For a long time, crypto has treated privacy as a philosophical issue. Either you support full transparency, or you support secrecy. That framing sounds clean, but it collapses the moment you look at how real financial markets actually work.

In regulated finance, privacy is not about hiding wrongdoing. It is about protecting positions, strategies, counterparties, and client information while still operating inside strict rules. Public blockchains, by default, leak all of that information. Anyone can observe balances, transactions, and behavior in real time. That might work for retail speculation, but it breaks down fast when you introduce institutions.

This is where the conversation around privacy needs to mature—and where Dusk Network positions itself differently from most chains.

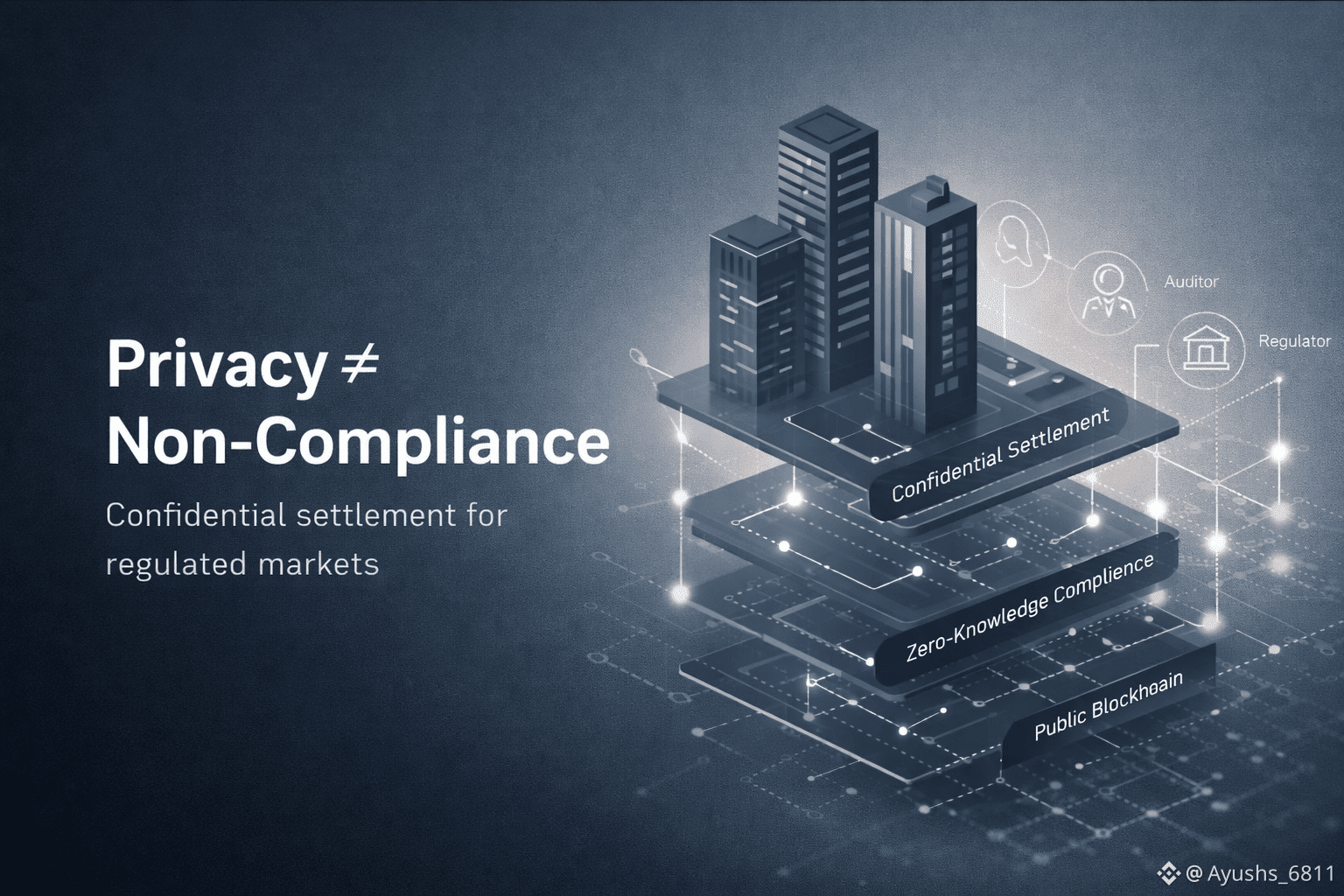

Dusk’s core idea is not “privacy at all costs.” It is confidential settlement that remains provable. In other words, transactions and smart contracts can keep sensitive details private, while still allowing the network—and when necessary, regulators or auditors—to verify that the rules were followed.

That distinction matters.

In traditional markets, firms do not broadcast their trade intent before execution. They do not expose internal risk limits, client allocations, or inventory in real time. Yet those same firms operate under heavy regulatory oversight. Compliance exists, but it is enforced through reporting, audits, and controlled disclosure—not through radical transparency.

Public blockchains flipped that model. They made transparency the default and hoped institutions would adapt. Most haven’t, for obvious reasons.

Dusk approaches the problem from the opposite direction. It treats privacy as a base-layer requirement and uses cryptographic proofs to preserve trust. With zero-knowledge techniques, a system can prove that conditions were met—eligibility checks, limits, settlement finality—without revealing the underlying private data. The outcome is verifiable, even if the inputs remain confidential.

This is not a small design choice. It changes who can realistically use the network.

Instead of asking institutions to accept exposure they would never tolerate off-chain, Dusk is trying to mirror how regulated finance already functions, just with on-chain settlement guarantees. That is why its narrative resonates more with real-world assets, tokenized securities, and enterprise use cases than with meme-driven DeFi cycles.

What often gets missed in surface-level discussions is that compliance does not require visibility of everything. It requires the ability to prove correctness when challenged. Confidential systems that support selective disclosure align far better with that reality than transparent ledgers ever could.

From a market perspective, this also reframes how Dusk should be evaluated. It should not be compared to generic L1s competing on throughput or fees. Its real comparison set is infrastructure designed for regulated environments—systems where confidentiality is not a feature, but a prerequisite.

Whether Dusk ultimately succeeds will depend less on slogans and more on execution: developer tooling, real deployments, and use cases that demonstrate this model working under pressure. But conceptually, the direction is clear.

Privacy is not the enemy of compliance. Poorly designed privacy is.

Dusk is betting that provable confidentiality is the only path that lets blockchain move beyond speculation and into real financial infrastructure.

That bet is worth watching.