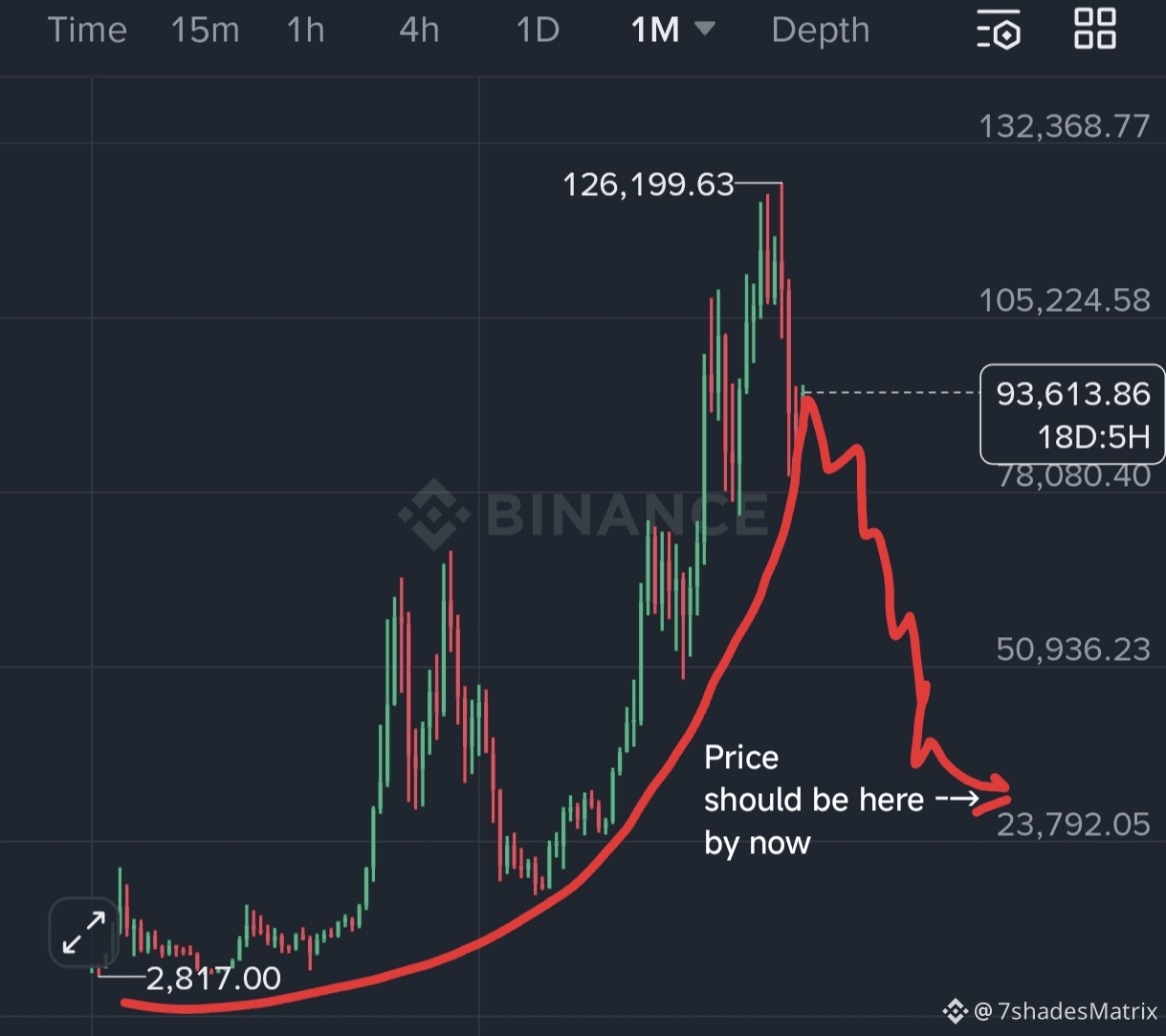

Look at the monthly BTC chart, not the noise.

BTC is forming a half U-shaped parabolic expansion after an unnaturally compressed growth phase.

Markets never allow vertical growth without a reset.

