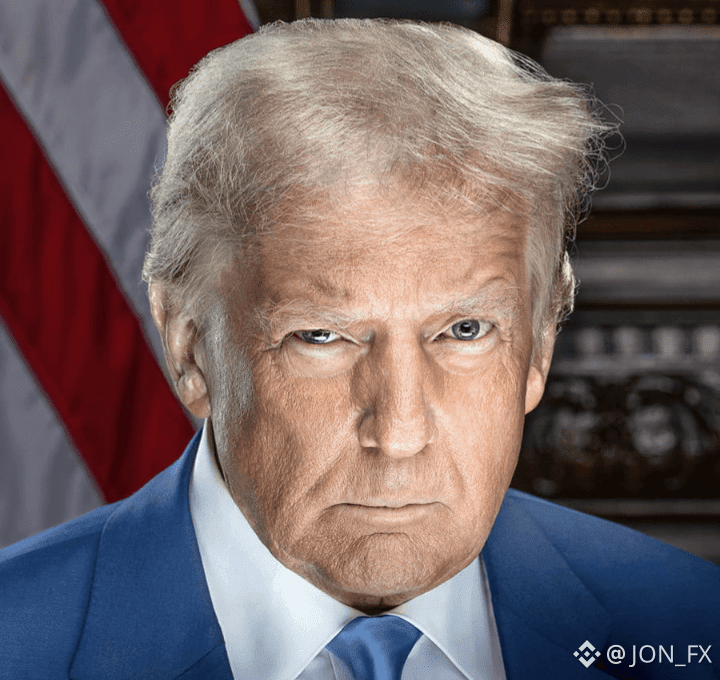

BREAKING: President Trump calls on Fed Chair

Powell to cut interest rates after this morning's CPI inflation data.

"Thank you mister tariff," Trump adds.

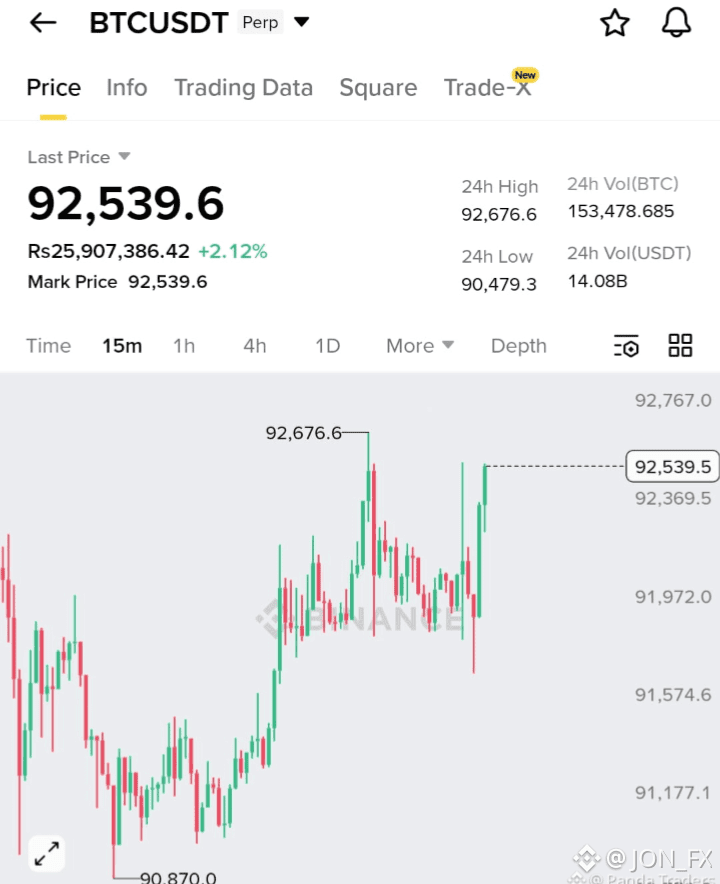

Market is volatile at the Moment ...

🧨 What’s happening right now

• President Trump publicly called on Federal Reserve Chair Jerome Powell to “meaningfully” cut U.S. interest rates after the CPI inflation report for December 2025 showed inflation still above the Fed’s 2% target but moderating. Trump made the comments in response to the data and urged the Fed to move on rates. �

Reuters

• Markets are volatile in reaction — with stocks, bonds, and the dollar fluctuating as investors weigh the inflation figures and political pressure on the Fed. Independent analysts are warning that political attempts to influence the U.S. central bank could undermine confidence and lead to wider financial stress. �

The Guardian

📊 Inflation & Economic data context

• December CPI data showed inflation still running above target at about 2.7% year-over-year, with some price pressures remaining in essentials like food and gas. Economists see the moderation as welcome but still not clearly signaling a need for sharp rate cuts. �

AP News

⚖️ Political clash and Fed independence concerns

• The backdrop to Trump’s comments includes broader tensions between the White House and the Federal Reserve — including a controversial Justice Department investigation involving Powell that critics say is aimed at pressuring him. Powell and former Fed officials have publicly defended the Fed’s independence. �

AP News

📉 Market reactions (broader picture)

Equity and currency markets have shown swings as traders price in uncertainty about future Fed moves and potential political interference.

Analysts have pointed to historic parallels where political pressure on central banks contributed to instability. �

The Guardian

🧠 What the Fed has signaled (recent history)

Although not tied to today’s meeting, the Fed has previously signaled caution on cutting rates without clearer data — focusing on inflation remaining above target and uncertainty tied to fiscal/tariff policy changes that could affect price levels. �

Investing.com