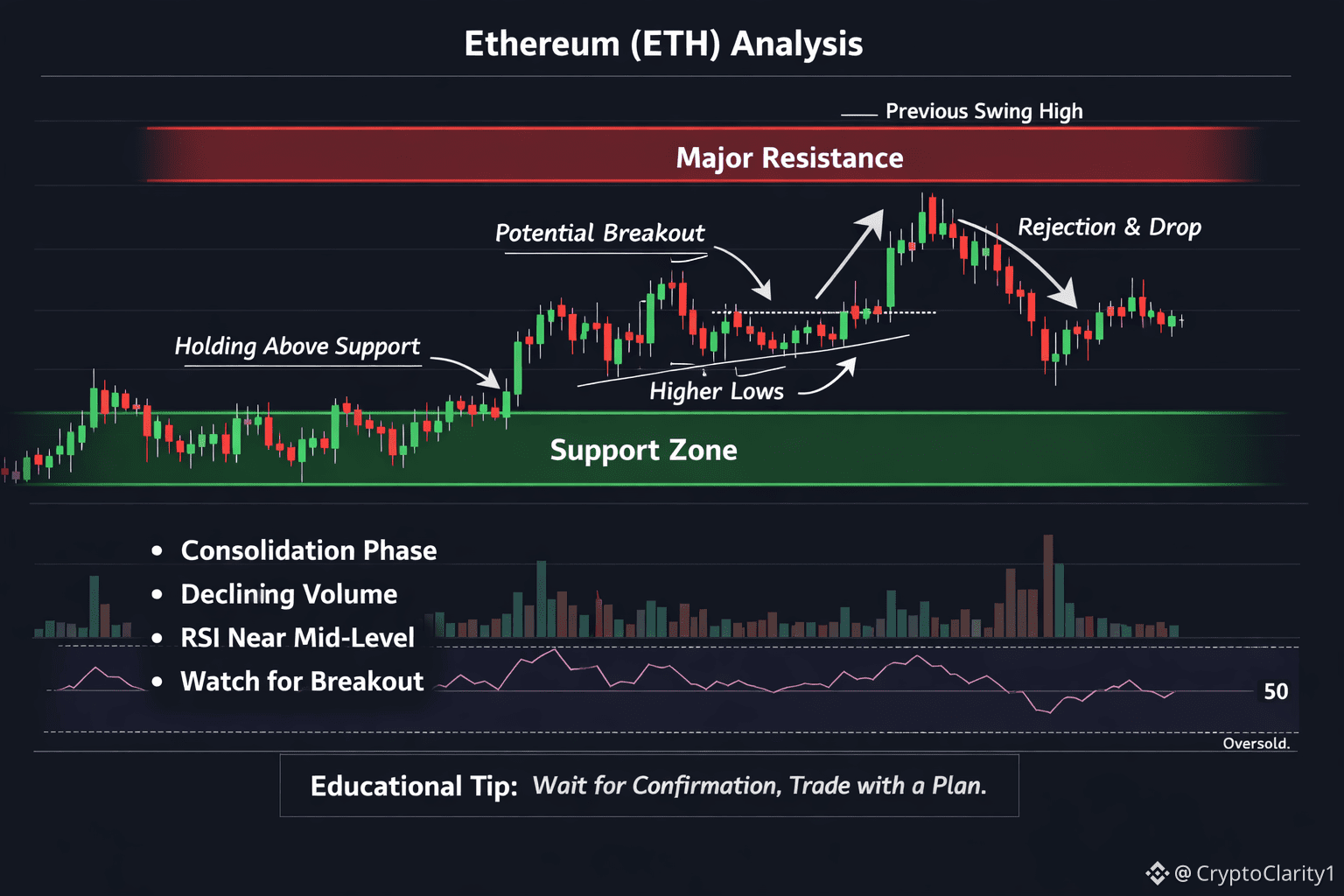

$ETH Ethereum is currently trading within a consolidation range after its recent impulse move. Price action shows higher lows, which indicates that buyers are still defending key demand zones. This suggests that the broader trend remains neutral-to-bullish unless major support is broken.Key Support & Resistance:

The primary support zone lies around the recent demand area, where price previously reacted strongly. If ETH holds above this level, a continuation toward the next resistance zone is likely. The major resistance is positioned near the previous swing high, which acts as a supply area where sellers may step inTechnical Indicators Insight:

Momentum indicators such as RSI are hovering near the mid-range, signaling balance between buyers and sellers. This often precedes a strong breakout. Volume analysis shows declining selling pressure, which is a healthy sign during consolidation phasesTrend & Bias:

As long as Ethereum remains above its key support and the structure of higher lows is intact, the bias remains bullish in the medium term. A confirmed breakout above resistance with strong volume could signal the start of a new upward legEducational Takeaway:

#learntotrade Smart traders wait for confirmation, not prediction. Trading near support with clear risk management or entering on a confirmed breakout is a more professional approach than chasing price movements emotionally....