The latest inflation data has put Federal Reserve Chair Jerome Powell in a challenging position. While the Fed remains publicly hawkish, economic indicators suggest the central bank may need to pivot sooner than anticipated. $DASH

📊 INFLATION DATA: COOLING OFF

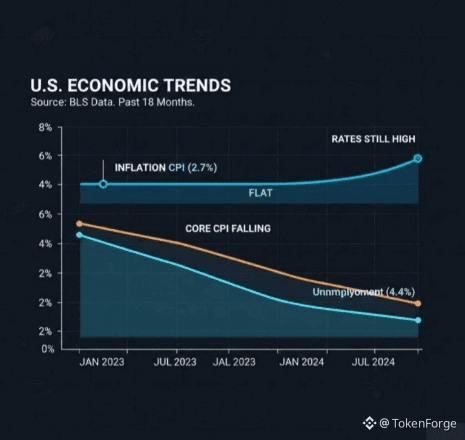

Headline CPI: 2.7% (in line with expectations)

Core CPI: 2.6% (below expectations)

Truflation: shows inflation under 1.8%

Key insight: Inflation is not accelerating. The numbers are clearly telling a story opposite to the Fed’s recent pause on rate cuts.

⚠️ THE FED’S DILEMMA

Powell paused rate cuts hoping inflation would pick up, but the data is sending a different signal:

CPI is flat

Core CPI is falling

Inflation expectations are declining

In short, the Fed is behind the curve, risking overtightening at a time when the economy is already feeling pressure.

📉 ECONOMIC HEADWINDS

Despite the Fed’s hawkish stance, the broader economy is under stress:

Growth is slowing

Unemployment rising to 4.4%

Financial stress is building

Historical context:

In 2024, the Fed cut 50 bps when Core CPI was 3.3% and unemployment at 4.1%

Today, inflation is LOWER and unemployment HIGHER, yet the Fed remains hawkish

🔥 WHAT THIS MEANS FOR MARKETS

Powell can talk tough, but the data speaks louder:

Rate cuts are likely inevitable

Markets may start pricing in policy easing sooner than expected

2026 could force the Fed’s hand, reshaping risk assets, bonds, and equities

💡 BOTTOM LINE

The Fed is walking a tightrope. With inflation cooling and the economy slowing, monetary policy may need to pivot, despite the public hawkish rhetoric.

Investors should watch:

CPI & Core CPI trends

Unemployment updates

Fed communications for subtle hints of easing

The next rate cut cycle could arrive faster than Powell anticipates, creating opportunities and volatility across markets.