Market Structure:

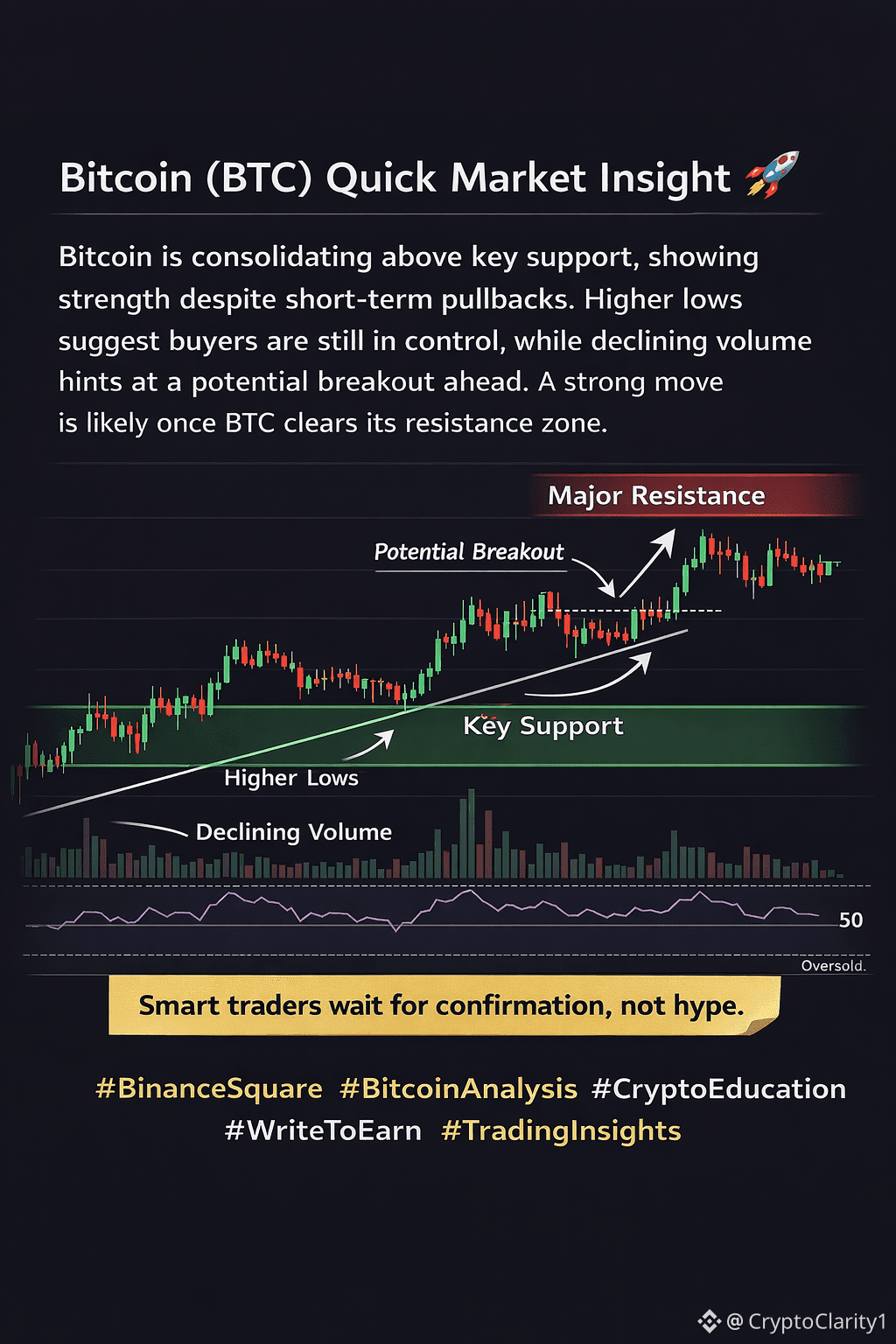

Bitcoin is currently moving within a controlled consolidation after a strong prior move. Price action shows stability above key demand levels, which indicates that buyers are still in control despite short-term pullbacks. This behavior is typical before a continuation or expansion phase.

#Support & Resistance Zones:

The major support zone lies around the recent accumulation area where price previously found strong buying interest. As long as BTC holds above this level, the overall structure remains healthy. The primary resistance is near the recent swing high, acting as a supply zone where profit-taking can occur.

Momentum & Volume Analysis:

Momentum indicators such as RSI are holding near neutral levels, suggesting the market is neither overbought nor oversold. Volume has slightly decreased during consolidation, which often signals that a larger move is building in the background.

Trend Bias:

The higher-timeframe trend remains bullish as long as Bitcoin maintains higher lows. A breakout above resistance with strong volume would confirm trend continuation, while a loss of support could lead to a deeper corrective move.

Educational Takeaway:

Professional traders focus on structure, not emotions. Waiting for confirmation at key levels and managing risk is more important than trying to predict every price move.

#BinanceSquare  #BitcoinAnalysis #CryptoEducation💡🚀 #writetoearn #TradingInsights

#BitcoinAnalysis #CryptoEducation💡🚀 #writetoearn #TradingInsights