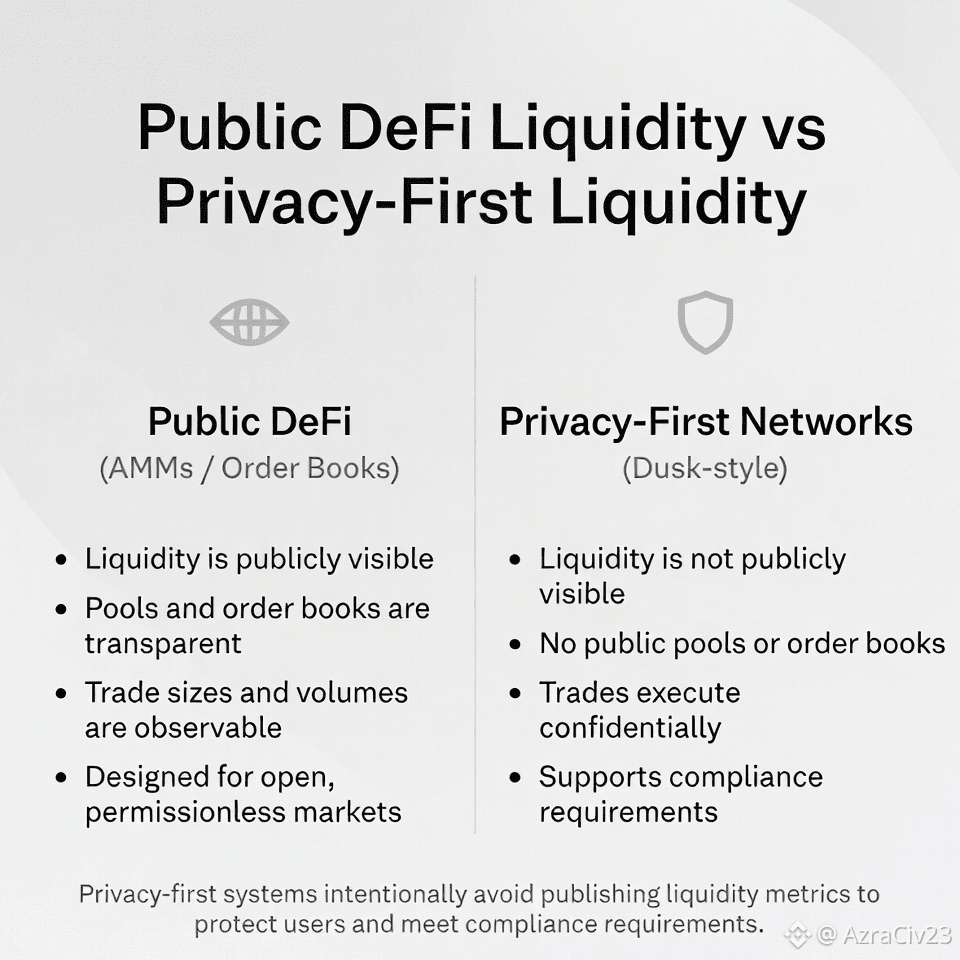

Have you ever thought about how liquidity can even exist on a privacy first network like @Dusk .

Normally, liquidity is obvious - pools, order books, visible depth. But on Dusk, everything is confidential. You can’t just expose balances and orders if the goal is privacy and regulatory compliance at the same time.

So liquidity has to come from somewhere else.

Instead of public pools, it relies on participants who are willing to commit capital and prices quietly, absorb risk in the background, and let trades go through without revealing who traded, how much, or why.

Those participants (users or institution) are called Hedges.

Markets still function, but sensitive data never leaks.

That’s how Dusk manages to keep trading usable while respecting both privacy and compliance -something that a lot DeFi systems can’t do at the same time.