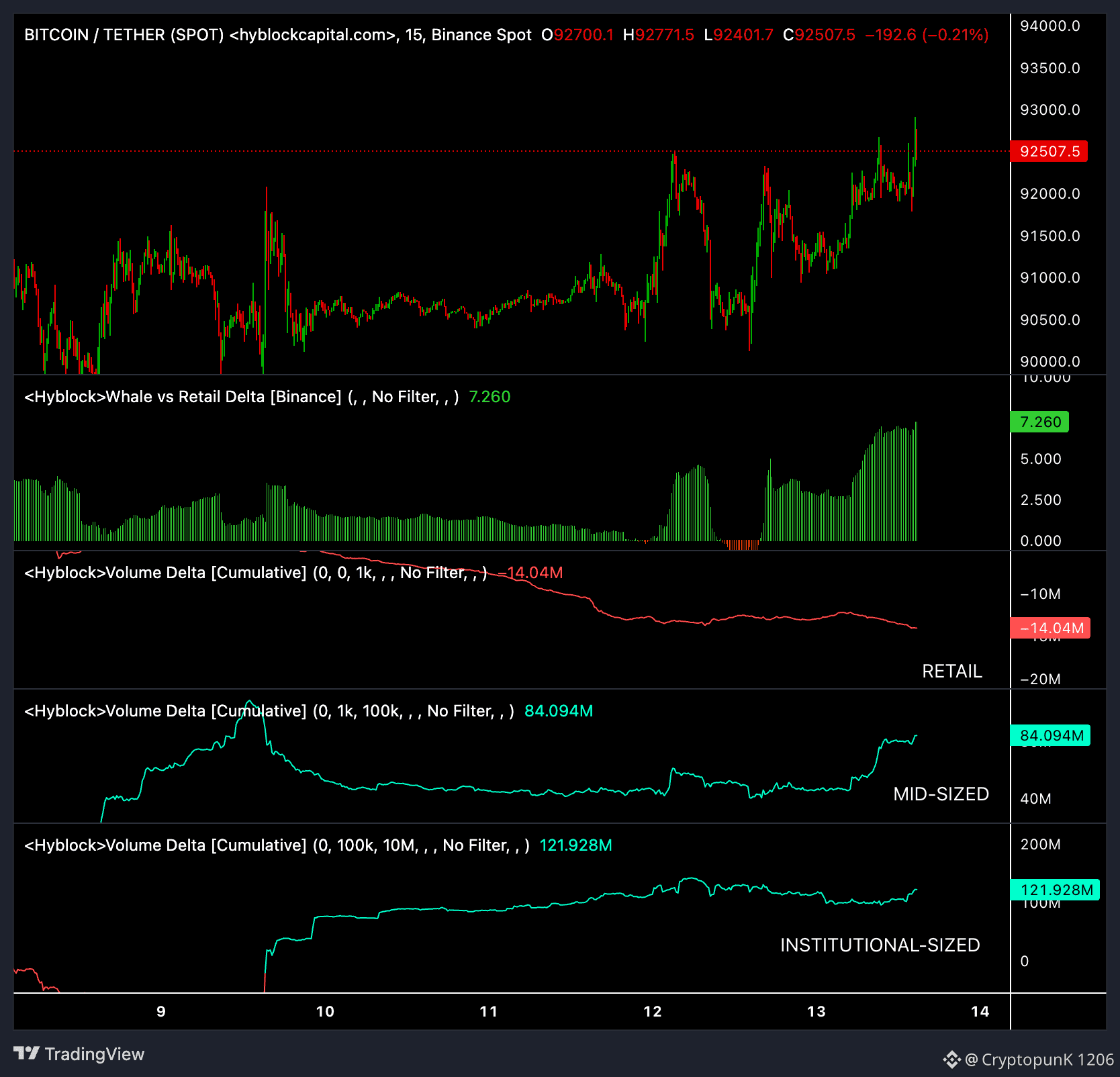

We are witnessing a "Great Hand-Off." As Bitcoin takes its third crack at the $94,000 psychological resistance today, the tape shows a clear aggressive green delta. However, the most telling part of this move isn't the price—it's who is doing the buying.

1. The Volume Delta Breakdown (Jan 14, 2026)

The buying pressure is heavily skewed toward large-lot orders. The mid-sized and institutional cohorts are essentially "eating" the retail sell wall.

As a Senior Crypto Analyst focusing on order flow and market psychology, I am tracking this exact "Volume Delta" shift as we move through January 14, 2026.

The data you're seeing is a classic signal of Institutional Absorption. While retail is mentally exhausted by the "dump-and-chop" of late 2025, the "Smart Money" is using this $94,000 resistance as a massive accumulation zone.

Cohort Divergence: Retail Fatigue vs. Institutional Accumulation

We are witnessing a "Great Hand-Off." As Bitcoin takes its third crack at the $94,000 psychological resistance today, the tape shows a clear aggressive green delta. However, the most telling part of this move isn't the price—it's who is doing the buying.

1. The Volume Delta Breakdown (Jan 14, 2026)

The buying pressure is heavily skewed toward large-lot orders. The mid-sized and institutional cohorts are essentially "eating" the retail sell wall.

CohortTrade Size24h Net DeltaActionRetail$0 – $1k- $14MExiting: Selling into strength, likely looking for a "better entry" that may not come.Mid-Sized$1k – $100k+ $84MAccumulating: Active market buying from high-net-worth individuals and small funds.Institutional$100k – $10M+ $122MAggressive Absorption: Large entities and ETFs are clearing the ask side of the book.

2. Why Retail is "Offloading Bags"

The psychological scars of the November-December 2025 correction (where BTC fell from $126k to $80k) are still fresh.

The "Break-Even" Trap: Many retail traders who bought the Q4 top are simply happy to "get out even" at $94k.

Scarring Effect: Three months of sideways "chop" has conditioned retail to believe every rally is a "fakeout." By the time they realize this move is structural, price will likely be north of $110,000.

3. The $94,000 Resistance: The Final Boss?

Technically, $94,000 is the most significant level on the chart since the 2025 All-Time High.

The "Tape" is Green: Despite the retail selling, the Cumulative Volume Delta (CVD) is sloping aggressively upward. This means the market buys are overwhelming the limit sells.

Supply Shock Imminent: With exchange reserves at 7-year lows, once this $94k "sell wall" from retail is consumed, there is very little "natural" resistance left until the $100,000 – $107,000 zone.

THE ANALYST'S VERDICT: Don't Get Shaken Out

The data suggests we are at the tail end of a "Transfer of Wealth" phase. Institutions are not buying $122M worth of Bitcoin at $94k because they think it's the top—they are buying because they see a clear path to the $150k – $170k targets projected for later this year.