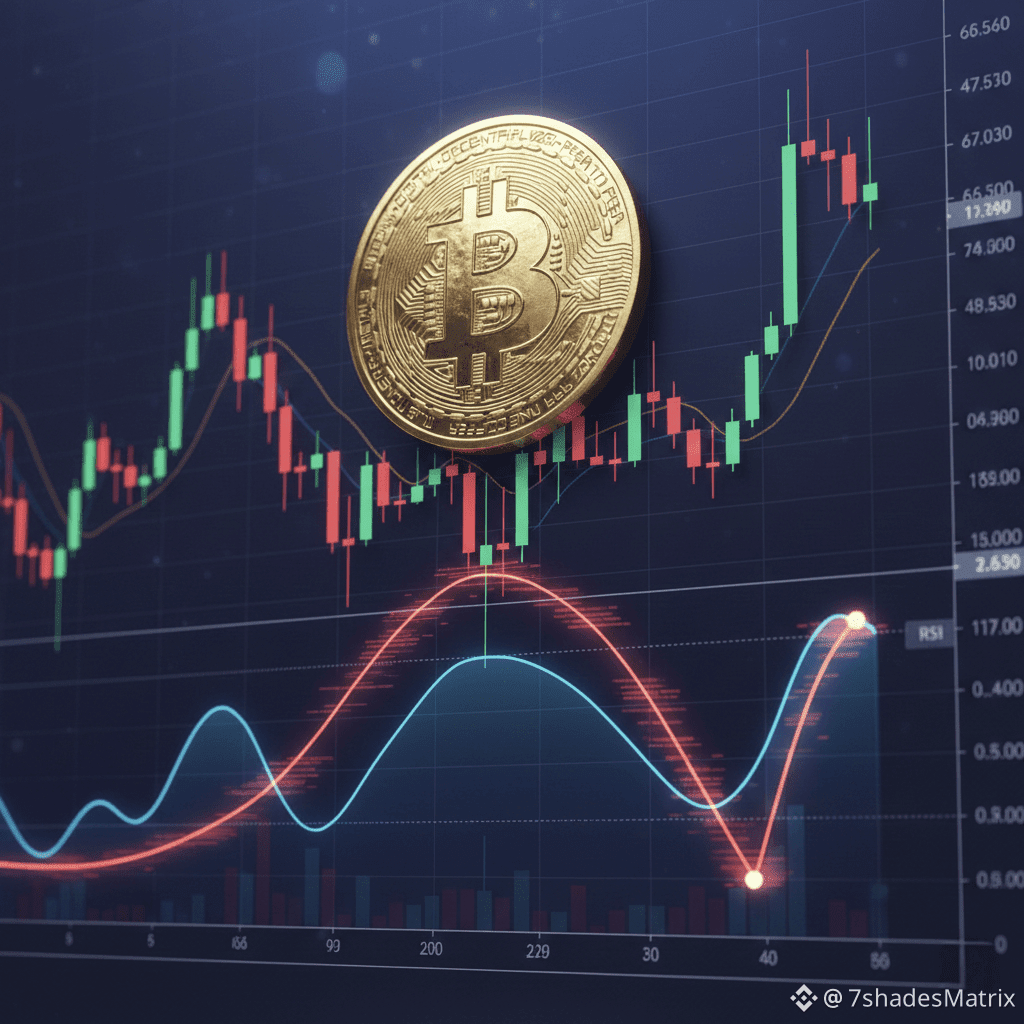

🔻 RSI REALITY (HIGH TIMEFRAME)

On higher timeframes:

RSI expands aggressively during parabolic moves

It must reset via time correction or price correction

Current BTC condition:

