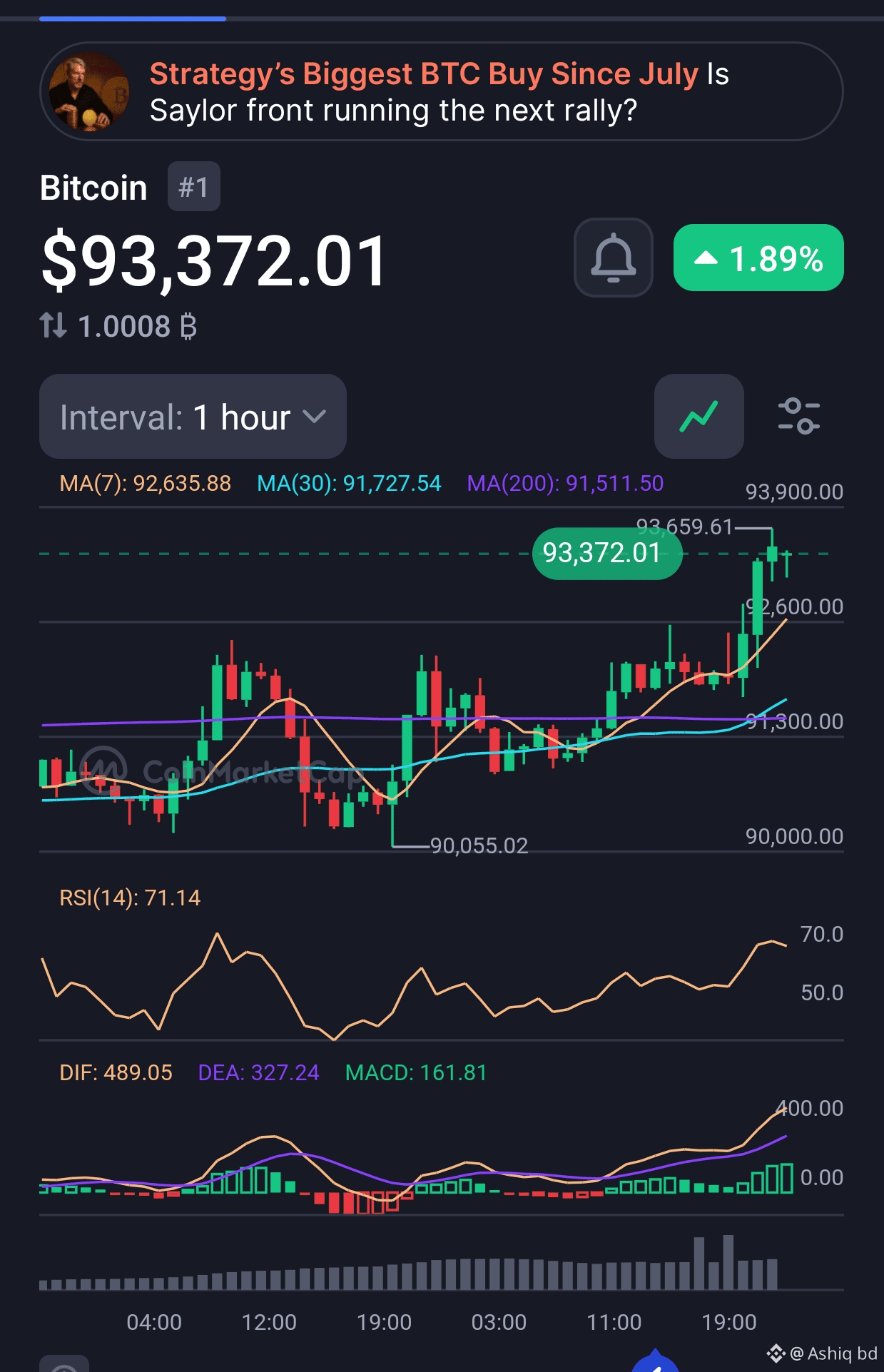

What is your analysis 13 January 2026

Michael Saylor is back in the spotlight! On January 12, 2026, Strategy (formerly MicroStrategy) announced its largest Bitcoin acquisition in six months, signaling a massive "risk-on" bet for the year ahead.

📊 The Numbers:

New Purchase: 13,627 BTC for $1.25 Billion 💰

Total Holdings: 687,410 BTC (Now over 3% of total supply!)

Average Cost Basis: ~$75,353 per BTC

Current Portfolio Value: ~$62.3 Billion (with BTC trading near $90,500)

🔥 3 Reasons Why Saylor is Buying Now:

MSCI Index "Victory": After a proposal in late 2025 to exclude "Digital Asset Treasury" (DAT) companies, MSCI recently resolved to keep Strategy in its global benchmarks. This protects institutional visibility and prevents forced selling.

Nation-State Adoption: CEO Phong Le predicts 2026 will be the year sovereign nations begin adopting BTC. Saylor is essentially front-running these "whale" entries.

Macroeconomic Tailwinds: With the U.S. Federal Reserve expected to ease interest rates by mid-2026 and rising geopolitical tensions (like the U.S.-Venezuela corridor), BTC’s "digital gold" narrative is strengthening.

⚠️ The "Leveraged Gamble" Debate

Critics, including gold-advocate Peter Schiff, warn that the company has become a "leveraged BTC proxy." Despite the current $10B unrealized gain, Strategy reported a staggering $17.44 billion unrealized loss in Q4 2025 when Bitcoin slid from its $126,000 peak.

What’s your take? Is this a genius move to corner the market, or is the leverage too risky? 👇

#Bitcoin #MicroStrategy #MichaelSaylor #BTC #CryptoNews #BullMarket2026