Massive price expansion

RSI cooled only slightly

Price still elevated

➡️ This mismatch = distribution, not accumulation

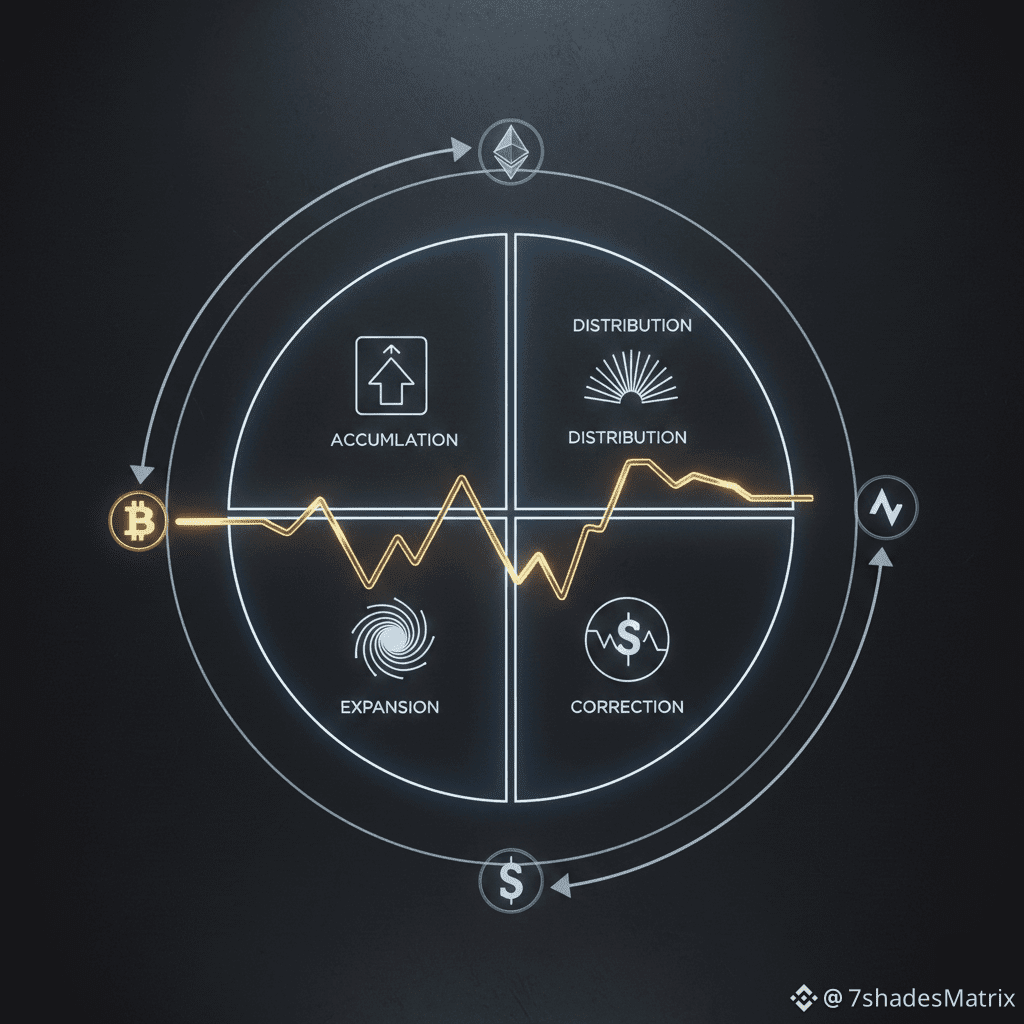

⏳ CYCLE MATH — HOW HEALTHY MARKETS MOVE

A normal crypto market cycle follows:

Accumulation → Expansion → Distribution → Correction

BTC violated this rhythm:

Too much expansion

Too little correction

Cycle artificially compressed by liquidity + narrative

When cycle math breaks, the market forces balance — often violently.

📉 BTC HISTORICAL CYCLE COMPARISON

🔹 2013 Cycle

Parabolic move

Deep correction (>80%)

Long accumulation phase

Healthy reset

🔹 2017 Cycle

Mania-driven expansion

Massive RSI overheating

Brutal correction (~84%)

Multi-year consolidation

🔹 2021 Cycle

Double-top distribution

RSI divergence

~77% drawdown

Proper cycle reset

🔴 Current Cycle

Fastest expansion in BTC history

No equivalent deep correction yet

RSI never fully reset

Price held high artificially

📌 This is historically abnormal

Every previous cycle punished late entrants before the next opportunity.

This one has not done it yet.

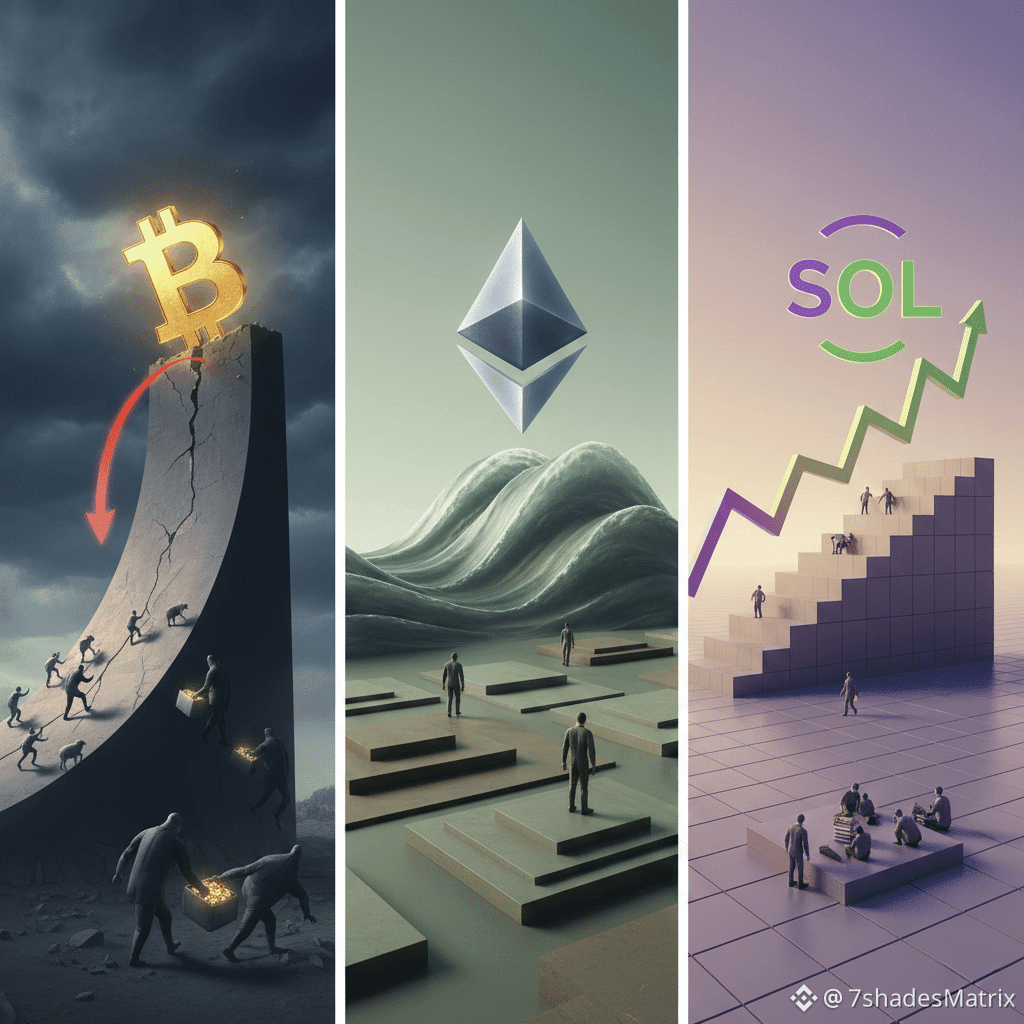

🔍 BTC vs ETH & SOL — STRUCTURAL TRUTH

🔴 BTC (Late-Cycle Risk)

Parabolic structure

Weak pullbacks

RSI cooling while price remains high

Poor risk–reward for new entries

🟢 $ETH & $SOL (Early-to-Mid Cycle Potential)

Multiple deep corrections already done

RSI reset properly

Long accumulation phases

Price far below ATH = undervaluation

ETH and SOL already cleansed leverage, fear, and weak hands.

BTC still carries euphoria and late money.

📊 FINAL TECHNICAL TRUTH

Assets that already corrected → future upside

Assets still being chased → future pain

$BTC currently offers limited upside with heavy downside risk.

ETH & SOL offer asymmetric opportunity for patient capital.

This is not anti-Bitcoin.

This is history, structure, RSI, and cycle math.

⚠️ Late entry into overextended cycles is how retail becomes exit liquidity.

Ignore hype.

Respect cycles.

Protect capital.